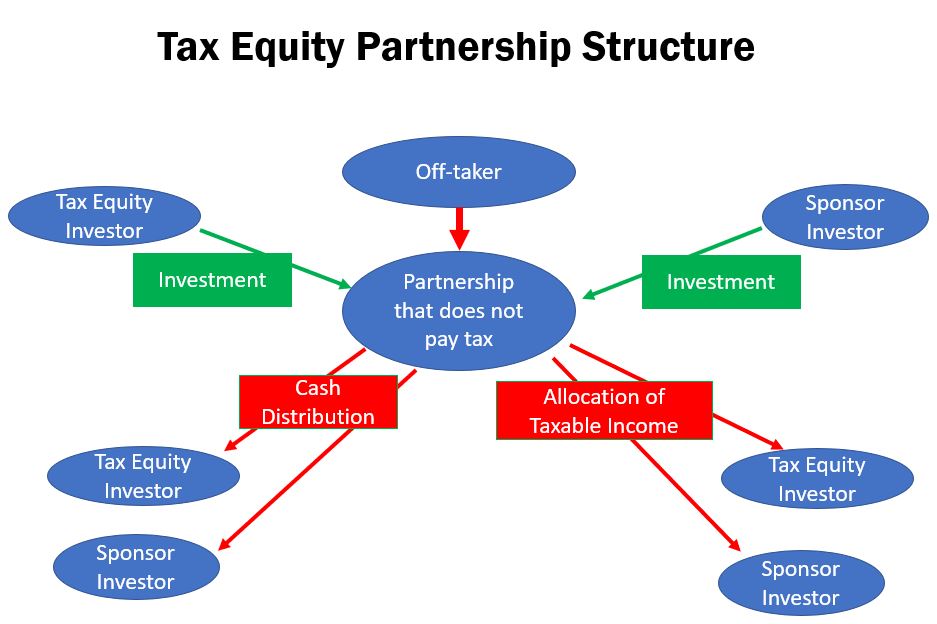

This is a holding page that takes you to other pages to work through the tax equity modeling in an A-Z manner. These pages demonstrate how to great a tax equity model from A-Z with a fixed flip date and annual flows. The fixed flip date is more common for projects with a lot of ITC. Here the tax equity investor earns such a high return that a yield based flip would work too fast. The flip works until the accelerated depreciation is finished and there is no reason for the tax investor to be in the transaction. This first page introduces modelling of outside capital and inside capital. I demonstrate that the only capital account that really matters is the outside capital because the outside capital affects actual taxes paid by the tax investor. The inside capital is only computed for the remote chance that the partnership will be dissolved.

The second page introduces yield based flip structures that are more common in wind projects where the PTC was used instead of the ITC (I realize that the PTC will terminate). In the wind transactions it takes longer for the tax investor to realize the return and the risk for the tax investor is reduced by assuring the return which may take longer to generate. If the yield based structures are used together with a thing called a PAYGO, then the risk to the developer is increased and the back leverage debt will also be riskier. With a yield based structure and stranded taxes from the outside capital analysis, a circular reference will arise. This is because the outside capital is affected by the timing of the distributions and the timing of the distributions are affected by the stranded taxes which are affected by the outside capital.

The third page includes periodic analysis with monthly and/or quarterly cash flow. With monthly cash flow during the construction period, a bridge loan that funds the tax equity and the project of back leverage can be evaluated. The bridge loan causes typical circular reference problems that arise from interest during construction, fees during construction and the DSRA. After the construction period, all flows should be computed on a quarterly basis because of the importance of tax flows in evaluating the IRRs.