This page works through a sale leaseback transaction in the context of U.S. tax equity. The discussion and the modelling demonstrates how rental payments can be structured and the transaction can be modelled from the perspective of the sponsor/developer as well as the tax investor/lessor. The dicussion includes the issue of making an intital prepayment lease of the entire project and alternative structures to deal with the end of the lease and the repurchase of the asset.

In working through sale leaseback issues the first thing to understand is that a key difference between leases and loans with a flat payment is that leases involve the funding provider having access to tax depreciation and ITC. If there were no tax depreciation transfers to the lessor (like the lender or the tax equity), then the lessor would be just like a lender. In addition the residual value of the lease at the end of the lease term should be evaluated. As the lease will be transferred at the fair market value, issues with recording the up-front taxable gain to the developer will be addressed as well.

.

Prepayment Sale and Leaseback – Entire Project

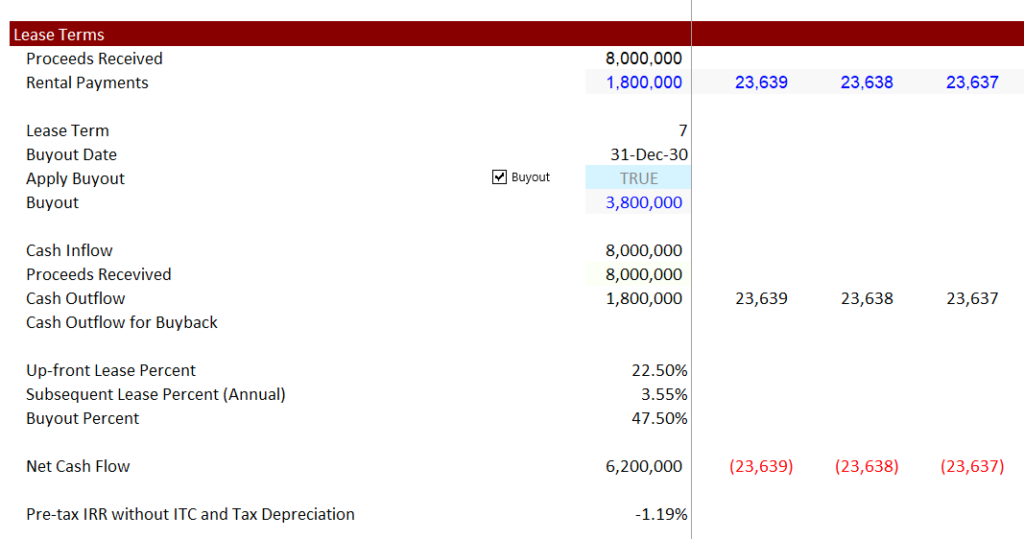

For a prepayment lease, the tax equity is a lessor (lender or tax investor) who buys the entire project from the developer. The lessor then owns the asset and can use all of the tax benefits. This basic idea of a sale and leaseback was used to sell and leaseback nuclear plants.

When, the lessor develops a rent payment it should include the value it receives as tax benefits in the effective rental payment. The developer pays some of the rentals up-front using the proceeds from the sale. This is like paying off debt to reduce future payments. The lease payments can then be structured so that cash flows are sufficient to repay the rental payments. A step by step cash flow for a pre-payment lease would involve the following:

Cash Flows on the ITC Date:

- Lessor pays FMV to sponsor/developer. In the example below, this is 8 million.

- Developer pays up-front rental payment to lessor (this is taxable to lessor and deductible for developer; thereby offsetting some of the tax benefits of the ITC). In the example below the up-front rental is 22.5%.

.

.

The problem with this structure is that the original developer of the project does not have any ownership in the asset. In theory, when the asset is sold, it is at the fair market value and can be expensive. This is the problem with the developer not having ownership of the project. If the rental payments are high the sponsor may not have an incentive.

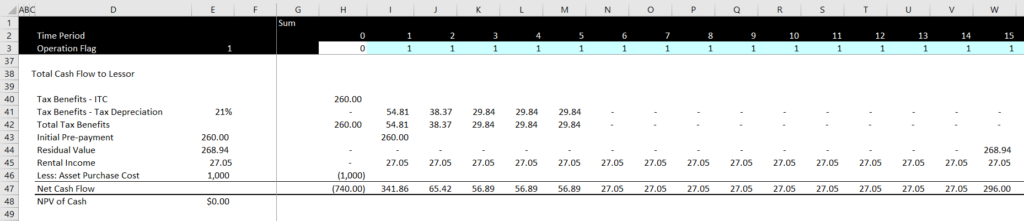

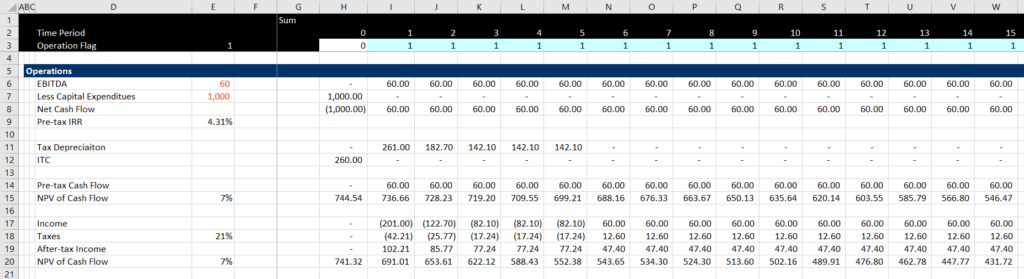

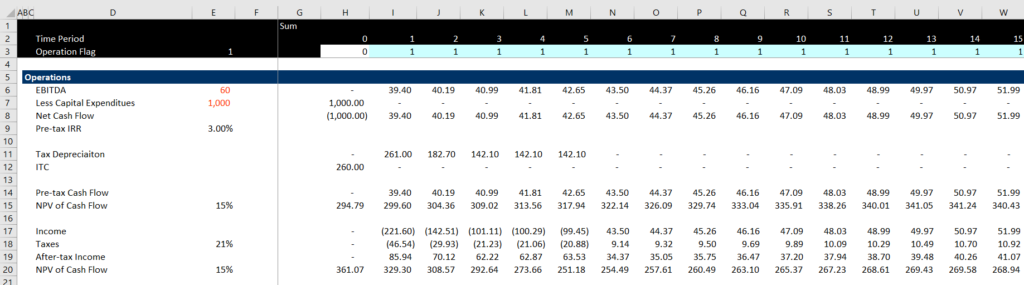

This is a standard lease. You can begin by using the PMT formula to find a flat payment that re-pays a loan. Then you can add the tax benefits to the lessor and re-compute the lease payment. You can also compute the IRR to the developer by assuming that the developer makes the initial payment during construction. To illustrate the standard lease, you can start with the cash flows and the computation of the net present value of cash flow. The value of the tax benefits will be part of the the lease payment

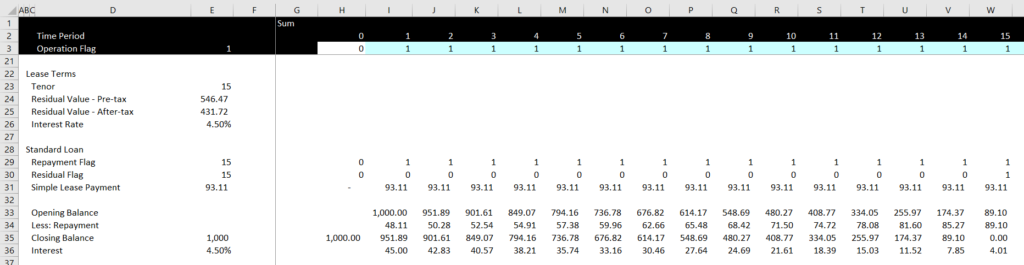

Once you have made the initial calculations, you can compute some lease payments. If you were to compute a simple loan without considering the tax benefits and make it into a lease payment, it may be the case that the lease payment is higher than the cash flow. In the first case I use an interest rate of 4.5% and the payment is more than the cash flow. This case with the lease rate without considering taxes or residual value, the lease rate is 93.

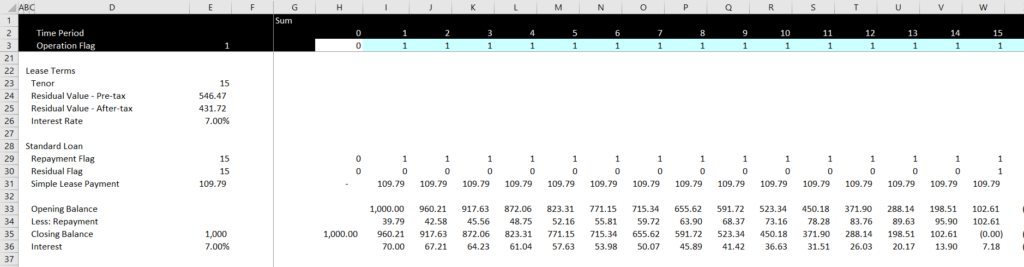

Even though the lessor is much like a lender, they would probably not be generous enough to give you an interest rate of 4.5%. If the interest rate increases to 7%, the lease payment increases to 109 as shown in the screenshot below.

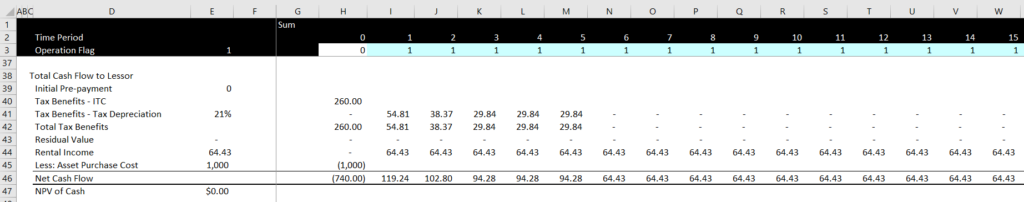

These simple examples did not account for residual value or the tax benefits that are retained by the lessor. When you include these, you can make a little goal seek to compute the level payment that will give you a lease payment. If you do not assume an up front payment by the developer (now the lessee), then the payment is lower. With the 15 year assumption and no residual value, the lease rate is 64.43 as shown in the screenshot below.

In this case the rental rate is higher than the cash flow. If you assume increasing cash flow from something like merchant cash flows, then the deficit in cash flow is worse. Think about it. Then the original developer does not have an incentive to operate the asset. He just wants to take his money an run away. Further, by assuming that the developer sells the asset at cost, he does not make any money.

Now assume increasing cash flow that leads to a somewhat lower IRR of 3%. You can also assume a valuation with a high discount rate. Then the deficit in cash flow is more even if you assume a residual value. You can see that in this case the initial cash flow is only 30

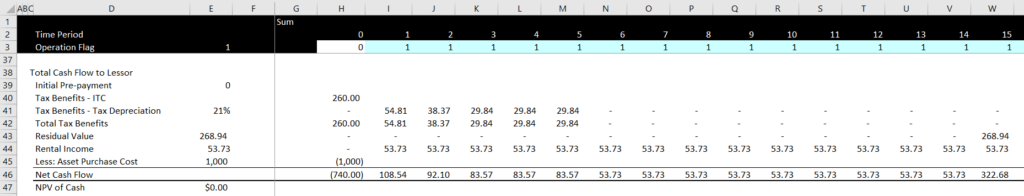

The screenshot below shows the lease payment without an initial repayment. In this case with a residual value, the lease payment is again higher than that cash flow.

In the final case I assume that money is paid back in an initial payment. This allows the lessor to make a lower payment.