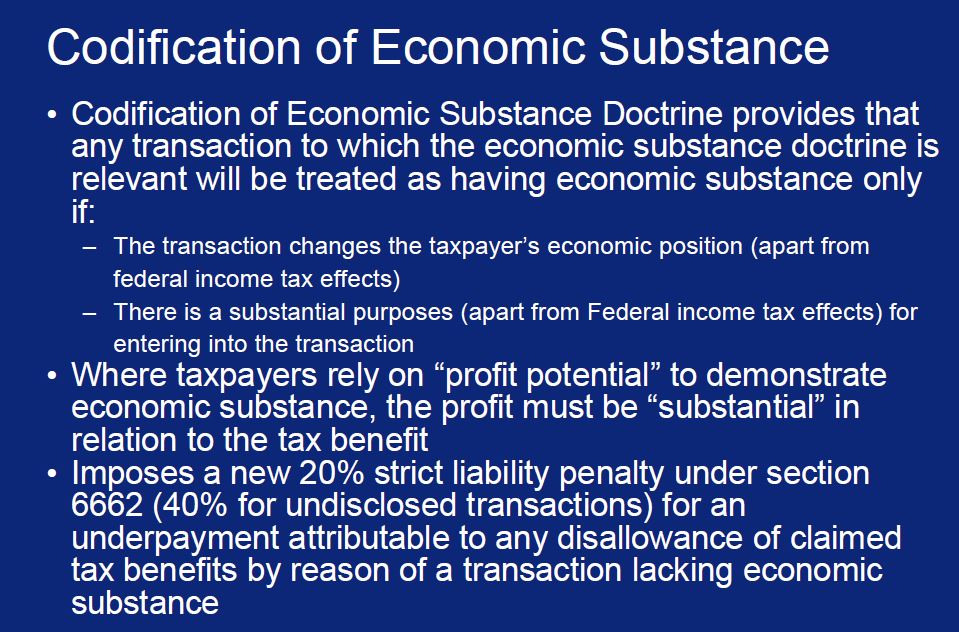

This page describes the outside basis or the tax basis for capital accounts in U.S. tax equity transactions for solar and wind projects. The outside basis calculation is important because the calculation of net tax investment in the assets of a partnership can result in increased taxable income to the tax investor. This is due to the fact that if the asset basis or outside basis would become negative, the investor is not considered to have economic substance in the investment and is considered a bare purchaser of the tax benefits. The outside basis is essentially the allocated net assets of the partnership to one of the partners with the important constraint that the tax basis cannot be negative. The importance of the outside basis is that a negative balance can limit the tax benefits to that tax investor because of the idea that if the tax basis is negative, the tax investor does not have an economic stake in the project. This affects the after-tax IRR for the tax investor through limiting the tax benefits. Over the years, people have sent me tax equity financial models that include a layout of the outside basis or the tax basis. I use some models to try to explain the theory (which sometimes does not make all that much sense to me) and the structure of the tax basis. More importantly, I try to understand the implications of the outside basis on the economics to the tax investor and the potential for stranded taxes which affects the tax investor IRR. The theory of having an outside basis comes from the idea that the tax investor must have economic substance in the partnership and he cannot be an investor to only take the tax benefits (I have put a quote from Deloitte at the end of the page about this). I separate what seems to be absolutely clear from the more ambiguous items.

There are some mysteries to me about tax equity transactions for which I probably am mistaken. These days, investors seem to favor back-leverage rather than project debt. As back leverage is not debt of the partnership, it does not affect the capital accounts and does not impact the tax basis or the inside capital account (discussed on the associated page). It is understandable that the tax investor wants a senior position to debt, but putting debt at the project level may reduce the potential for stranded tax. With project debt, the tax investor takes on a high proportion of the debt meaning the outside basis will have a higher value. The issue therefore is why not use project debt if the project debt increases shared liabilities in the outside tax basis and thus reduces the potential for stranded taxes from the outside basis. Another question is how to compute the gain on the sale of property by the tax investor after a sale of his interest to the sponsor/investor.

Substantial economic effect. The question is whether a tax equity investor is a partner or is a “bare purchaser of tax benefits”

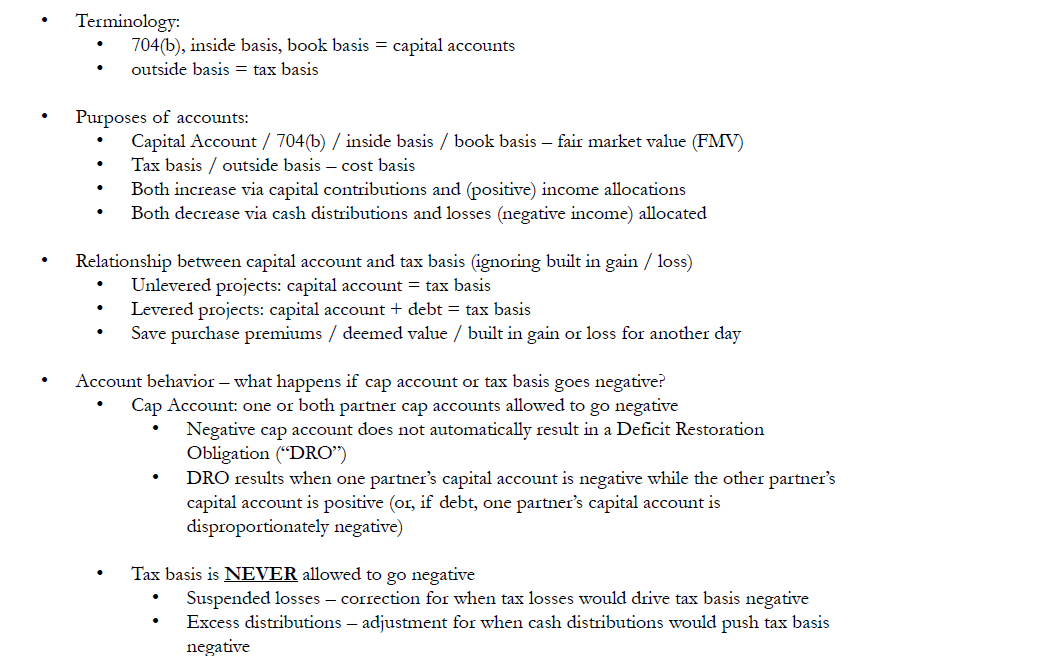

Definition of Outside Basis

When the tax returns are filed, both the outside basis and the inside basis are submitted to the IRS — I have seen the tax forms (which are very simple). The account discussed on this page — the outside basis or the tax basis — is the account that matters most. It is the capital account that can affect the after tax IRR of the tax investor by limiting the tax deductions of the tax investor.

The Tax Basis account represents the tax investor’s (and also, if you want to compute it, the sponsor/developer) tax basis in the partnership SPV (the LLC). It is often referred to as the “outside basis”. If there were no limits for suspended losses or for excess dividends above the tax basis (called 73), then the outside basis would just be division of the net assets of the partnership between the tax equity investor and the sponsor/developer. I focus more on the tax investor’s tax basis than the sponsor/developer tax basis because the tax investor is trying to limit his stranded tax which is the whole issue.

A tax investor’s tax or outside basis is equal to the total of :

- the capital contribution by the investor (initial capital contribution or amount paid by the tax investor),

- additional capital contributions (not generally there),

- dividends paid from the pre-tax cash flow distributions (that are subtracted)

- allocations of net profits and losses of the partnership (e.g. the 99%), and

- the Member’s share of the liabilities of the partnership SPV (the LLC).

You should be able to reconcile the tax basis of the To explain the tax basis, you can think of the balance sheet at the partnership SPV. The assets are the net plant of the partnership less the 50% ITC basis adjustments. The balance sheet should balance. There are two items that can affect the outside basis of the tax basis. The first is dividends paid (pre-tax dividends from the cash flow distribution) that can bring the balance to below zero. The second is suspended losses that are computed after the excess dividends.

The Outside Basis cannot be Negative

Gain from Dividends paid above the Balance of the Outside Basis — Section 731(a)(1) Gain. (Also Called Excess Distributions, Deemed Sale)

- Excess Distributions (a.k.a Distributions in Excess of Tax Basis a.k.a 731(a) Excess Distributions)

• Results when cash distributions (before tax losses) pushes a partner’s tax basis below zero

• Deemed to be a sale of part of the interest and requires partner to recognize a gain

• Cash distributions to a partner are tax free to the extent they do not exceed the

partner’s tax basis

• Excess distributions are taxed at ordinary income (21%)

Distributions Cash or property (and constructive cash distributions from reductions in share of liabilities) in excess of a Member’s Tax Basis. Here the tax investor is assumed to have no more economic interest.

- The calculation Occurs at the end of the year (after all allocations for the year). (If you care about the tax numbers, this results in the recognition of §731(a)(1) gain by the tax investor.

- Occurs when the sum of Cash Distributions during the year exceed the end of period Tax Basis Before Distributions. This is why there is a sub-total in all of the accounts below.

- The tax investor will recognize gain in the amount of the excess. This is called a deemed sale.

The gain will increase the outside capital account or the basis of the Tax investor so that the end of year basis of the investor will have a balance equal zero.

- The gain recognized will also result in an increase in the basis of the partnership SPV LLC’s assets. This is under something called Section 734(b).

- It will result in an increase in the Tax Investors’ Capital Accounts (under Regulation §1.704-1(b)(2)(m)(4) if you care about all of these tax numbers)

- As now stated many times, the amount of the gain recognized is added to the basis of the Member.

- On the outside tax basis – a gain (income) is recognized which brings tax basis back to zero

• The new asset is split between the sponsor and the tax investor

• New intangible asset is depreciated via 15 year SL

• Depreciation deductions from these new assets can be specially allocated (allocate in same ratios as gross income)

Here is a more technical tax discussion that I have adjusted to make more sense to people like me. The second area of ambiguity relates to permissible reductions in the investor minimum investment (the tax investor makes an initial investment that is affected by income and dividends like any investment in the world). The wind energy safe harbor requires the investor to maintain, for the duration of its

participation in the project, its capital contribution at or above the level of the investor minimum investment (I think this means that the investment balance cannot be negative). The investor minimum investment may be reduced only ‘‘as a result of distributions of cash flow from the SPV. Thus,

only distributions of cash representing may reduce the investor’s contributed capital below the level of the investor minimum investment (I think that is why you put the sub-total in the outside capital account.

Suspended Loss — The Suspended Loss Affect Cash Flow of the Tax Equity Investor and the Timing of the Yield Flip

Suspended Losses

- Results when taxable losses (after adjusting for excess distributions) cause a partner’s tax basis to go negative

- Partner is unable to utilize the loss (it is “suspended”) and must carry it forward until they have a sufficiently positive tax basis to absorb the losses

- Results when taxable losses (after adjusting for excess distributions) cause a partner’s tax basis to go negative

- Partner is unable to utilize the loss (it is “suspended”) and must carry it forward until they have a sufficiently positive tax basis to absorb the losses

- In wind transactions, suspended losses still count as an income allocation for overall income allocation percentage and subsequent PTC allocations

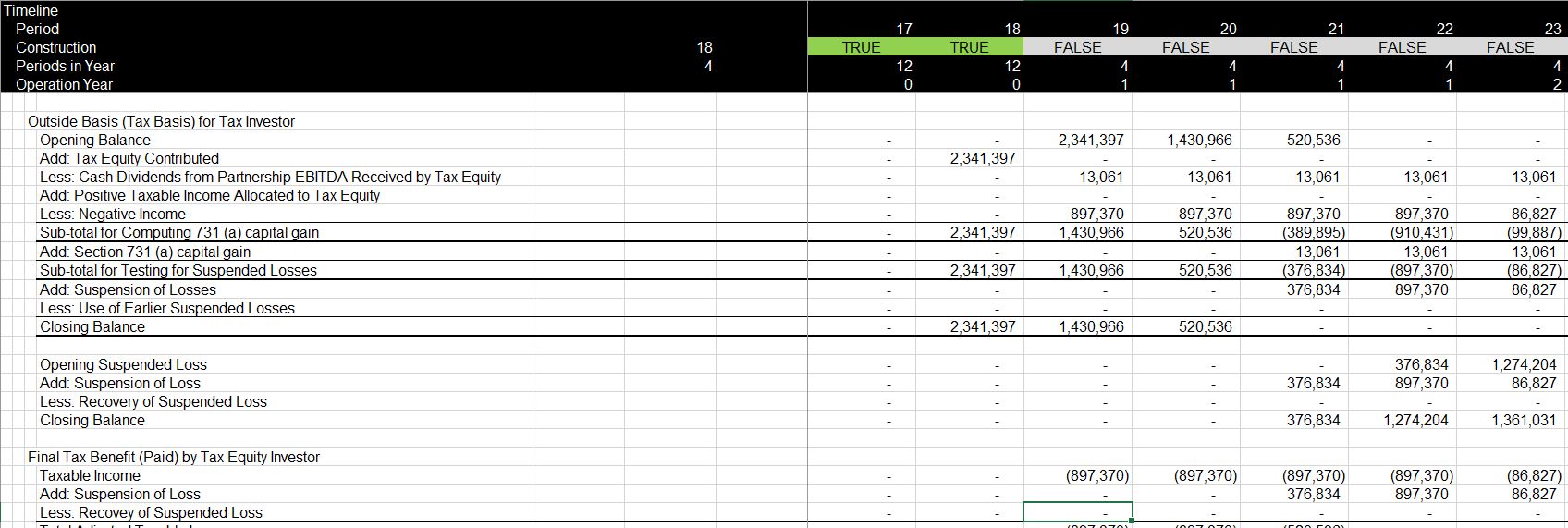

Examples of Tax Equity Accounts in Models

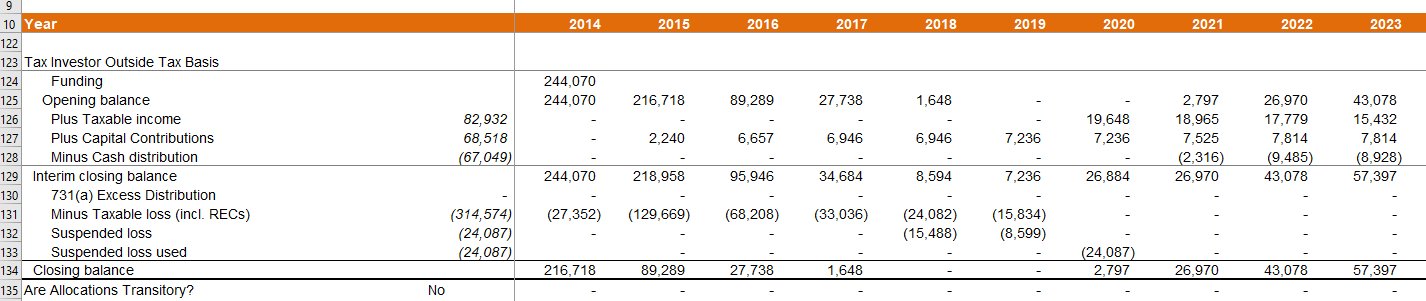

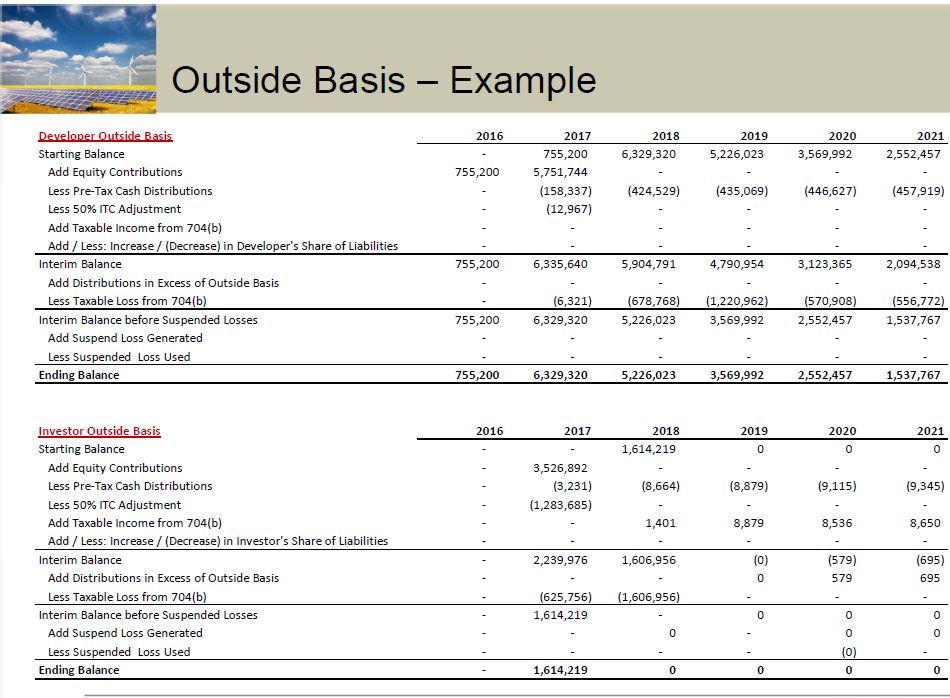

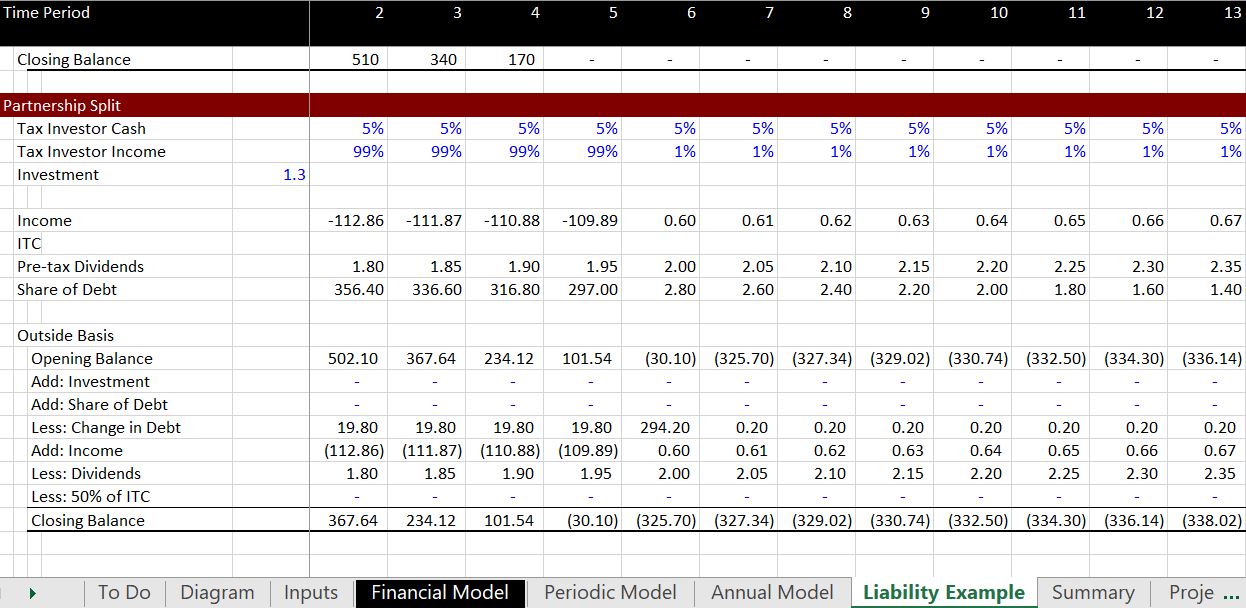

I have included a lot of examples of the outside basis. This should get boring because the accounts are all about the same. There is always a sub-total to compute the deemed sale or excess dividends; there is always a section for the suspended losses. Note there is no section for the DRO. There may be a section for share of liabilities, but not a section for the minimum gain. The format of the outside basis is consistent in models with a sub-total for computing the limit on taxes if dividends exceed the invested capital of the tax investor and an NOL type mechanism called the suspended loss if the balance of the tax equity is still negative.

Here is the second example from an actual model. It is for a wind project and with the assumptions the amount does not go down to zero. But the titles are the same. Note that the positive income is separated from the negative income for computing the deemed sale.

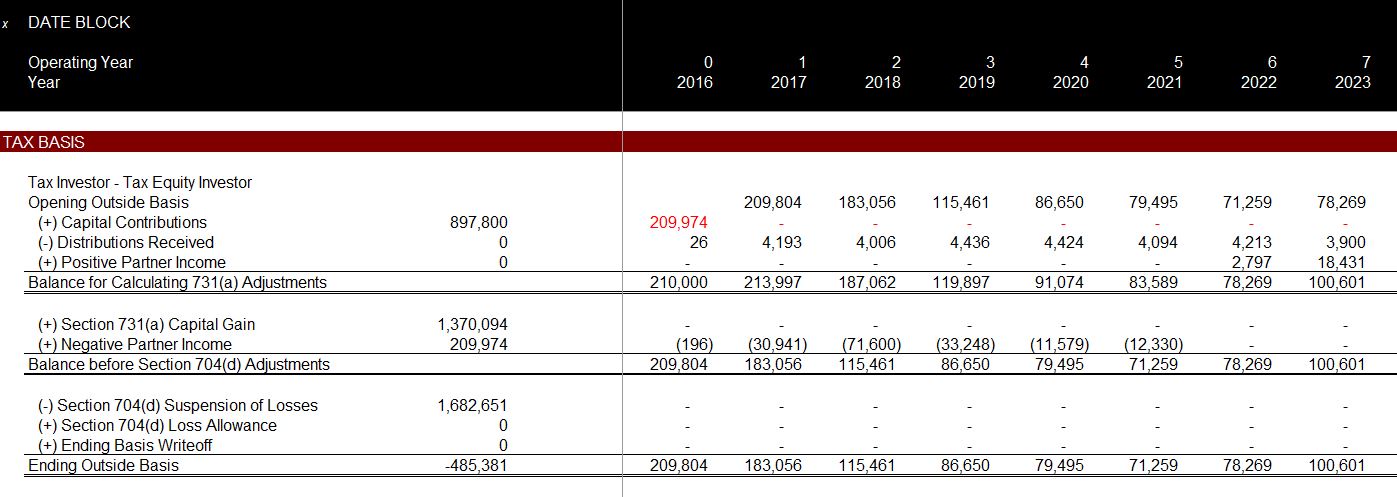

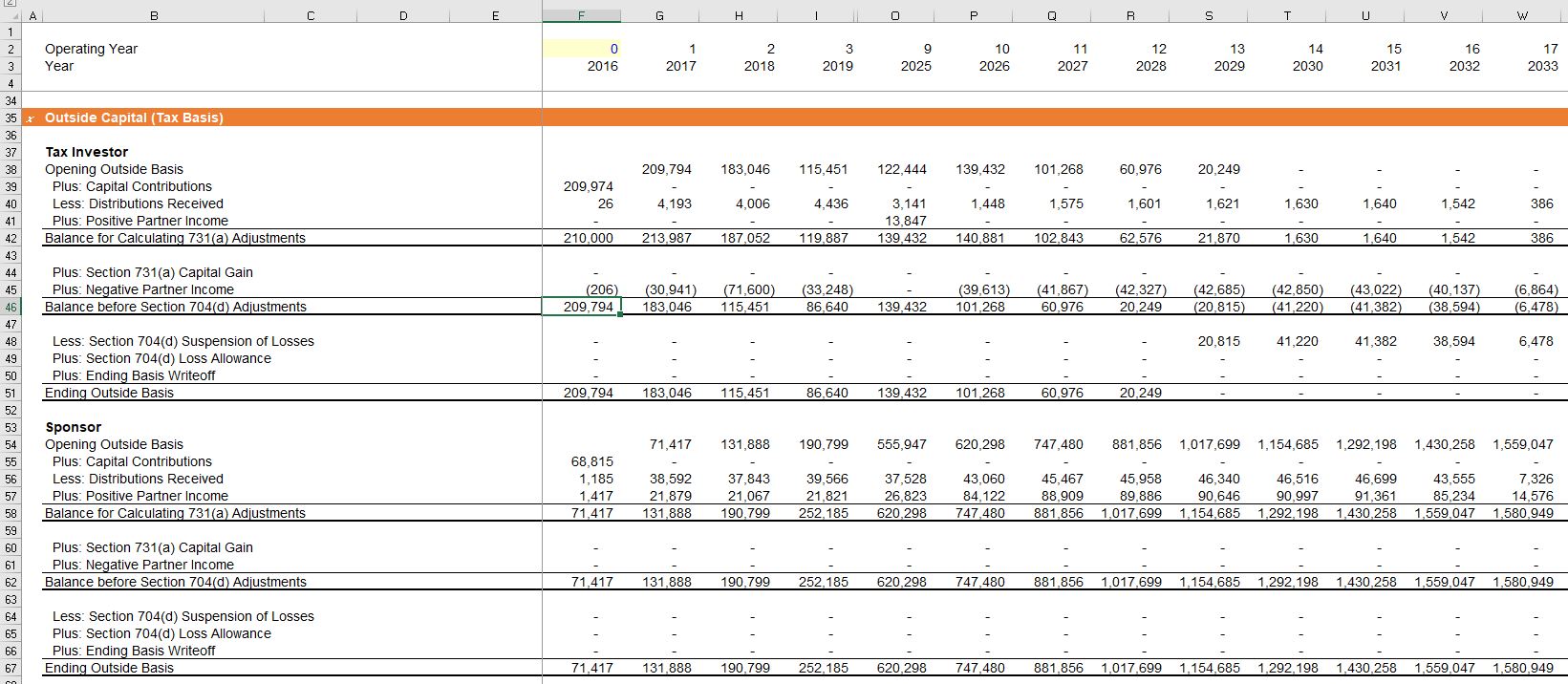

Here is another example where the model has a very similar structure. There is a sub-total for computing the balance to evaluate the excess dividends.

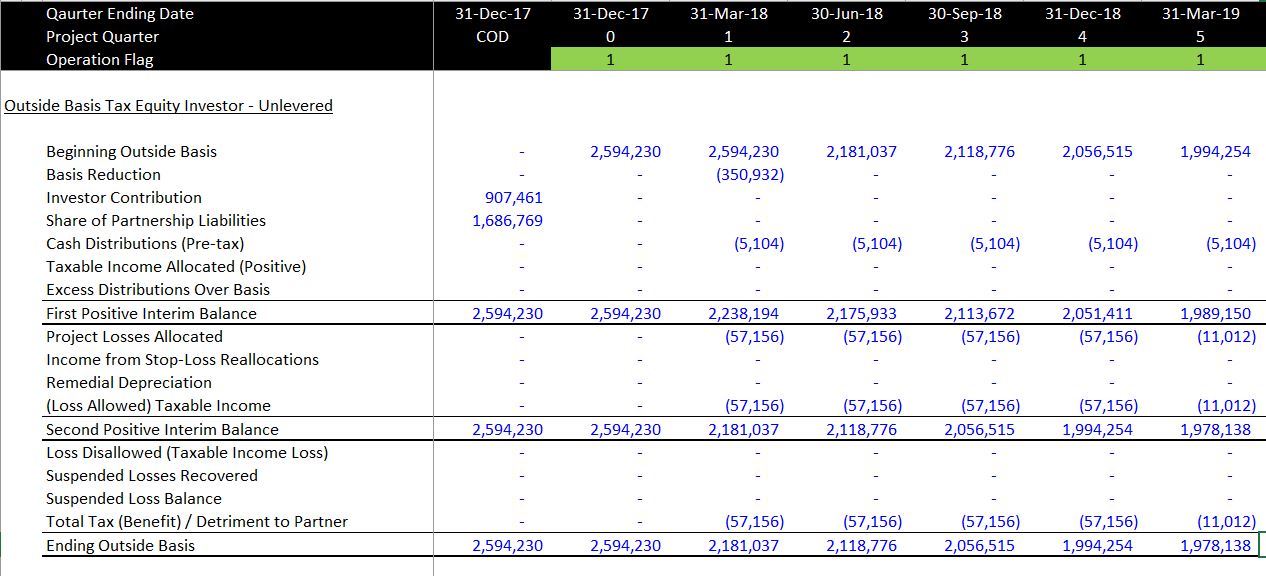

This example is an exception. In this case the share of partnership liabilities is included in the outside basis and there is a line item for remedial depreciation. These two items are not in the other examples. The partnership liabilities are not in the other examples because project level debt is not in the models. The remedial depreciation is a question.

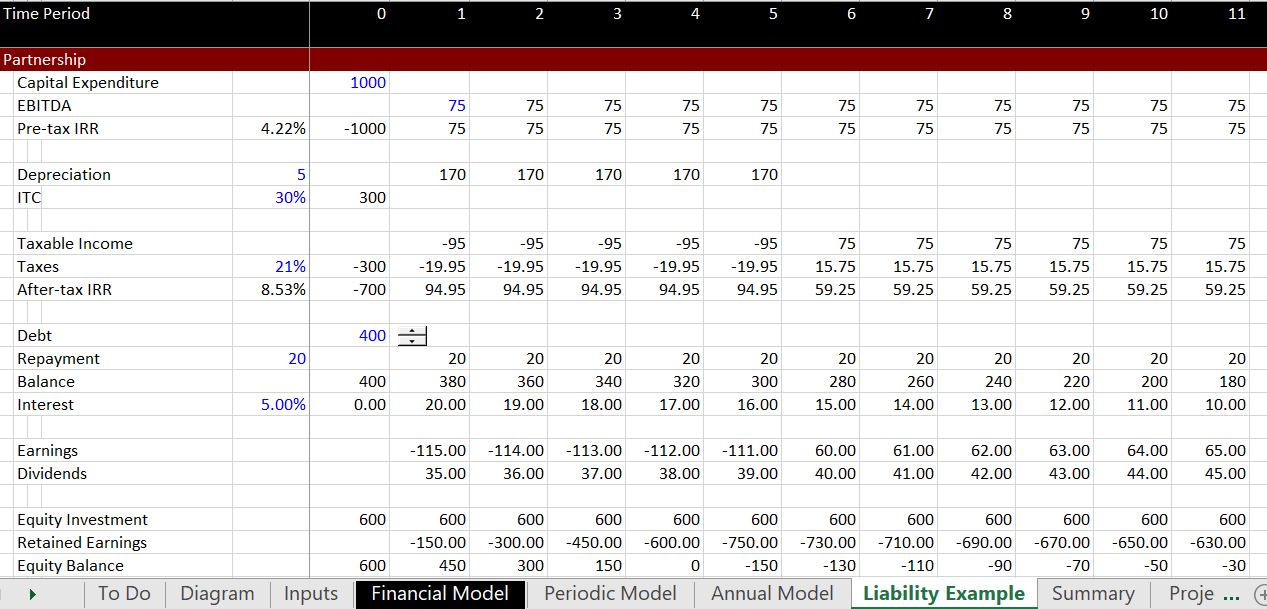

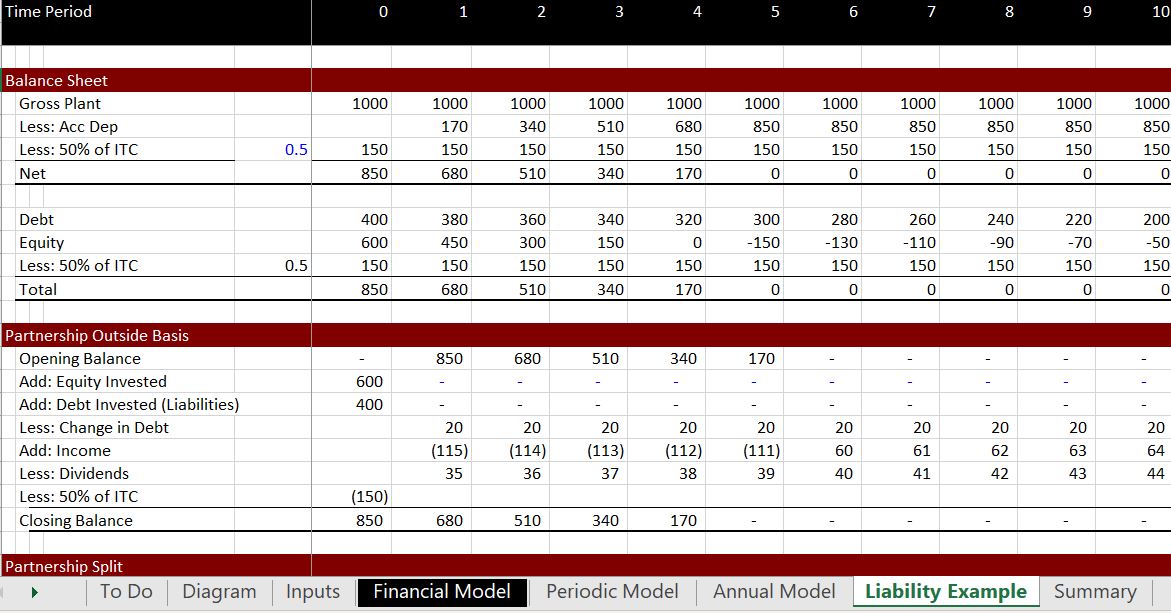

One of the best examples is show in the screenshot below. Here is another example that includes an line item for share of liabilities. Note the that when the liabilities are added at the beginning of the process, the liabilities increase the outside basis. Then when the liabilities decline, the outside basis. The simple example below illustrates that this adjustment results in the outside capital representing the share of total assets rather than only the equity capital. The example also demonstrates that project debt has an advantage in that it reduces the exposure to stranded tax as the outside basis is increased. I understand that tax equity does not want any exposure to being subordinate to debt or to have the possibility that the SPV will declare bankruptcy. But the addition of the liabilities to the balance makes one wonder why project level debt is not used more often.

Share of Partnership Liabilities

Beginning of period and end of period liabilities. This means that you should set-up a beginning balance and a closing balance for the debt at the partnership level and then allocate that debt to the tax equity investor and the sponsor/investor. The tax investor basis includes its share of liabilities of the LLC – for example, debt at the partnership level. This implies that any change in those liabilities (either through increased borrowings, debt payments or changes in the ratio in which those liabilities are shared among the Member’s) results in a change in the tax investor’s basis. A reduction in the tax investor’s share of liabilities (from debt repayment) is treated as a Constructive Cash Distribution reducing basis.

Simple Example Demonstrating Why and How Shared Liabilities are Included

This section shows a very simple example with a partnership balance sheet that illustrates how the debt works along with the outside capital account. If there is no debt for the partnership, the sum of capital accounts should be the same as the tax basis. If you think of a really simple case with no current assets and no cash and no debt, then the total assets are the net plant. As the balance balances, the net plant equals the total equity. Therefore in a simple case, the capital account is the same as the net plant of the project or the tax basis.

Selected Quotes from Public Articles on Tax Equity

Here is a quote from Deloitte on the idea that the tax investor must have economic substance in the investment.