This page includes background for project finance theory courses. The project finance theory includes the essense of project finance, selected case studies, debt financing structure and the theory of debt contracts. A theme of hte course is that project finance is much more than just another kind of debt. I suggest the debt financing of the project defines the value of the project and the cost of capital which is such a difficult issue in finance and an important issue in the allocation of resources in the economy. As with other files, this webpage includes a number of files attached to different buttons which include powerpoint slides and a number of excel files that are used to demonstrate various theoretical issues. The first few files below address this issue. The initial section also covers the difference between project finance and corporate finance, arguing that project finance should be the foundation of all of financing. The course then moves to four mini-case studies that are designed to demonstrate the struture, contracts, economic analyis and other issues associated with project finance. I have tried to select historic case studies that were spectacular successes or failures. In the subsequent section I move to contract analysis, including the loan agreement. Finally, I discuss the upsides in project that arise from reduction in risk.

The page includes slides I use for the course as well as exercises that demonstrate theoretical points and databases. As with other pages for the courses I also include some of the utility files — the generic macro file and the read pdf file.

.

.

Files to Download During the Course

Section 1: Essence of Project Finance

The idea of this course is to think differently about the essence of project finance and work through some case studies with different contract structures. When teaching the course I put some of the files we use on this website. The file attached to the first button is power point slides file. The first file is the power point slides we use throughout the course. You can keep this open while working on the exercises that demonstrate project finance principles.

.

.

The first exercise demonstrates risk issues with volatilty and mean reversion. The idea is to show how project finance is about manageing risk over long-term periods. You can use the probability of default with the DSCR and the probability of loss with the PLCR. You can see the probability of default and probability of loss with different DSCR Ratios. The idea of this file is to enter different levels of volatilty and mean reversion and then determine what DSCR will result in a reasonable probability of default and probabilty of loss. You can look at the macros in the file that are used to create a Monte Carlo simulation.

.

.

Alternative Project Finance Definition … finding money from a bank (not associated with your company) and/or an investor for a capital investment where you can prove (through nonrecourse loans and equity cash flow evaluation) that the project is economic on a stand-alone basis and has acceptable risks where debt and equity is structured corresponding to the risks, the timing and the pattern of cash flows from the project. Long-term financing is achieved through demonstrating mean reversion in cash flow and/or use of long-term contracts can meet debt service and provide a reasonable growth rate in cash flow to investors.

.

.

Project Finance and IRR

The file attached to the button below addresses the definition calculation and nuances of the IRR. The file demonstrates that the IRR is a growth rate when measuring stocks or when measuring the IRR earned from an LBO where there is one date for the investment and one date for the exit value (i.e. there are no intermediate dividends). The file demonstrates that the biggest problem with the IRR is in the context of project finance where there are a lot of dividends and the implicit assumption is that the dividends are re-invested at the same rate as the IRR itself. (I have an alternative to this where the risk premium is computed, but it is not used much). I also reconcile the IRR and the ROI in the sheet using economic depreciation and demonstrate that you can use this method to compute performance measures.

.

.

The next file is my general file on downloading stock prices and includes the IRR’s, volatility and betas for many stocks.

.

.

The final file for the first session compares companies investments in renewable energy project finance to other companies such as oil companies. The file use the financial database that is described in detail on the database menu. When you compare the ROE to the price to book ratio or the EV/EBITDA ratio, you can see how the value of project financed investments are high compared to the cash flow produced by things that have more volatile cash flows.

.

.

.

Project Finance and Cost of Electricity

.

I have worked matching a project finance model and equations that use the PMT and PV functions to compute the levelised cost of electricity. The file attached to the button below includes a data set with the Lazard operating assumptions and many different financial inputs. The file demonstrates the importance of project finance in evaluating the cost structure of capital intensive investments.

.

.

Section 2: Mini Case Studies

.

This file is used to introduce the Ras Laffan case with analysis of commodity prices. You are supposed to look for volatility and mean reversion in the prices and make a judgement as to what is acceptable.

.

.

This file contains the pre-sale report for Ras Laffan which was used as a credit write-up and discussed the risks of the project. The idea of this report is just to skim through the discussion of risks and look at the presentation of the financial model.

.

.

This file is the financial model for Ras Laffan with alternative oil prices. You are to use this file to evaluate the cost structure of the project and to compute the break-even oil prices by yourself.

.

.

The button below is for the Dahbol case. You are to compute a couple of IRRs and use the data to evaluate the key risk of the project which could not be easily mitiagated.

.

Excel File with Data from the HBS Dabhol Electricity Plant Case with PPA and Capital Costs

.

The file below has the exercise for Eurotunnel. You can evaluate the construction risk and the traffic risk, both of which were not properly mitigated and both of which were difficult to accept in project finance.

.

.

The file below has the initial offering memo for Eurotunnel which describes the construction contracts and the traffic projections.

.

Offering Memo for Initial Public Stock Offering of Eurotunnel Project before Financial Close

.

.

Solar Resource Analysis for Solar Case Study

.

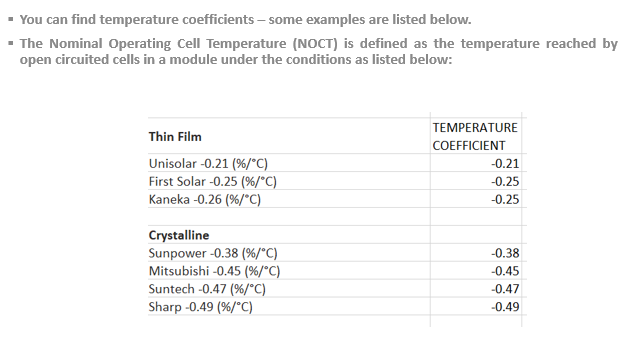

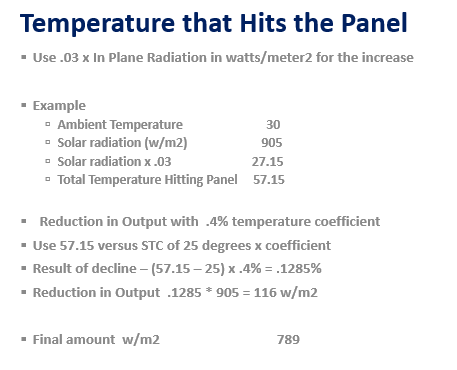

The two files below are for introduction to the solar case study. The first file is for the Middle East and the second file is for northern Europe. You can see the dramatic difference in solar patterns. These files will be used to discuss the performance ratio that can be part of EPC and O&M contracts. The video below works through the example and how to find the data. The analysis uses temperature coefficients and estimated temperature that hits the panel.

.

Excel File with Solar Resource Data Including Comparison of Models and Analysis of Performance Ratio

.

.

.

.

Section 3: Loan Agreements and Contracts

.

The file attached to the button below is a file that illustrates different financial issues that are used in the remainder of the course. The file attached to the first button is an example term sheet. If you work through the document and understand the language it would be a good thing to do.

.

.

PDF File with Term Sheet for Loan Agreement that Illustrates Various Financial Structuring Items

.

The file attached to the button below includes a term sheet that we use in the course to understand and not be intimidated by various elements.

.

.

Excel File with Comparison of Alternative Models for Computing Solar Resouce with Saudi Example

.

.

Partner Files to So You Do Not Waste Time on Formatting and Using the Paint Brush

I have included two files that are used to make the excel exercises work more smoothly. The first is a file called Read PDF which allows you to grab data from PDF files and then convert the data to excel files. To run this file you copy stuff from the pdf file and then operate the macro with SHIFT, CNTL, A. When you copy data from a PDF to excel, make sure that you copy and paste special as UNICODE text. There are different formats that you can use to resolve the PDF. If you are reading from the Lazard LCOE stuff you can use the first green box. If you are reading from the PVGIS you can use the second green box.

The second file is a file that has a whole lot of macros to prevent you from wasting time on formatting and copying formulas to the right. This file is called GENERIC MACROS. I have revised the generic macro file in the link below so that you are not prevented to open it because of something called the auto open — a macro that operates when you open the file and excel considers dangerous. When working through the exercises, it would help a lot if you have this file open and enable the macros. The big things that this GENERIC MACRO allows are to press SHIFT, CNTL, R to copy to the right and also CNTL, ALT, C to open the window that has a whole lot of formatting options. There are a lot more utility macros in the GENERIC MACROS file. You can go to https://edbodmer.com/excel-utilities-and-backpack/generic-macros-file/ and see some of the other stuff including a few user defined functions.

.

.

.