This article discusses how you can create and use the option pricing models to evaluate credit spreads and probability of default. Debt can be structured as a sold put option where the owner takes a fee but is exposed to falls in value. This webpage describes how you can used the concept of option pricing models to measure the credit spread, probability of default and the loss given default.

Using Option Pricing Models and the Merton Model to Evaluate PD and LGD

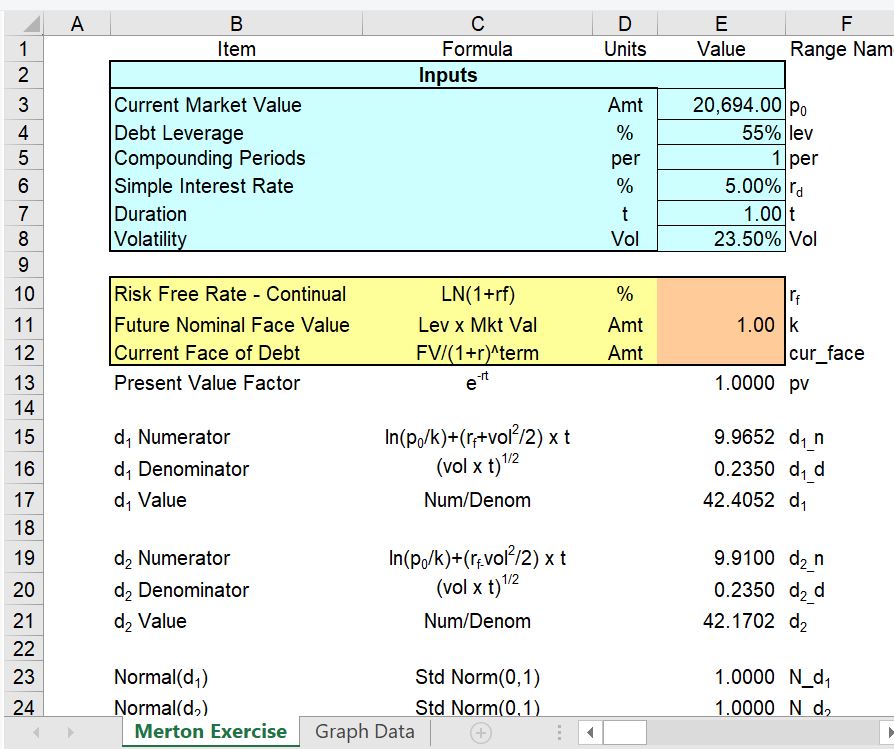

The screenshot below illustrates a page from one of the files that evaluates the Merton model. After you open the file you can input volatility, leverage and the time of the option and then find various credit statistics.

Merton Model Exercise for Computing the Probability of Default and the Loss Given Default

Financial Model Used to Illustrate Results of Merton Model with Monte Carlo Simulation Using Macro

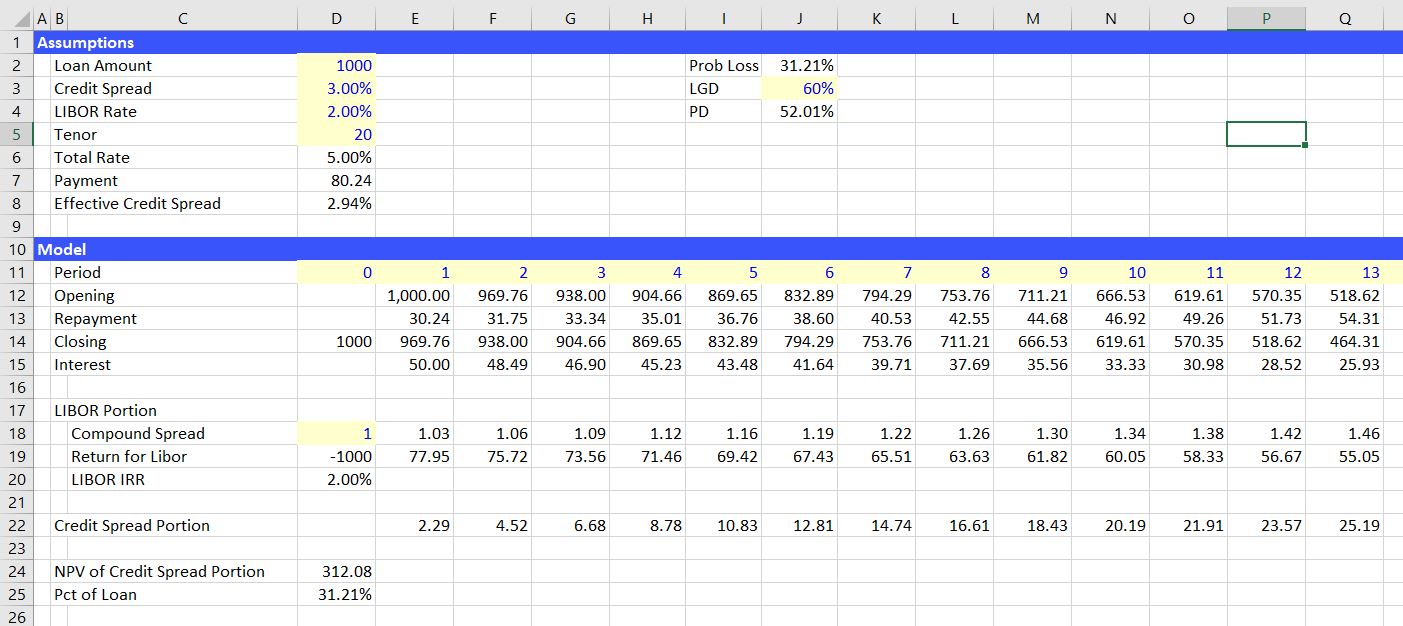

Excel File with Merton Model for Computing Credit Spreads with Completed Formulas and Analysis

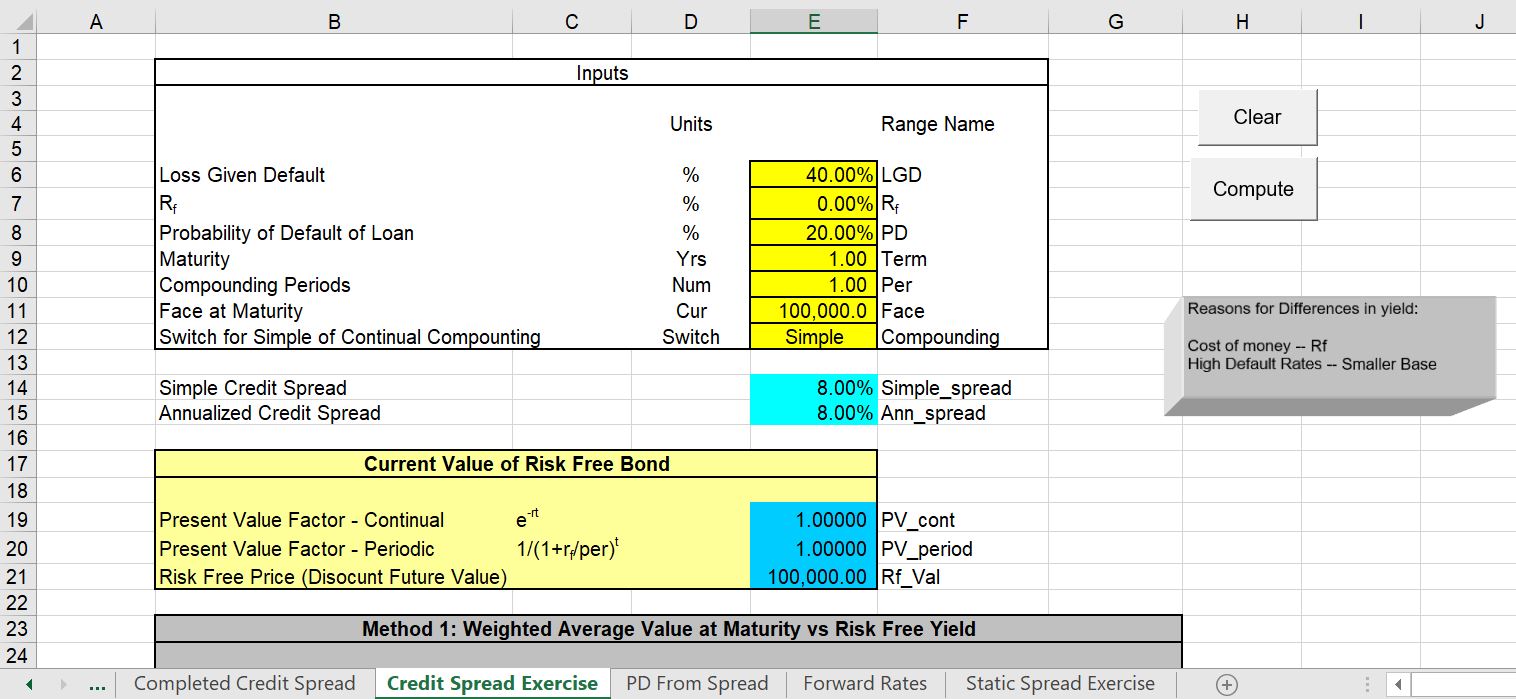

Implied PD from Credit Spreads