This page includes a few corporate models that are relatively simple corporate model that includes A-Z analysis and history. I have included a model of Amazon, Macy’s or the Saudi Cement Model to illustrate the general process. These models use automated methods to acquire historic data and demonstrate that a big deal in corporate modelling is getting financial data and making a model flexible enough to incorporate updated historic data. I demonstrate that a model without a Historic Switch is silly. The models include DCF valuation analysis for different scenarios with flexible holding periods. The models also include scenario analysis and presentation of the different assumptions.

The Saudi Cement model gathers financial data from the Saudi Stock Market webpage called TAWDAUL. The idea is that you should be able to get your data, easily connect it to the prior history, change the last historic data, change assumptions from the history and then quickly have a new model with new updated data. Two examples are include below that you can download by pressing the buttons. The first button below is attached to a file that used to explain modelling of sudden changes in demand (Macy’s).

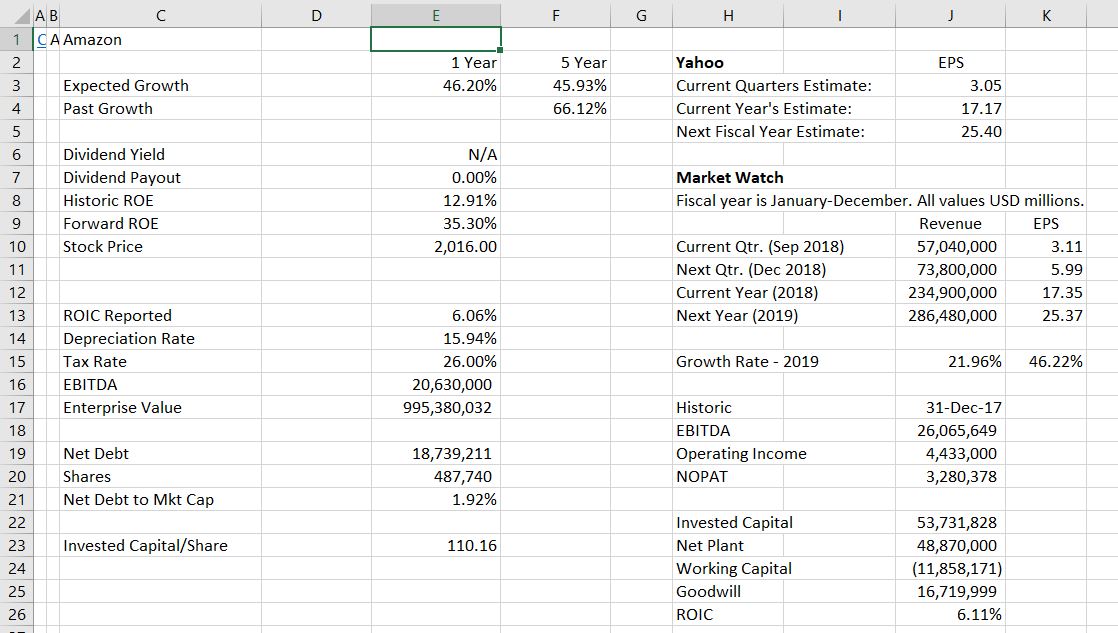

Amazon Model Example for Valuation

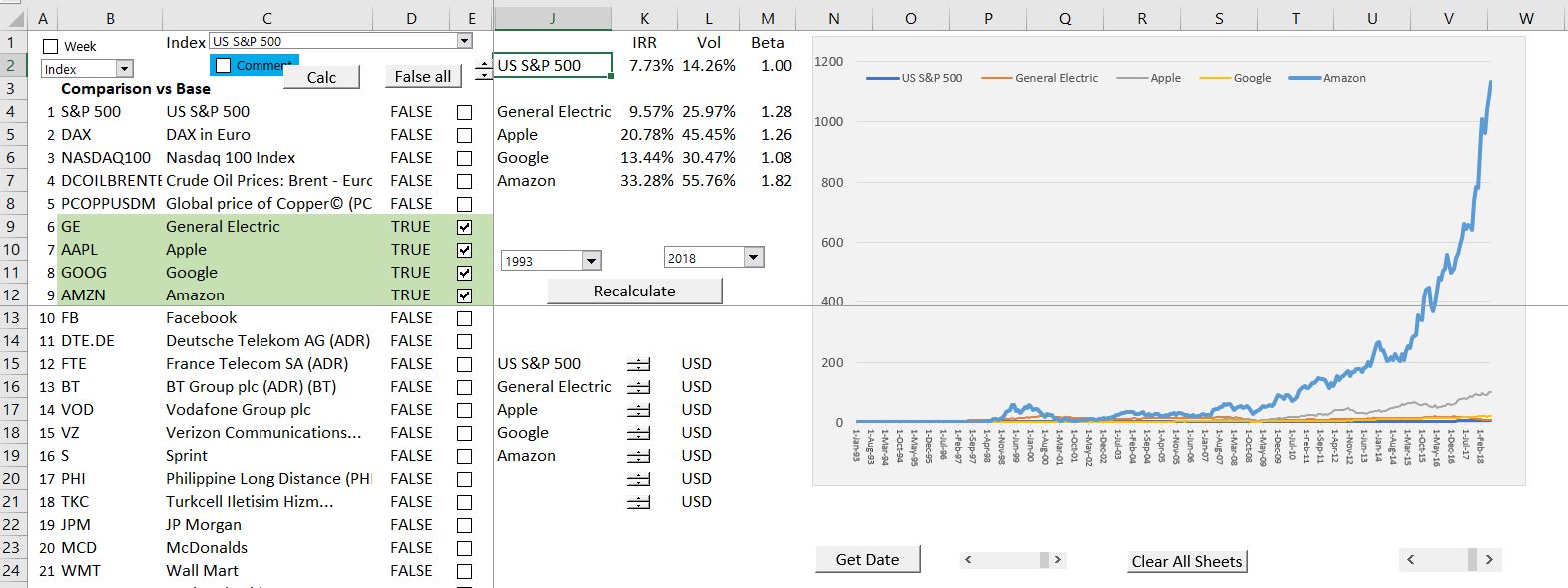

The Amazon model that you can download by pressing the top button below demonstrates a traditional model that starts with historic data and projects growth and margins and other drivers of model. The model that is attached to the second button is not traditional. It starts backwards with ROIC and growth and derives the cash flows and values from these inputs. This is opposite from the way a typical model works but it demonstrates the key drivers.

Excel File with Forecast of Amazon Using Historical Financial Statements from Financial Database

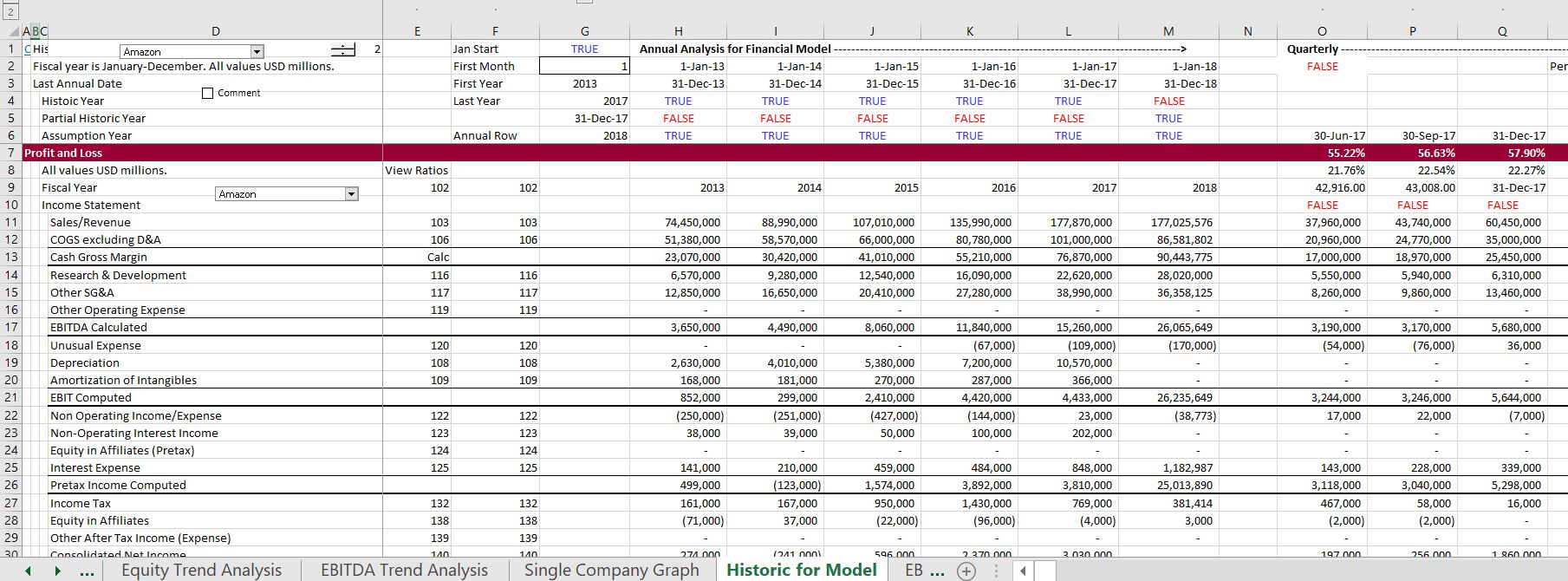

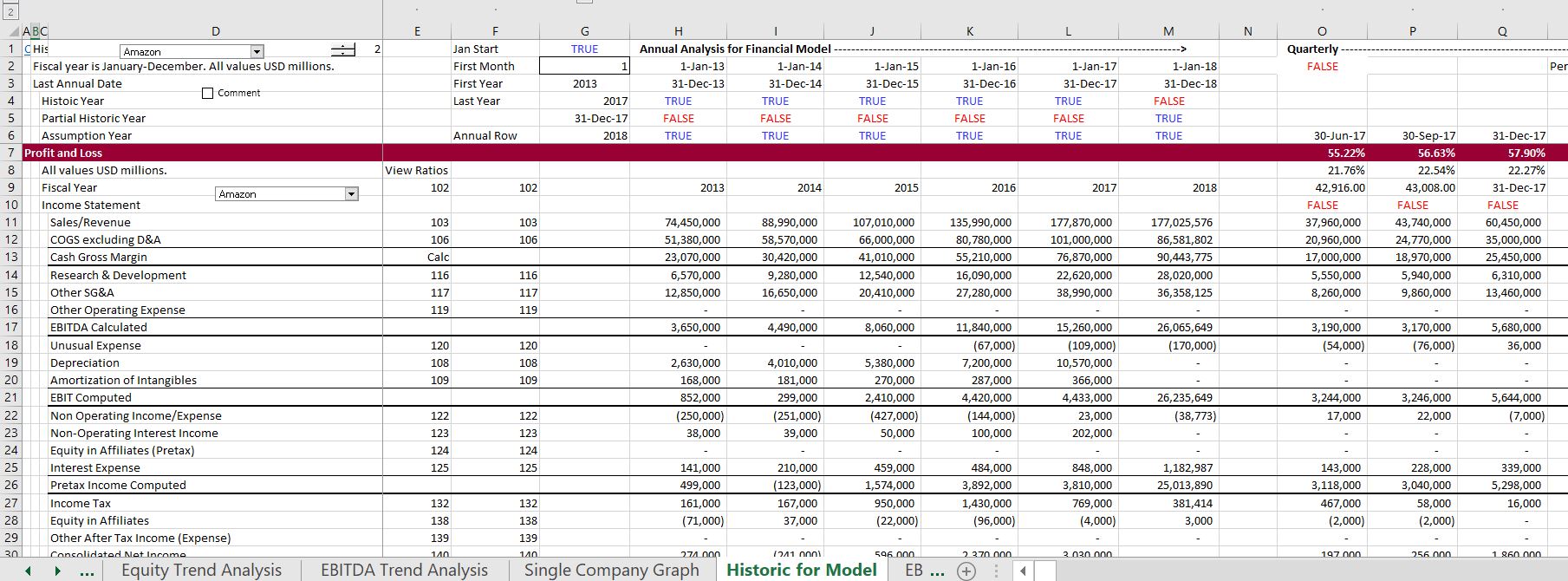

Some of the aspects of this model are illustrated below. The first screenshot illustrates the manner in which historic data can be downloaded from the financial database that is explained at https://edbodmer.com/comprehensive-financial-database/. An example of the historic database is shown below. Note that quarterly data can be annualized in different ways.

Amazon Background for Valuation

Valuation of Amazon has been a hot topic of debate for a long time. It reached a very high level during the financial crisis, but then crashed.

Cement Financial Model

I have included another simple example of a construction company in this section that illustrates very similar ideas. The models work all the way through the balance sheet and first develop operating cash flows. The separation between operating cash flow and financing cash flow is important and it is important to set-up accounts that keep track of debt and cash balances. The cash and debt accounts find the changes in cash flows from the cash flows.

Corporate Model of Saudi Cement Company Using Data that Can Be Updataed from TADWAL Website

Corporate Model of Construction Company Demonstrating Model Structure and Valuation Issues

This Saudi Cement model and the construction company model also demonstrates how you can make presentations of historic and projected financial statements and incorporate scenario analysis into a corporate model. The model contains graphs that show all of the items on a three statement model for both historic and projected levels. The scenario analysis is set-up with sensitivity analysis so that you can make a tornado diagram and see which variable has the biggest effects on the valuation of the company.

A video describing the Saudi Cement model is included in the table at the bottom of this page.

.

Further Information and Learning: Request Resource Library (Free), Find Details About In-Person Courses, Make Suggestions on Course Subjects and Locations

The reason I have worked on this website is so that you consider an in-person class which is by far the best way you can become a top project finance analyst. If you click on the button below, you will be forwarded to a website that describes some of unique courses.

I would really like to know what courses may be most interesting to you and where you would like the courses to be held. If you click on the left button below, I have a form that I will use to try and put together a class with a few people.

If you are a student, I would be honoured to come to your university or your business club and give you a hands-on guest lecture. If you click on the button on the left below, you can do me a big favor by giving me some information about your institution.

Click on this Button to Send Me and E-mail and Request Resource Library that Contains Google Drives and Zipped Files (No Charge for this) Click on this Button and Do Me a Favour by Suggesting Your Preferred Course Locations, Subjects and Possibilities of Guest Lectures and Your University