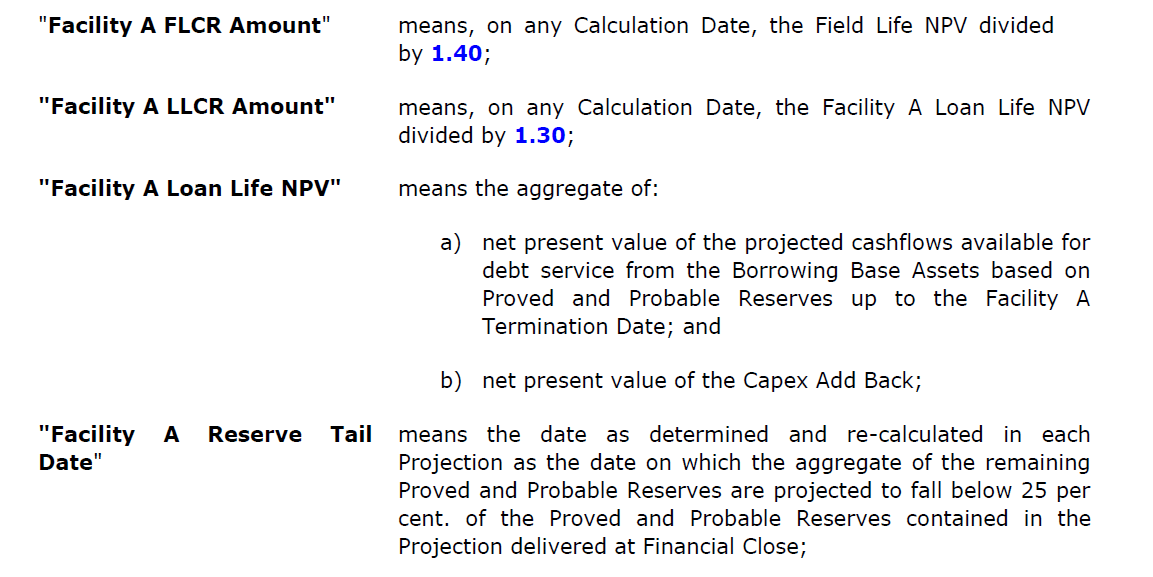

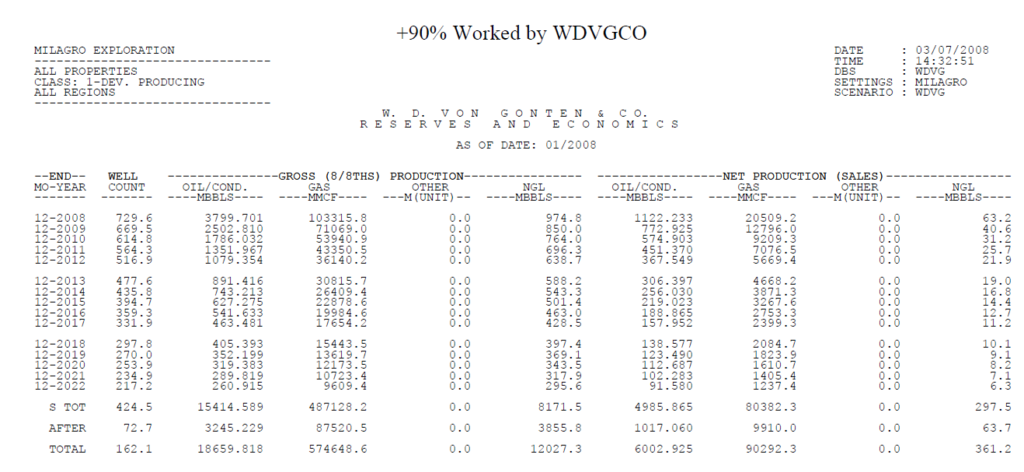

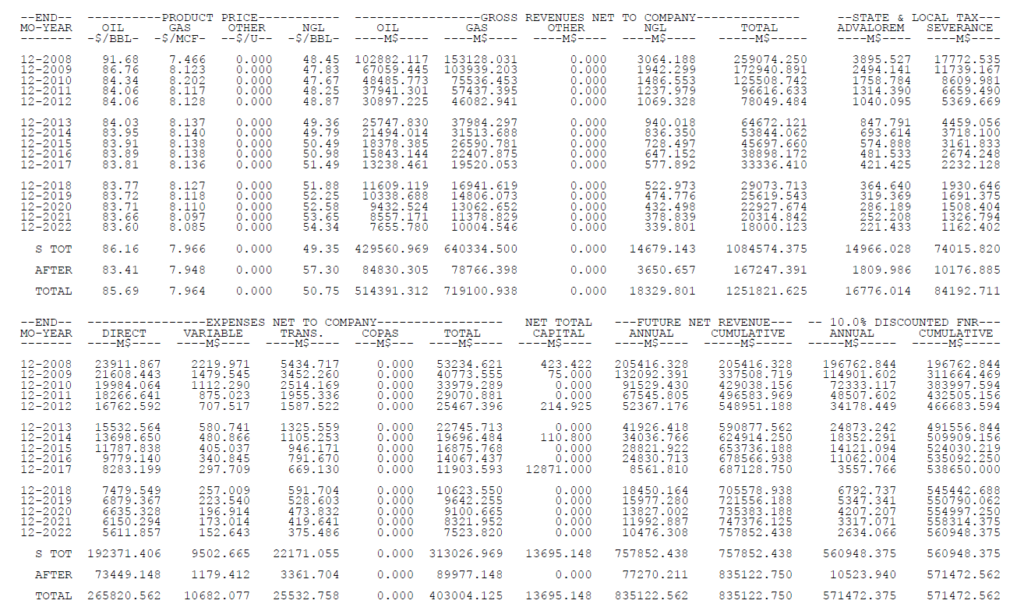

This page demonstrates how to evaluate reserve based loans. The reserve base computes the borrowing base which is defined with a term sheet. The key to create a model is to use changes in the borrowing base to evaluate the repayment of debt. In computing the borrowing base you evaluate the present value of the cash flow from the reserve report. Once the present value of reserves is evaluated, the borrowing base is the present value of the cash flows over the life the project or the life of the loan by the loan life coverage ratio or the field life coverage. The field life coverage ratio is like a project life coverage ratio. You need a forecast of cash flows. You take the present value of these cash flows and then compare the present value of the future cash flows to the amount of the debt. The big thing is that the present value of cash flows comes from reserve reports. Hence the name reserve based loans.

The Field Life Coverage ratio can be through of as the inverse of a loan to value ratio. If the Field Life Ratio is 1.5 then 1/1.5 = 66%. Then you compute the size of the loan from the reserve report which measures the present value of the reserves. The prepayment of the loan from the borrowing base is like a cash flow sweep with specific criteria.

Reserve Based Loan Terms — Debt Size from Field Life Coverage Ratio

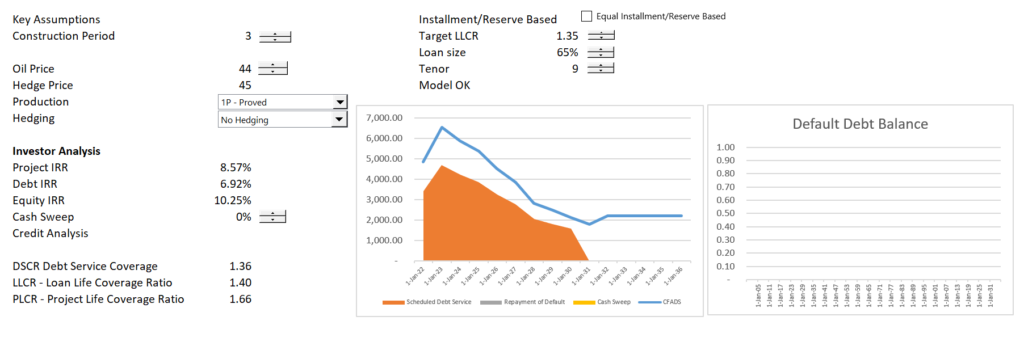

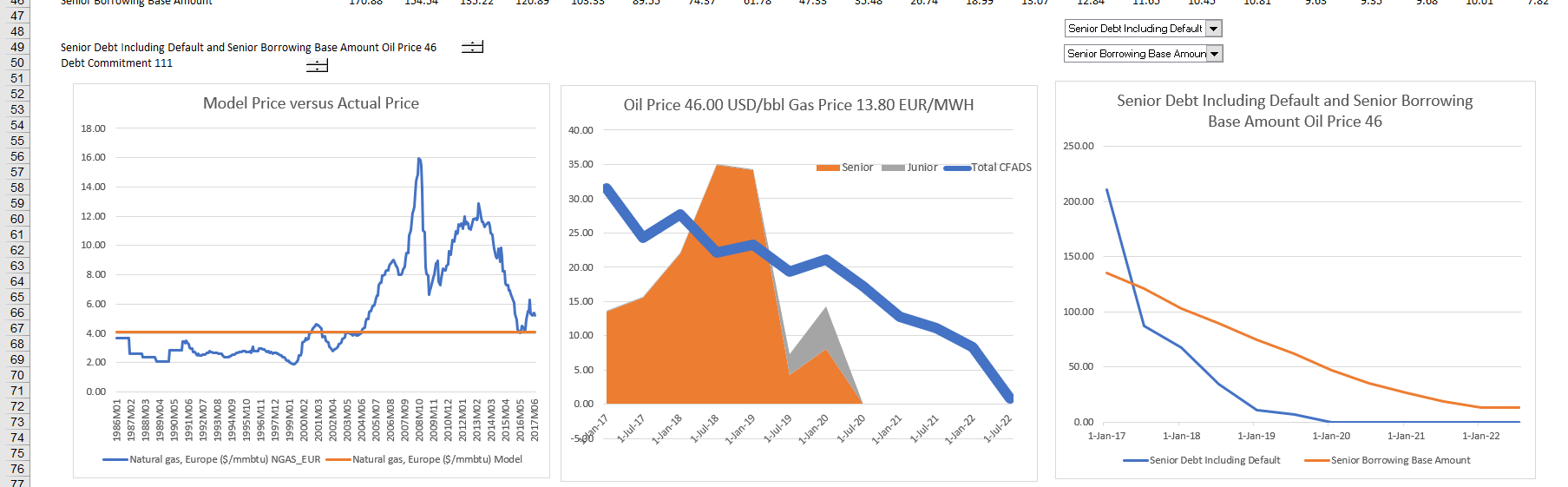

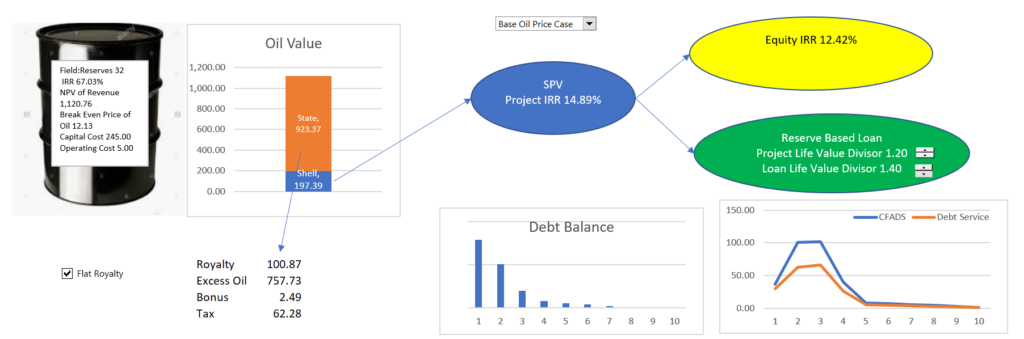

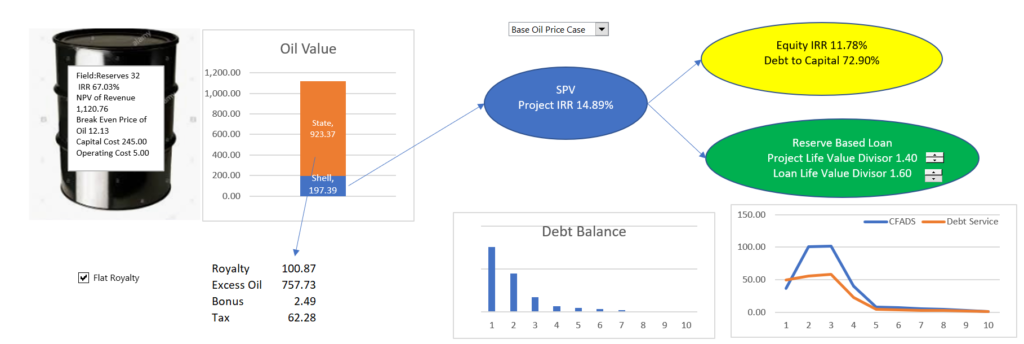

The first slide illustrates how you can illustrate the effects of different oil prices in the context of different oil prices.

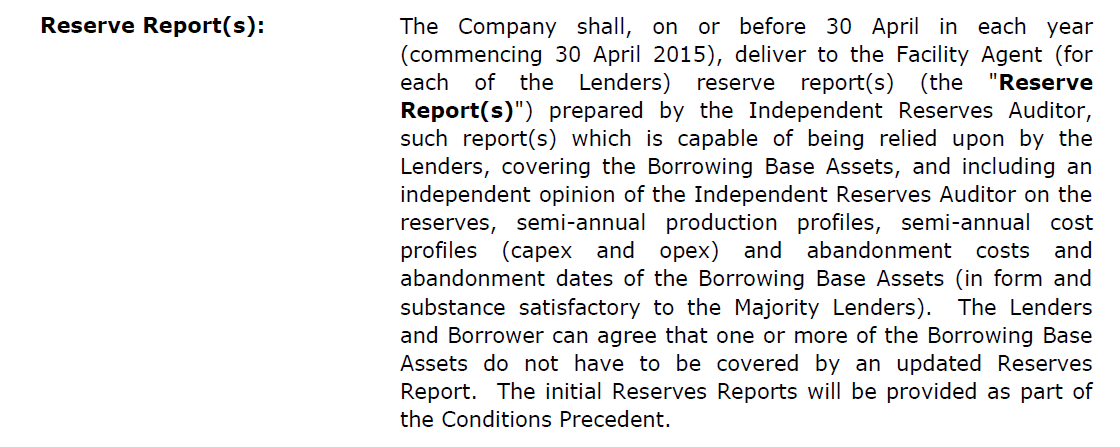

The first excerpt illustrates the requirements for reserve reports with drive the size of the borrowing base.

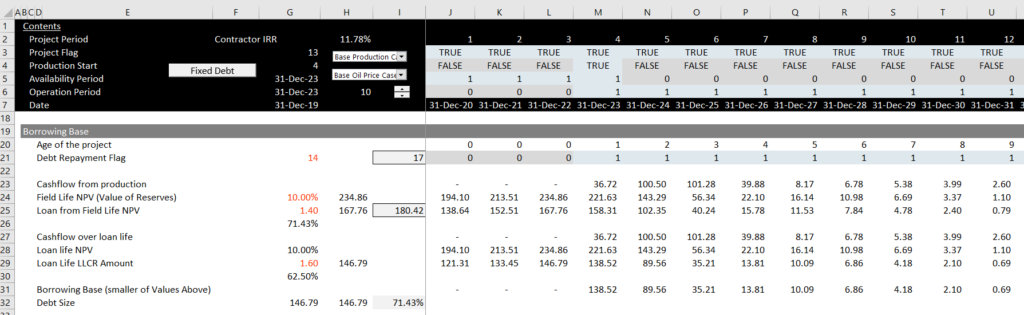

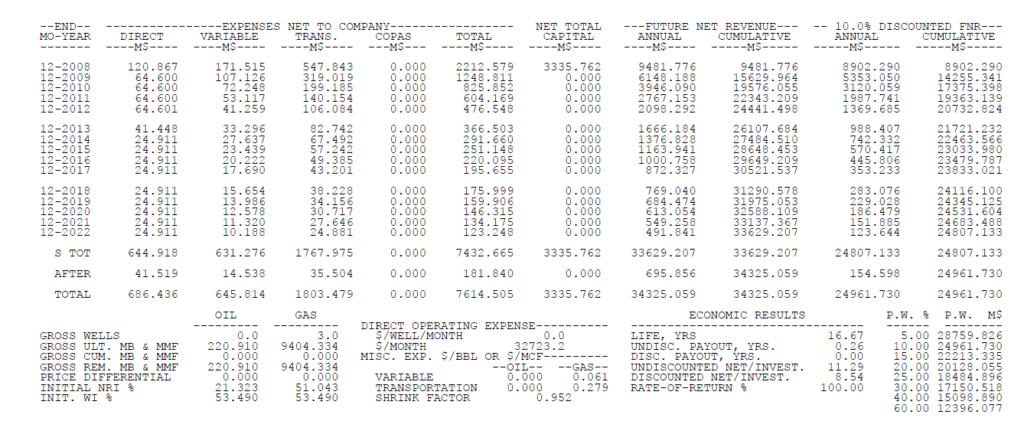

Here are some examples of essential drivers of a reserved based loan. First here are the debt sizing drivers. To measure this, you need to have a discount rate which is the discount rate used in the reserve report. It is generally around 10% which undervalues the value of the reserves and it means that the FLCR is not like a typical PLCR.

The next screenshot illustrates the definition and the use of the borrowing base. This shows the borrowing base is used for the availability and also the repayment.

Model Illustration

The debt sizing is illustrated on the screenshot below

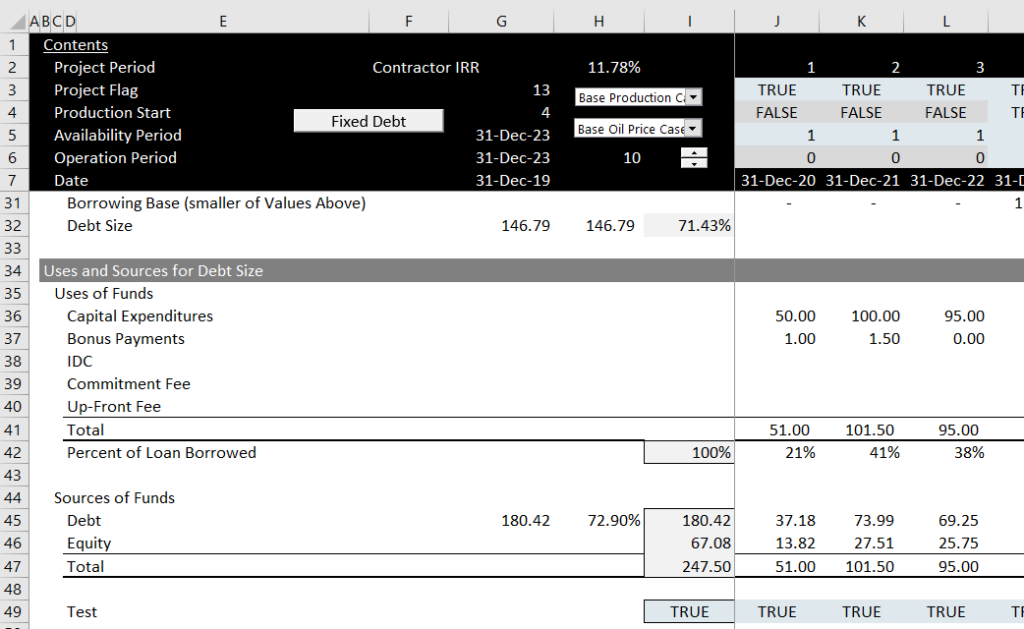

The screenshot below shows the sources and uses from the debt size.

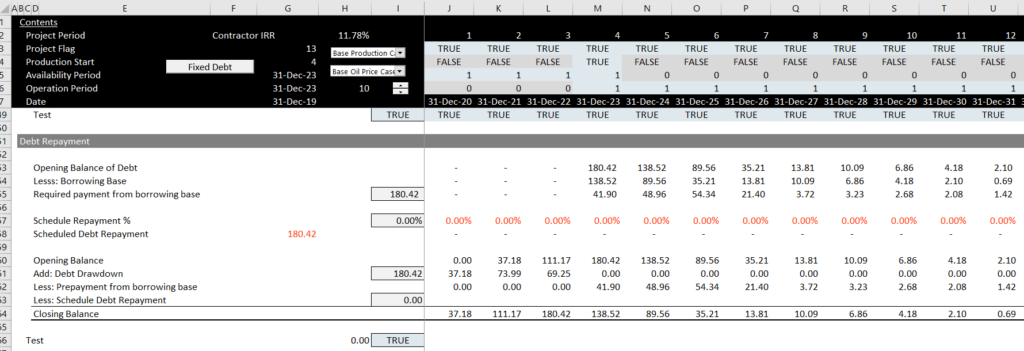

The debt schedule below illustrates how the repayment is driven by pre-payment for the borrowing base

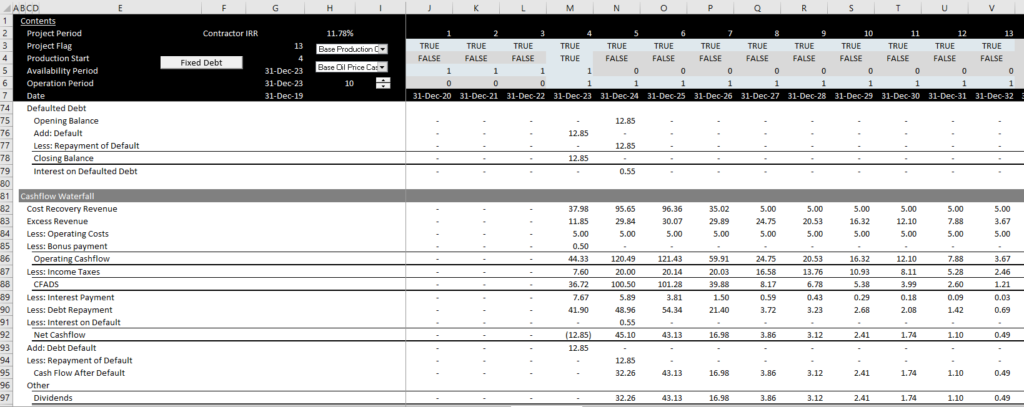

Cash flow waterfall and defaulted debt

Simple Case With Illustration of Alternative Repayments

The simplified example includes an option for reserve based loans. Notice that the pattern of debt service follows the production of the loans. This contrasts with other possible loan structures that include equal installments or a cash sweep. In the file below you can see how the present value of cash flows can be used to compute the value of reserves.