This page discusses the theory of project finance beginning with the definition of project finance, risk analysis and financial ratios (DSCR, LLCR and PLCR) and works through some famous project finance cases. Structuring of debt in project finance is then addressed through evaluating the effects of nuanced debt size, debt funding, debt repayment and interest rate issues on the equity IRR of a project. Throughout this website I emphasize that you must understand project finance theory and corporate finance theory before you try to develop models. I hope that this page gives my somewhat unconventional view on the theory of project finance by providing lectures and slides on various aspects of project finance risk analysis and project finance contract structuring. In addition to risk analysis and debt structuring issues, I discuss contracts, commitment dates, re-financing and suggest different ways to look at the fundamental theory of project finance. I hope to take a more philosophical and less Wall Street/Harvard approach.

Project Finance Overview Lecture Set:

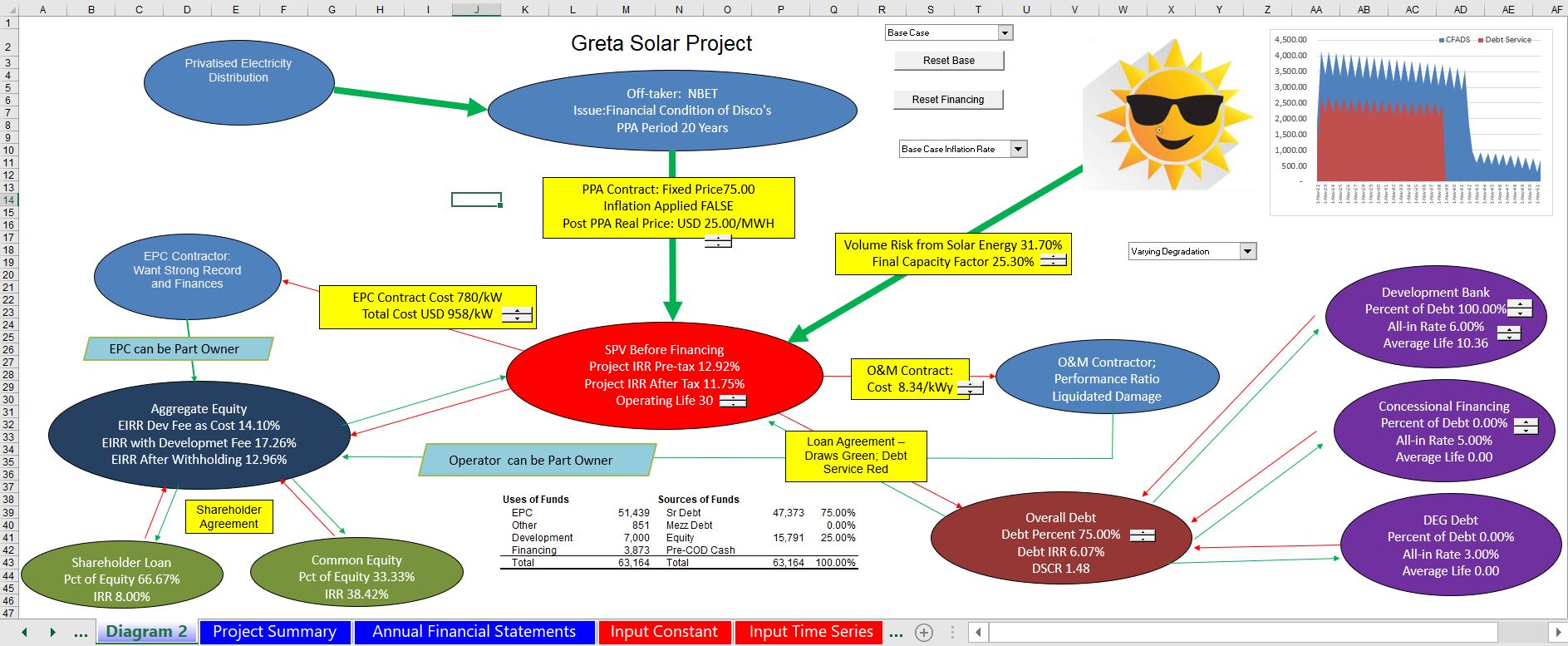

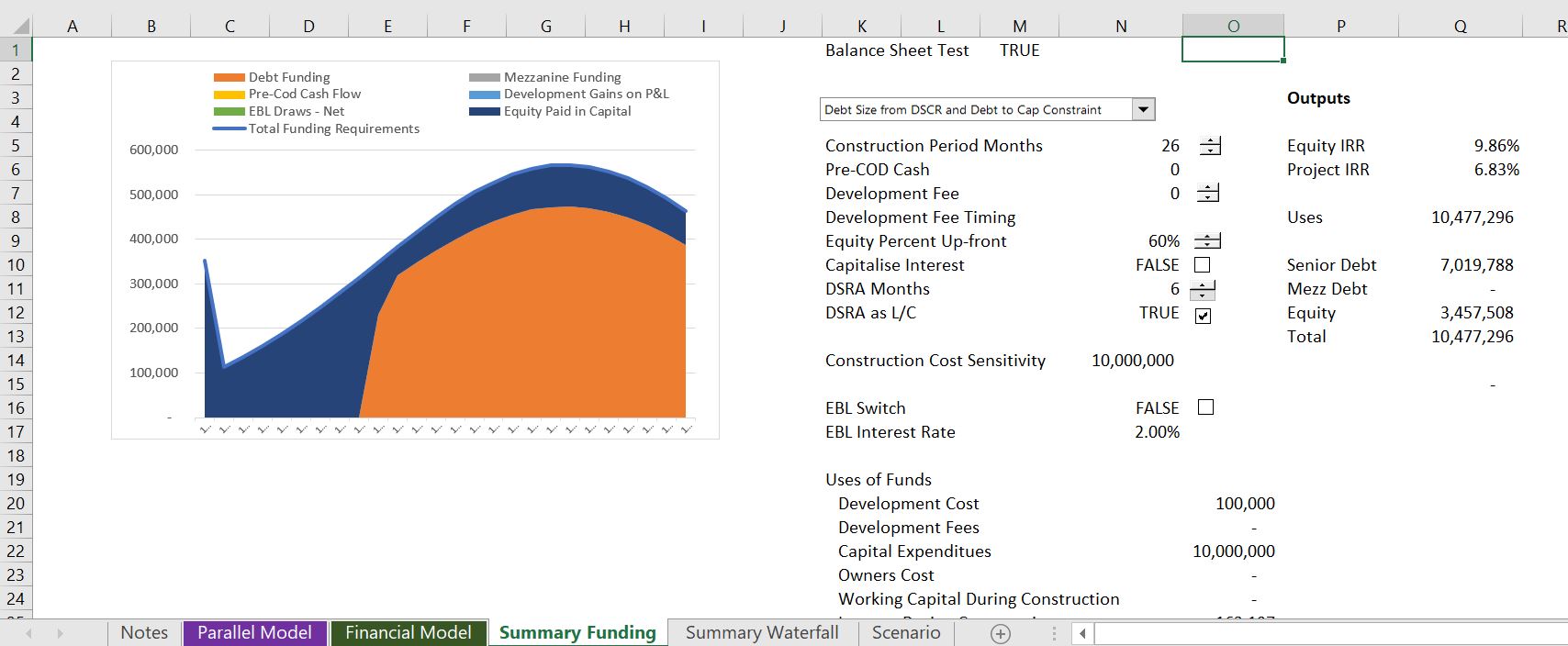

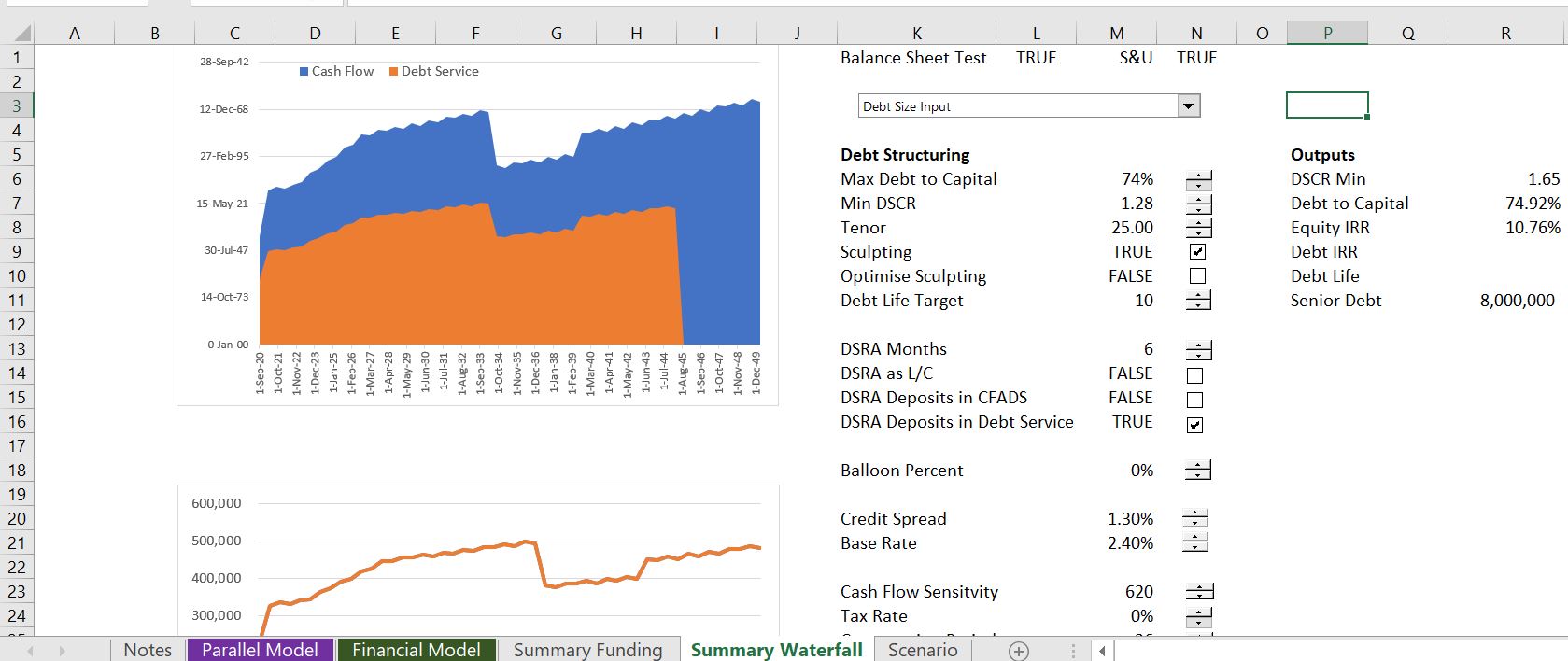

The videos below describe the power point slides that I use for an overview of project finance. I start with risk analysis and suggest that a few famous and old but important case studies can give background on different types of risks in projects such as why a power contract can be dangerous if the contract has a high price and situations in which bad contract structure can lead to disaster. Then I move to debt structuring and discuss various issues in the sizing, funding, repayment, interest rates and credit protections. For both the risk case studies as well as the structuring, you can find much more detail in other places on the website, but the slides and videos below provide an overview of some of my ideas. The first file below is a detailed financial model that allows you to see the structure of a project with various risks and returns. The case has with multiple debt issues and sculpting along with sensitivity and scenario analysis. This case accompanies the power point slides below and that walk through case studies for a solar project, a thermal project and a toll road project. A diagram of the summary page in this model is shown in the screenshot below.

Power Point Slides that Accompany the Video Lecture Series on The Theory of Project Finance

Article on Project Finance that Includes Definition of Project Finance and Some General Statistics

Power Point Slides that Accompany Project Finance Modelling A-Z Analysis and On-line Course

Example Old Term Sheet for Discussion of Debt Structuring Iterms (from Defunct Bank and Never Used)

A set of four videos that provide and overview of project finance on this page. The videos begin with the definition of project finance and move to different kinds of risk and structuring issues in the second and third video. The final video addresses re-financing and selling projects at different times.

I have also included a model that illustrates the effects of various different structuring issues. In the attached file (that resolves all circular reference issues) you see how various structuring elements affect the returns to investors.

Part 1: Project Finance Theory and Overview

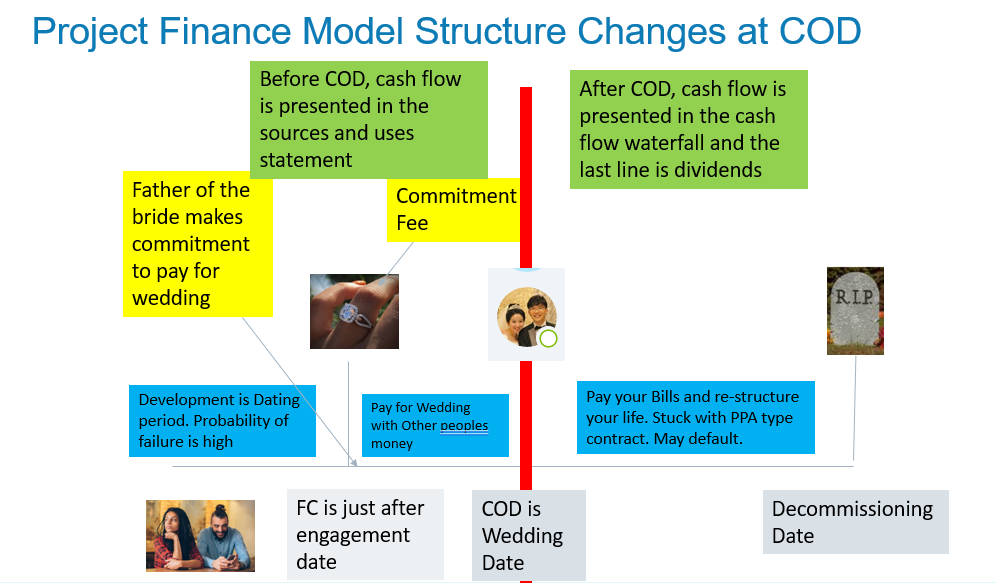

The first video provides an overview of project finance with the definition of project finance compared to project finance. Timing issues in project finance covered and the change in risk over the life is emphasized. Different types of projects with volume risk and availability risk are illustrated with project structure diagrams.

Part 2: Debt Structuring in Project Finance

The second video addresses the five parts of debt structuring (in contrast to the first part which addresses risk analysis). The five parts include: Debt size, debt length, debt repayment, interest rates and credit protections. Sculpting is covered in debt repayment and the sizing of debt using either the debt to capital or the DSCR constraint. You need to know that the debt at COD is the PV of the debt service.

Part 3: Re-financing and Credit Spreads in Project Finance

This third part of the series reviews risk analysis, project diagrams and debt sizing. Then the lecture goes into the effects of re-financing and credit spreads. Re-financing changes everything. Re-financing is a option and the value of re-financing comes from uncertainty. The credit spreads are also covered as well as the implied probability of default from high credit spreads that are earned and compounded over a long period.

Part 4: Credit Protections

The final part of the project finance theory lecture series addresses credit protections. All credit protections can do is to add a bit of liquidity to the project and it can limit dividends. Debt Service Reserve Accounts (DSRA), cash lock-up DSCR covenants and cash sweeps are discussed.

Slides of Debt Structuring in Project Finance

I have also included other slides that I sometimes use in my courses. The first set is about project funding issues that can be classified into (1) debt sizing; (2) debt funding during construction; (3) debt repayment; (4) interest rates and fees and (5) credit protections like the DSRA and cash sweeps.

Power Point Slides that Review Fundamentals of Valuation in Project Finance and DSCR Standards

Power Point Slides that Review Various General Risk Techniques in Project Finance (e.g. Risk Matrix)

Further Information and Learning: Request Resource Library (Free), Find Details About In-Person Courses, Make Suggestions on Course Subjects and Locations

The reason I have worked on this website is so that you consider an in-person class which is by far the best way you can become a top project finance analyst. If you click on the button below, you will be forwarded to a website that describes some of unique courses.

Click on this Button and See How to Create A Project Finance Model and Debt Structuring Analysis in A Couple of Days by Attending an Intensive, Hands-on In-Person Class If you click on the right button you can quickly send an e-mail to edwardbodmer@gmail.com and request the resource library (no charge). The google drives include more case studies, financial models, risk analysis files and other materials than are included on the website. I promise not to pester you if you do send me an e-mail.

I would really like to know what courses may be most interesting to you and where you would like the courses to be held. If you click on the left button below, I have a form that I will use to try and put together a class with a few people.

If you are a student, I would be honoured to come to your university or your business club and give you a hands-on guest lecture. If you click on the button on the left below, you can do me a big favor by giving me some information about your institution.

Click on this Button to Send Me and E-mail and Request Resource Library that Contains Google Drives and Zipped Files (No Charge for this) Click on this Button and Do Me a Favour by Suggesting Your Preferred Course Locations, Subjects and Possibilities of Guest Lectures and Your University

Link to My Youtube Channel Where You Can Look At All of the Different Videos that I have Made

Example of Project Finance Model with Parallel Model to Resolve Circular References

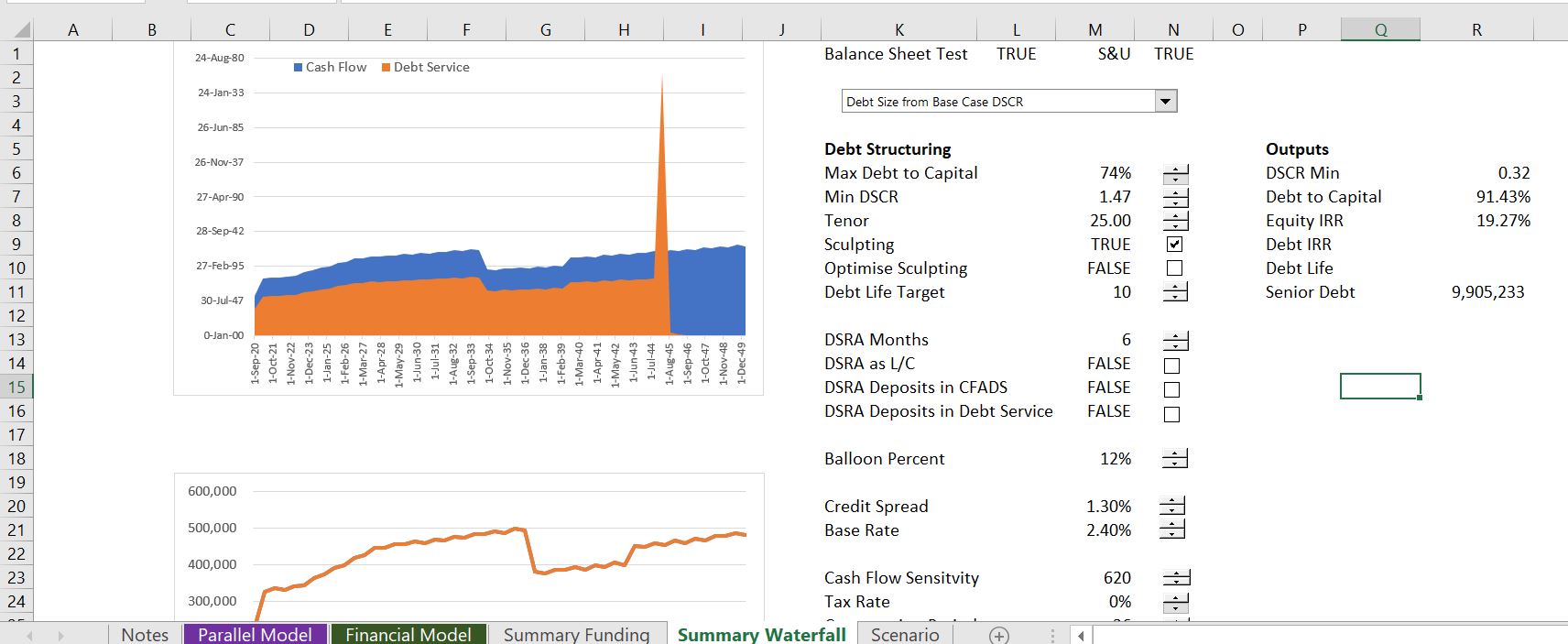

The model that you can download by clicking on the button below resolves circular references without the iteration button or copy and paste macros. This makes the model faster, more transparent, more accurate and much more flexible. I have been working on this for a long time and I am going to post a template model that makes it easy to add to your model that has circular references. Please do not think this is difficult to do as I will be adding a lot of examples and videos that demonstrate you can easily add a page to your model and get rid of your copy and pasted values. You can add up to 30 different debt issues; you can use all kinds of different debt sizing, debt funding, debt repayment and interest rate structures. You can put in balloon payments, you can sculpt where changes in the DSRA are in the numerator or denominator of the sculpting formula.

I am continue to perfect this approach so it is easy to implement and can handle more possible of debt and taxes. You can see my progress if you have downloaded the google drive. The location of the files on the google drive is demonstrated in the screenshot below.

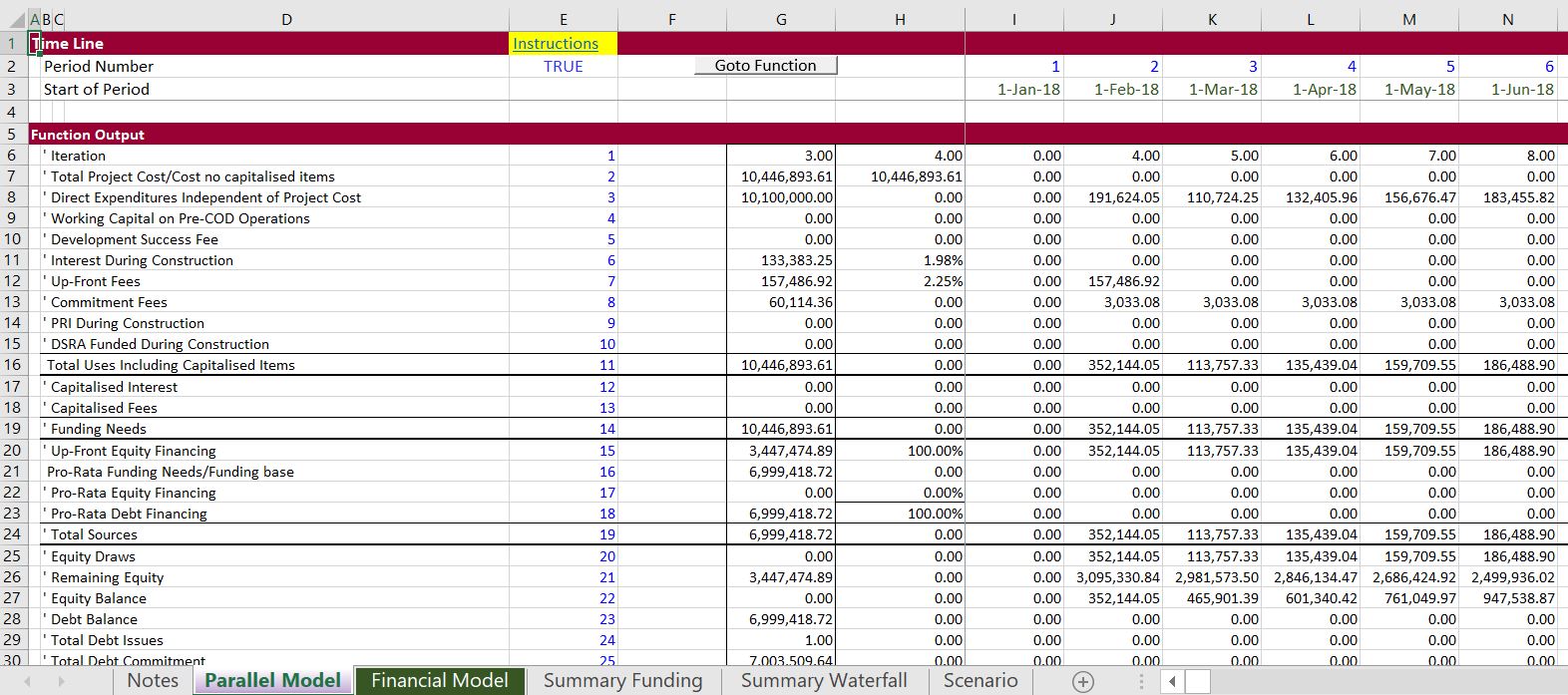

The screenshots below illustrate a few concepts about what the parallel model concept can do. The first screenshot demonstrates the parallel model page that you add to your model. This has a model that can be entirely independent of your model and used to test the accuracy of your model (the A in FAST). Data from the parallel model like the CFADS, total funding and DSRA flows can be connected to your model. This will eliminate the circular references in your model and make your model more transparent (T in FAST). By solving the circular references your model will be much more flexible and fast (the F in FAST). Finally, the parallel model outputs are structured so you can see all of the key cash flows of during and after construction. Making the parallel model in the two screenshots is done with a template and you do not have to re-enter the stuff.

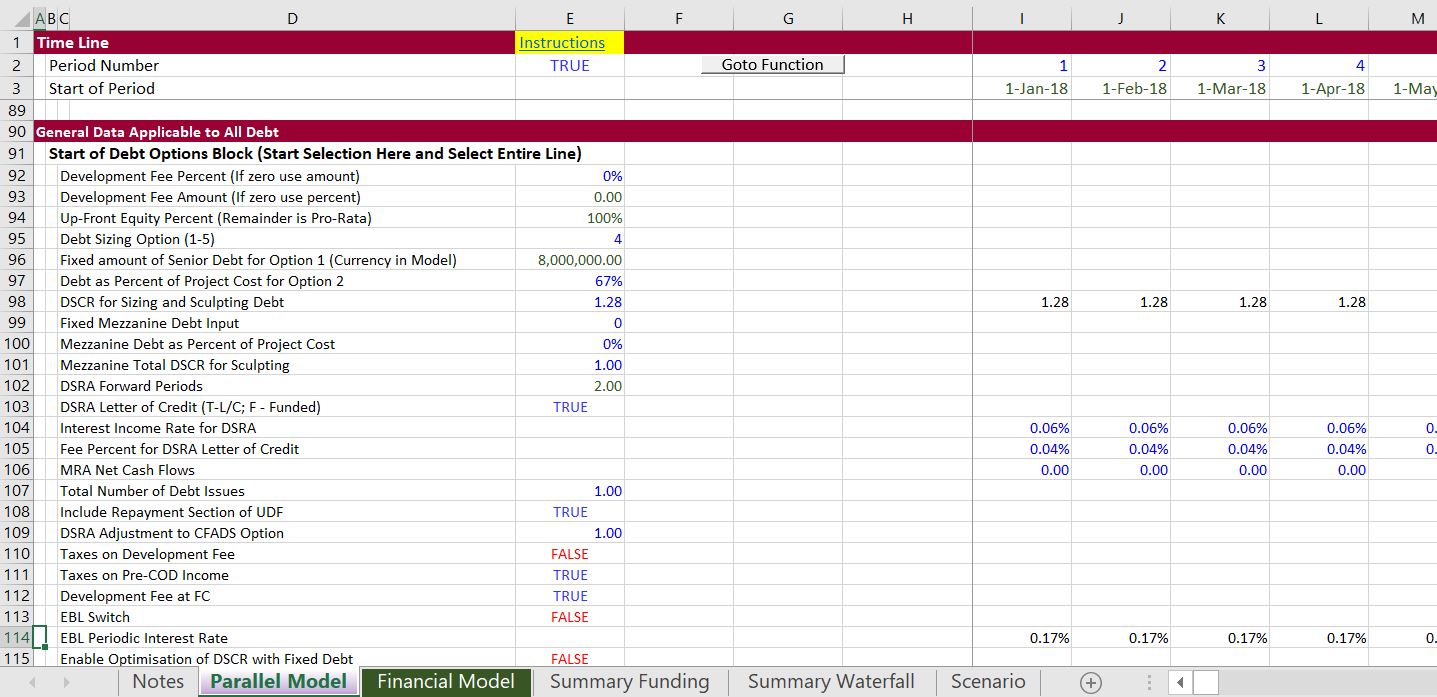

The screenshot below illustrates some of the inputs that you put in the parallel model. Please note that all of these inputs come from somewhere in your model. More importantly, many of the inputs that you may not care about like withholding taxes on debt issues or the percent of EBITDA cap on tax can be left out. It should only take you a couple minutes to fill in the inputs. Note that some of the inputs are scalar variables with single inputs while other variables are time series variables that some people simply call time variables.

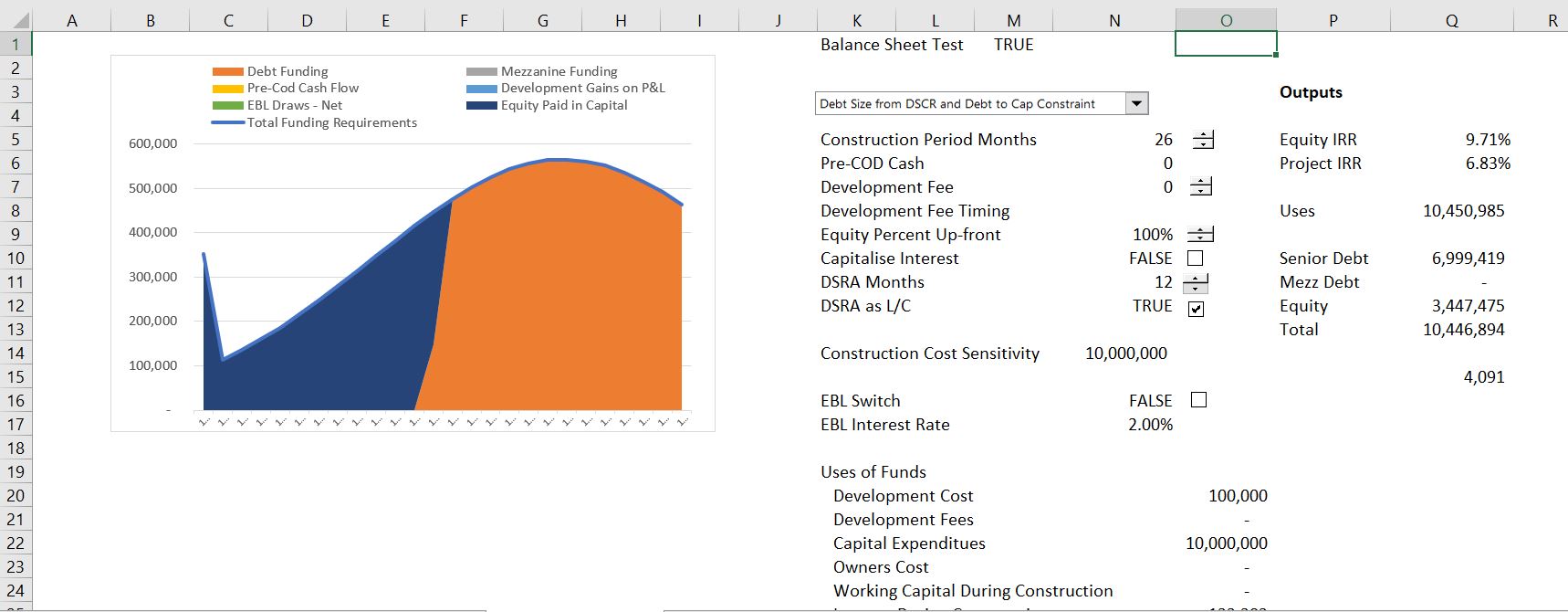

The next screenshots demonstrate some of the things that you can do with the parallel model concept that you could hardly imagine if you were using a copy and paste routine. The examples do not show that you can use a goal seek when you change anything (i.e. you can find the required price to give you an IRR with different structures. The first screenshots illustrate the types of funding analysis that you can do. In the first example there is equity first funding.

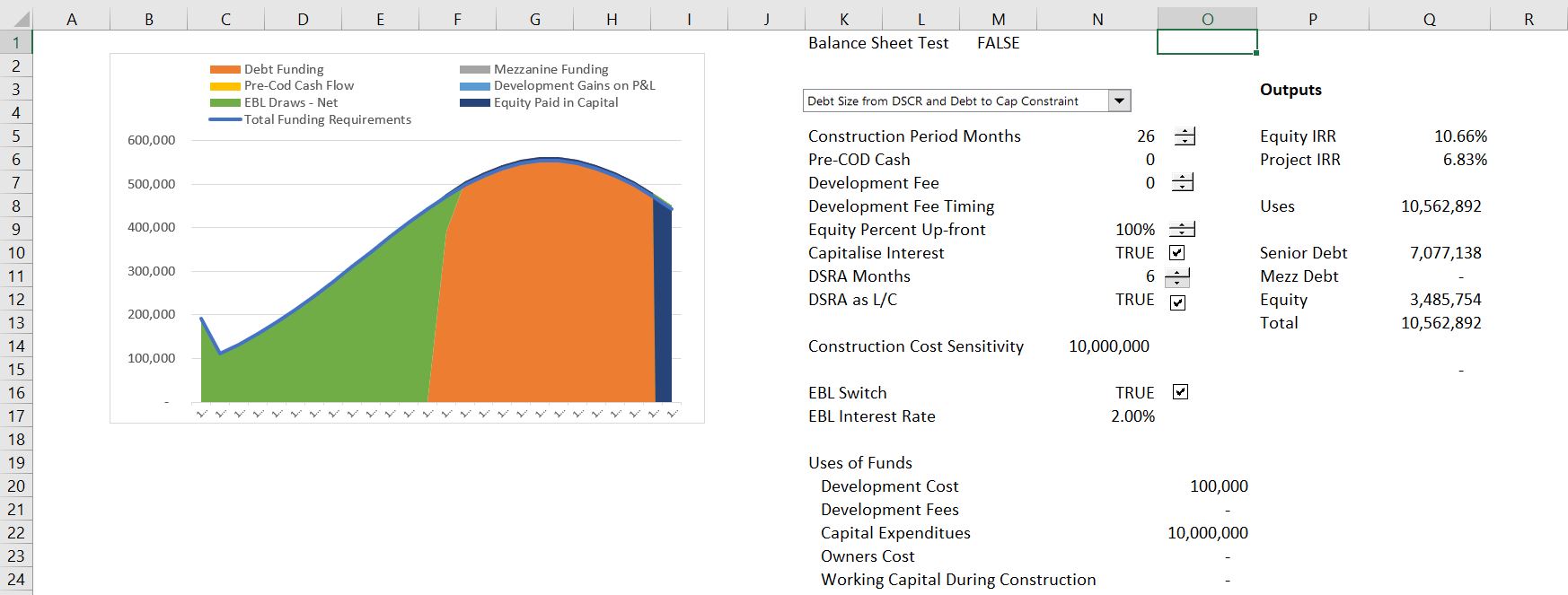

The second example shows what happens when you click the EBL switch button. In this case the is funded by a loan with an interest rate of 2%. Note that even with a short construction period of 26 months, the equity IRR increases from 9.71% to 10.66%. There is no copy and paste routine to run, there is no time to wait.

The third screenshot of the summary page shows the case where a part of the funding is from equity up-front and a part is funded using a pro-rata funding. This causes a lot of circular reference, but you can use the spinner button and change the equity up-front percent. You can immediately see what happens to the equity IRR.

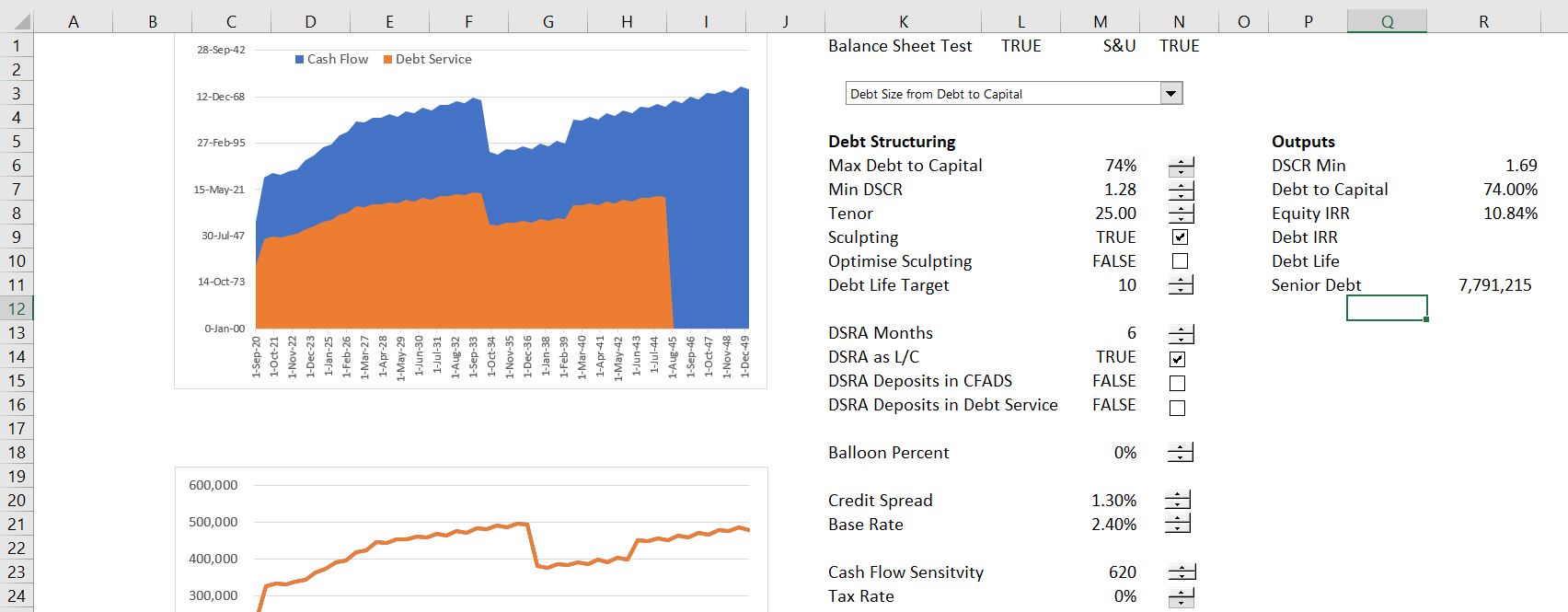

The next screenshots demonstrate how the parallel model can be used to make your model flexible in presenting results during the repayment periods. The graph shows cash flow and debt service. In the first demonstration a fixed amount of debt is used from the option. The parallel model allows you use different assumptions — fixed debt, debt from debt to capital, debt from DSCR or debt from minimum criteria — without pressing circular reference buttons.

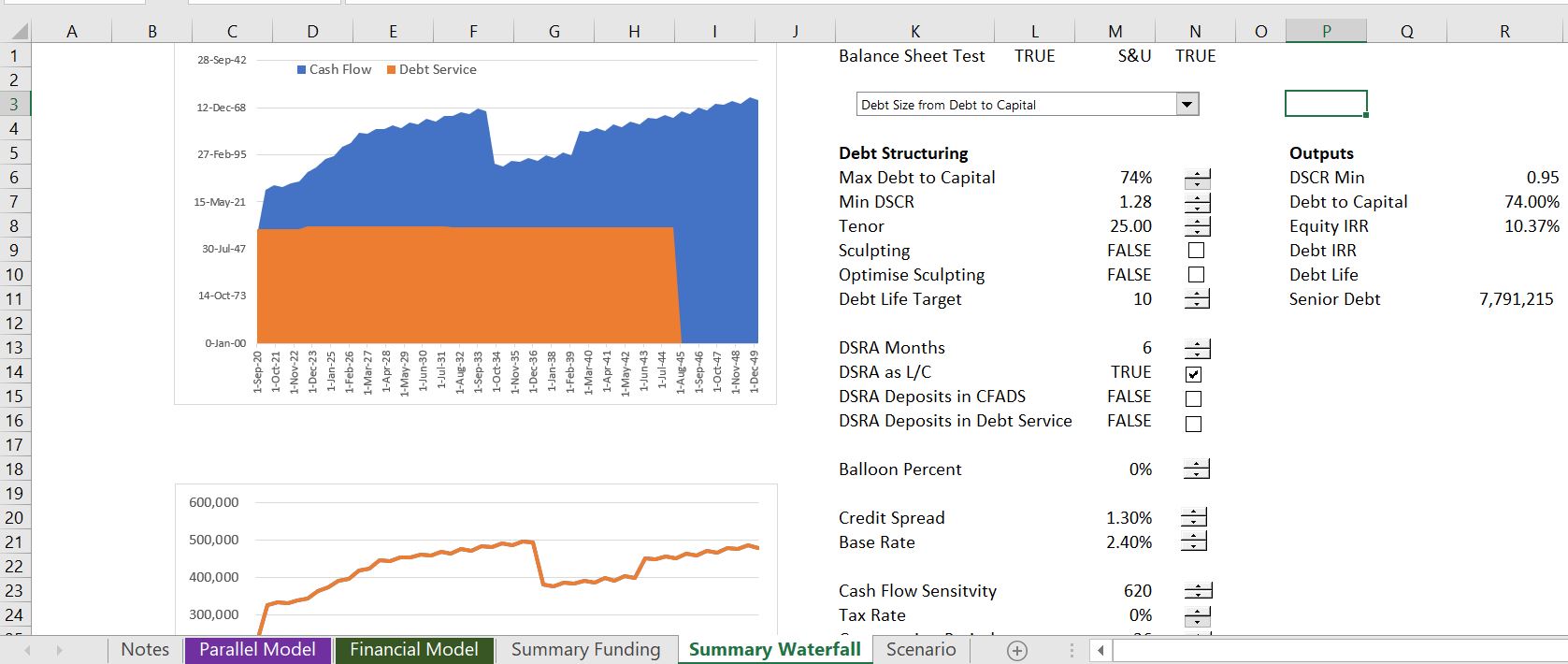

The next screenshot demonstrates that you can change the repayment from sculpting a repayment schedule input. In this case, you can see the effect on the DSCR and the equity IRR from different assumptions. Again all of this stuff can be incorporated in your model by adding a parallel model page and using the template.

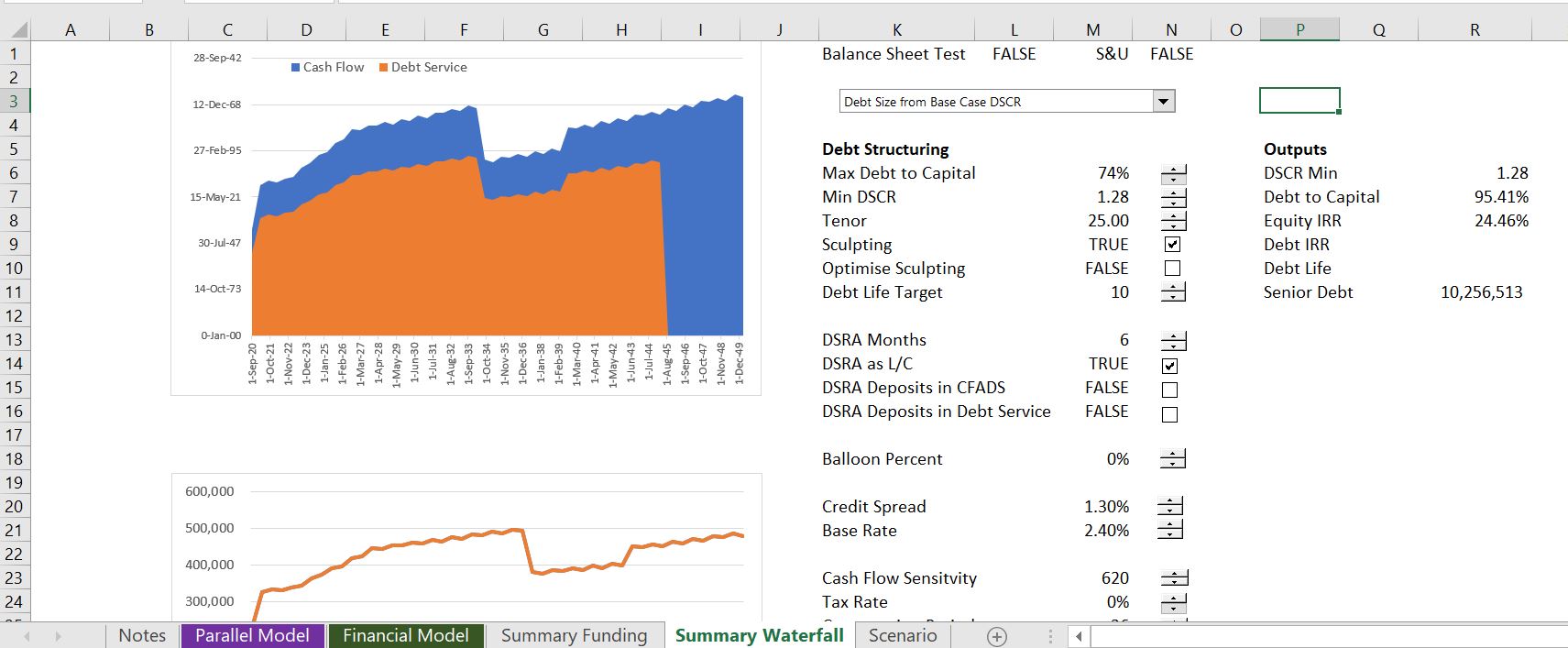

The third picture of the results of the model illustrates what happens when you change the debt sizing method to DSCR.

The next screenshot shows the effect of using the DSRA changes in the DSCR for sculpting. The DSRA changes could be classified as part of the numerator or a deduction in the denominator. If you tried this with a copy and paste routine you would end up with a real mess. The parallel model can apply different DSRA techniques by applying some mathematical formulas rather than forcing things. If you look carefully at the screenshot you can see that DSRA deposits in debt service is checked, meaning that the DSRA changes are included in the denominator of the DSCR for sculpting purposes.

The final screenshot demonstrates the effect of a balloon payment. If a balloon payment is used, there will be more debt for the given DSCR. This will have a different effect if equity up-front is used or the DSCR is used to finance the debt. There are painful circular references from the balloon payments as with the other factors.