This page includes selected examples of mining models. The mining models must deal with commodity price risk, reserve risk and cost over-runs. I have used the mining model analysis to demonstrate how Monte Carlo simulation can be applied to project finance models. The models include cash sweeps in debt.

Project Finance Model with Commodity Price Risk and Monte Carlo Simulation

The file and video below illustrates how you can incorporate Monte Carlo simulation into a project finance model. The model is set-up to be a model with commodity price risk. Once the project finance model is built, a time series analysis with volatility and mean reversion parameters is added to the model. The Monte Carlo simulation works with a little VBA code that re-calculates the price and by consequence also the cash flow for many simulations. The Monte Carlo simulation can be used to judge the efficacy of various structuring issues including cash flow sweeps and cash flow traps. The model below and the video demonstrates how you can incorporate either scenario analysis and/or Monte Carlo analysis to measure credit risk associated with commodity prices. The file shows that at least in theory, you can use the PLCR and LLCR with Monte Carlo simulation to measure the probability of loss. This can be adjusted for cash sweeps and other features.

Mongolia Mining: Assuming Prices During High Cycle will Continue and Problems with Cost Structure

Mongolia Mining owns a large Coal Mine in Mongolia. It’s coal is trucked to China. When it began operations a few years ago, coal prices were spiking and it could profitably sell to China with the expensive trucking cost. Coal prices have fallen and so has the demand for coal from the northern part of China. This has pushed the value of Mongolia Mining to very low levels (the company is traded on the Hong Kong exchange). This model demonstrates how to incorporate volumes and capacity into a model and evaluate the key driver which is the price of coal and the ability to transport volumes on a profitable basis. The Mongolia mining case therefore demonstrates how to use a financial model to perform credit analysis and evaluate the re-financing capacity.

I have used the Mongolia Mining case to discuss a couple of issues in financial modelling. The first video below describes issues related to creating a balance sheet. The second video explains how to create scenario analysis in the context of a mining company.

Africa Mining Example

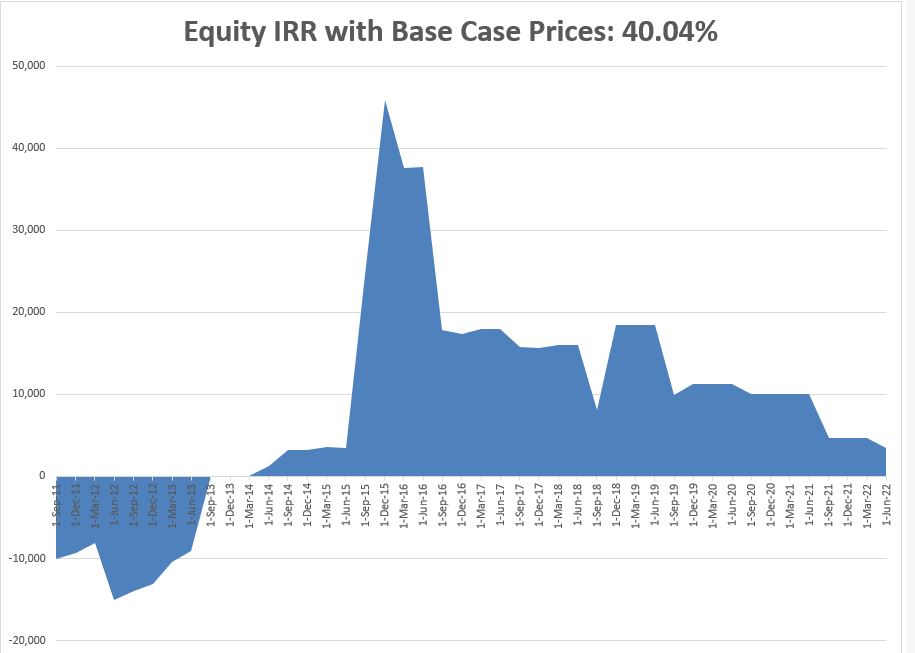

I complain a lot about stealing from developed countries and, in particular, Africa. Cash Flow in the model demonstrates and equity IRR of more than 40% as shown below.

If you want some other models to see the kind of capital expenditure layouts that are used and how resources are evaluated send me an e-mail.