This page illustrates how to create a UDF for a model with only a problem where the IDC drives the project cost and the project cost drives the debt and therefore the IDC. This is perhaps the most common circular reference in project finance models. The UDF for solving this problem is not as easy as the simple example I used for the fee example because as the debt is built -up during construction the IDC increases. This means you must simulate the accumulation of debt in the UDF and create a loop. It also can mean that you do not want to put the output of the UDF in a line rather than in a single number. This means that you can create a UDF with an Array where you need to go backwards and accumulate the debt. The file below includes the simple IDC method.

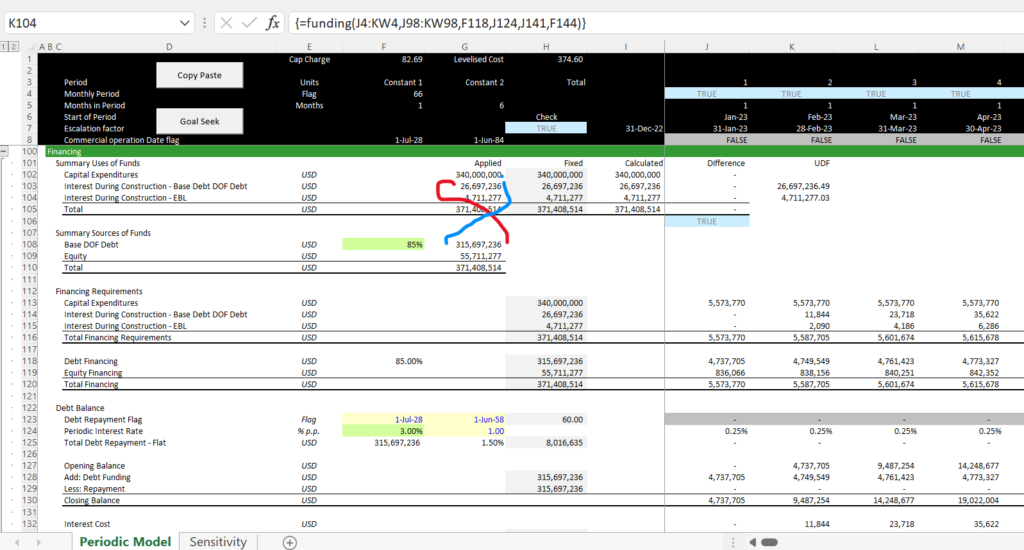

The screenshot illustrates the IDC resolution problem. The IDC and the EBL interest create a circular reference that could be resolved with a copy and paste macro. But as there is only one debt issue and you do not have many complicated items, you can write a UDF. In the screenshot, the line for IDC in the uses of funds comes from the UDF below and allows you to change scenarios and evaluate the costs of delay. You can then connect the applied column to the UDF and there is no need for a button. I have included the example with the UDF and without the UDF in buttons below.

.

.

When creating a UDF like this, I forget how to make an array variable sometimes. The except below shows the steps that includes:

- Use Variant in the function name

- Create a variable with an array (I use something like output). Make sure it has rows and columns.

- Define the output variable in a loop. This should have a row and a column

- Assign the name of the function to the variable with a loop

Function funding(time_range, cap_exp, debt_percent, interest_rate, EBL_rate, EBL_pct) As Variant

Dim output(2, 1) As Double

Dim financing_requirements(), debt_financing(), equity_financing() As Double

Dim debt_balance(), EBL_balance(), EBL(), IDC() As Double

difference = 999

Count = 0

For i = 1 To time_range.Count

If time_range(i) Then Count = Count + 1

Next i

construction_period = Count

ReDim financing_requirements(construction_period)

ReDim financing_requirements(construction_period), debt_financing(construction_period), equity_financing(construction_period)

ReDim debt_balance(construction_period), EBL_balance(construction_period), EBL(construction_period), IDC(construction_period)

' MsgBox " Cap Exp Sum " & WorksheetFunction.Sum(cap_exp)

' MsgBox " Periods " & construction_period

Do While difference <> 0

For Period = 1 To construction_period

financing_requirements(Period) = cap_exp(Period) + IDC(Period) + EBL(Period)

debt_financing(Period) = financing_requirements(Period) * debt_percent

equity_financing(Period) = financing_requirements(Period) - debt_financing(Period)

If Period > 1 Then

IDC(Period) = debt_balance(Period - 1) * interest_rate

EBL(Period) = EBL_balance(Period - 1) * EBL_rate

debt_balance(Period) = debt_balance(Period - 1) + debt_financing(Period)

EBL_balance(Period) = EBL_balance(Period - 1) + equity_financing(Period) * EBL_pct

End If

If Period = 1 Then

debt_balance(Period) = debt_financing(Period)

EBL_balance(Period) = equity_financing(Period) * EBL_pct

End If

Next Period

IDC_Last = IDC_output

EBL_Last = EBL_output

IDC_output = WorksheetFunction.Sum(IDC)

EBL_output = WorksheetFunction.Sum(EBL)

difference = IDC_Last - IDC_output + EBL_Last - EBL_output

' MsgBox " IDC " & IDC_output

' MsgBox " EBL " & EBL_output

' MsgBox " Period " & Period

' MsgBox " Debt Balance " & debt_balance(Period - 1)

' MsgBox " EBL Balance " & EBL_balance(Period - 1)

Loop

output(1, 1) = IDC_output

output(2, 1) = EBL_output

funding = output

End Function

The first example below isolates on what you have to do to create the array function.

Function idc_shell() As Variant

Dim output(1,1000) As Variant

For Period = 1 To 100

output(1,Period) = 100

Next Period

idc_shell = output

End Function

The second example illustrates the IDC calculation. I made a mistake at first by defining the loop to be longer than the number of inputs for the capital expenditures. Note also that you do not have define the capital expenditure and the flag with the DIM statement.

Function idc(constr_flag, int_rate, debt_pct, cap_exp) As Variant

Dim idc_output(1000) As Variant

Dim debt_balance(1000), debt_draws(1000), funding_needs(1000), cap_exp1(1000) As Double

For i = 1 To 15

For Period = 1 To 10

funding_needs(Period) = cap_exp(Period) + idc_output(Period)

debt_draws(Period) = funding_needs(Period) * debt_pct

If Period > 1 Then

If constr_flag(Period) = 1 Then idc_output(Period) = debt_balance(Period - 1) * int_rate

debt_balance(Period) = debt_balance(Period - 1) + debt_draws(Period)

Else

debt_balance(Period) = debt_draws(Period)

End If

Next Period

Next i

idc = idc_output

End FunctionAnother example of using an array for a function is shown below. It is called the read array and the file is attached below.

Function Read_Array(op_switch, EBITDA, Optional other) As Variant

Dim output(4) As Variant

If IsMissing(other) Then other = 0

tot_num = 1000

For i = 1 To tot_num

If op_switch(i) = True Then

start_oper = i

Exit For

End If

Next i

For i = 2 To tot_num

If op_switch(i - 1) = True And op_switch(i) = False Then

end_oper = i - 1

End If

Next i

For i = start_oper To end_oper

total_ebitda = total_ebitda + EBITDA(i)

Next i

output(1) = tot_num

output(2) = start_oper

output(3) = end_oper

output(4) = total_ebitda

Read_Array = output

End Function