On this webpage I have included a number of project finance issues that I consider quite advanced ranging from sculpting with changes in the DSRA to sculpting with multiple debt issues to computing net operating loss with expiration to working with different currencies. These advanced modelling issues are covered in various different sub-menus on the website and can be a little difficult to find (at least for me). Because some of the pages may be tricky to find with the menus, I have included the links to more than twenty subjects that I think are more advanced than the basic building of a model with funding, circular references, taxes and sculpting. I have included links to the different places where you can find selected advanced structuring subjects. Most of the links include an excel file with an example that you can work through as well as at least one video that explains my ideas. I have also included a link to a webpage where you can work through a complete exercise to create a project finance model. I note that the first twelve issues are or can be resolved with the parallel model. By using the parallel model you can either see how to structure the various issues in the model or you can just use the model to solve the problems and then you do not have to bother doing all of the programming by yourself.

I have include a file and a video below that works through some of the various different project finance issues. I use this file to go from a basic analysis to a more sophisticated analysis. The workbook attached to the button has many of the subjects discussed below.

Excel File with Comprehensive Project Finance Exercises and Model Mechanics from Basic to Advanced

.

Excel File with Project Finance Model Exercises Including DSRA, Mini Perm and UDF Exercises

Comments on Modelling Philosophy

Working through a Model from A-Z with Funding, Sculpting and Circular References

If you want to see an exercise for working through structuring issues with alternative funding you can go to the link below.

https://edbodmer.com/financing-exercise-without-circular-reference/

.

Advanced Issue 1: Structuring a Project with Evaluation of Debt Size from Either P90, P50, or Maximum Debt to Capital

https://edbodmer.com/solar-battery-hydrogen-course/

.

Advanced Subject 2: Inclusion of DSRA changes in the DSCR for Debt Sculpting

https://edbodmer.com/including-releases-or-deposits-to-dsra-in-dscr-and-sculpting/

.

Advanced Issue 3: Resolving Circular References without Copy and Paste Macros or the Iteration Button

https://edbodmer.com/technical-details-of-udf-parallel-model-concept/

.

Advanced Issue 4: Computing Debt Repayment where the Debt Size is Given, and Sculpting is used to Obtain a Minimum DSCR with Varying DSCR’s

https://edbodmer.com/sculpting-with-fixed-debt-and-changing-dscr-goal-seek-and-data-table-method/

.

Advanced Issue 5: Debt Sculpting of Multiple Debt Issues where cash flow is Affected by Interest Expenses and Income Taxes

https://edbodmer.com/multiple-sculpted-issues/

.

Advanced Issue 6: Incorporating options for DSRA funding with an L/C or with Cash Funding

https://edbodmer.com/sculpting-and-debt-fees-including-fees-for-dsra-l-c/

.

Advanced Issue 7: Modelling Sculpting with Balloon Payment at End of Tenor

https://edbodmer.com/separation-into-balloon-payment-and-sculpting/

.

Advanced Issue 8: Adding Re-financing to a Model where Debt Size Depends on Taxes which are Affected by Interest on the Re-financing

https://edbodmer.com/re-financing-analysis/

.

Advanced Issue 9: Evaluation of NOL Time Limits on the Calculation of Income Tax

https://edbodmer.com/expiration-of-nol-in-project-finance/

.

Advanced Issue 10: Computation of the LLCR with Different Debt Issues using the Prospective debt IRR

https://edbodmer.com/llcr-and-plcr-complexities-and-meaning-for-break-even/

.

Advanced Issue 11: Modelling Equity Bridge Loans and the Associated Circular References along and Options for IDC

https://edbodmer.com/equity-bridge-loans-ebl/

.

Advanced Issue 12: Modelling the Effect of Financing in Different Currencies with Translation Adjustments

https://edbodmer.com/currency-adjustments-taxes-and-debt/

.

Advanced Issue 13: Modelling Development Fees with Multiple Investors

https://edbodmer.com/development-fee-timing/

.

Advanced Issue 14: Including Actual Data in Models for the Construction Period and Operating Period

https://edbodmer.com/project-finance/actuals-in-project-finance/

.

Advanced Issue 15: Modelling Mini-perms and Different Re-financing Assumptions

https://edbodmer.com/mini-perms-and-re-financing/

.

Advanced Issue 16: Developing Alternative ways to Model Working Capital Requirements in the Initial Operating Periods of a Project

https://edbodmer.com/working-capital-in-project-finance/

.

Advanced Issue 17: Evaluating Different Structures for Equity Investors including Cash Flow Flips and Incentives to Developers.

https://edbodmer.com/performance-incentives-for-developers/

.

Advanced Issue 18: Accumulation of Projects into a Portfolio or a Fund

https://edbodmer.com/project-with-multiple-spvs/

.

Advanced Issue 19: Modelling Alternative Cash Sweep Structures

https://edbodmer.com/cash-sweep-and-risk-versus-return/

.

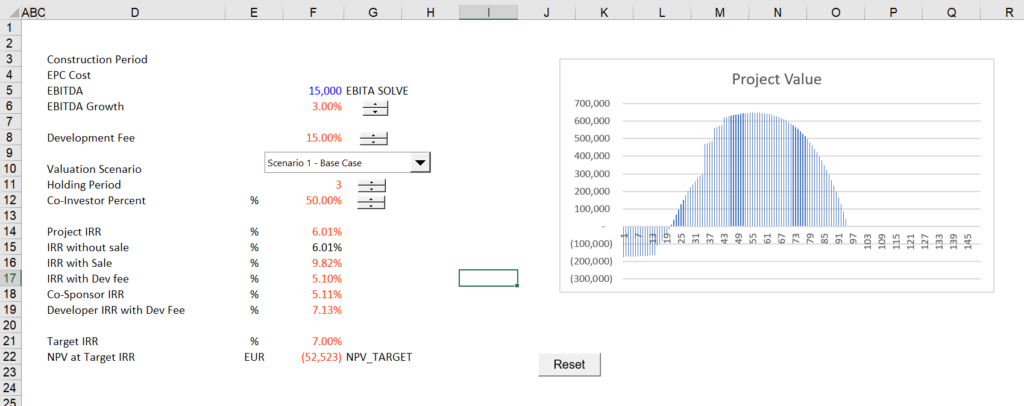

Advanced Issue 20: Valuation of Projects with Changing Buyer Target IRR’s and Computation of Holding Period Returns

https://edbodmer.com/irr-with-changing-discount-rates-and-assumed-sale/

.

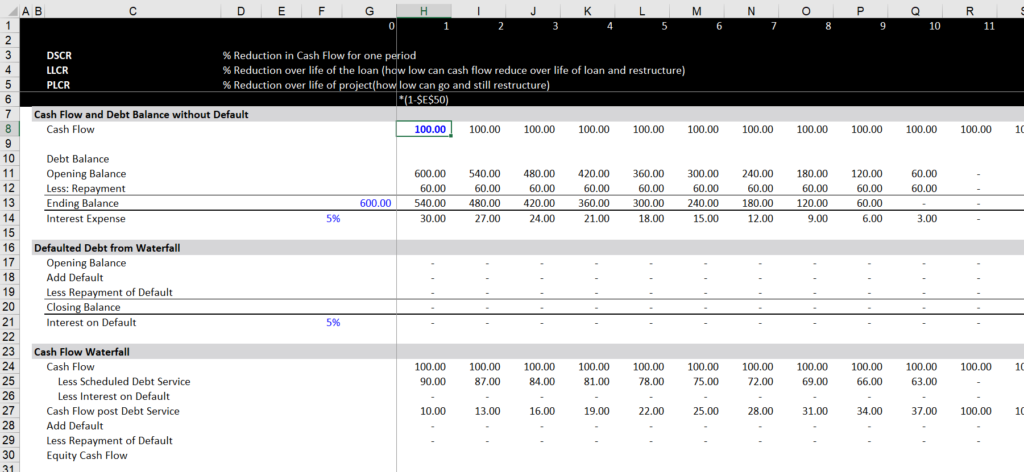

Advanced Issue 21: Evaluation of Defaults and the Risks of Senior and Subordinated Debt

https://edbodmer.com/cash-flow-waterfall-and-financial-statements/

.

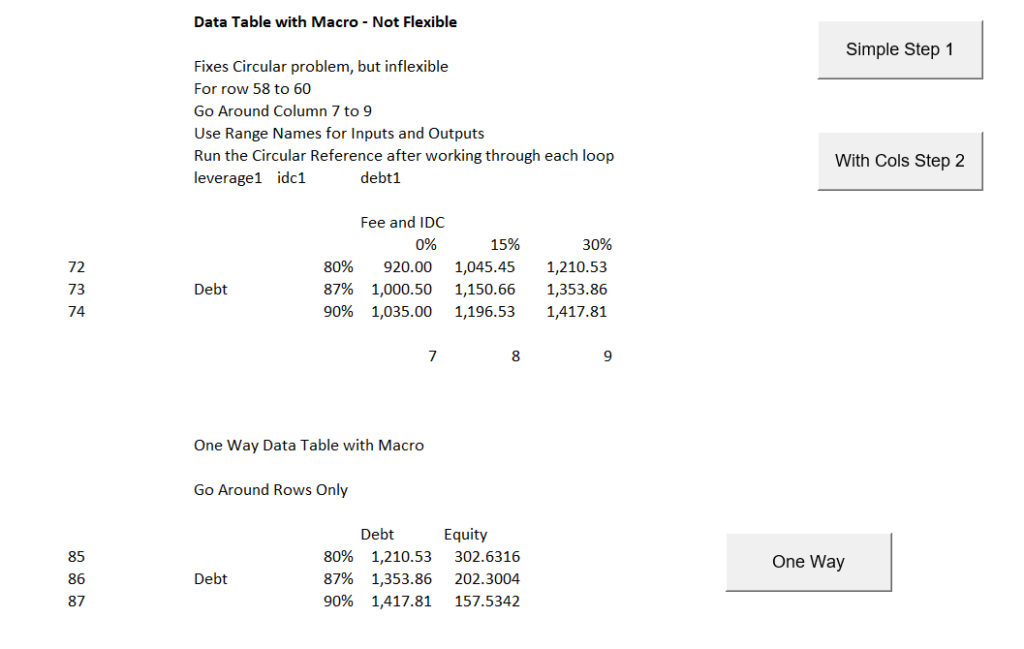

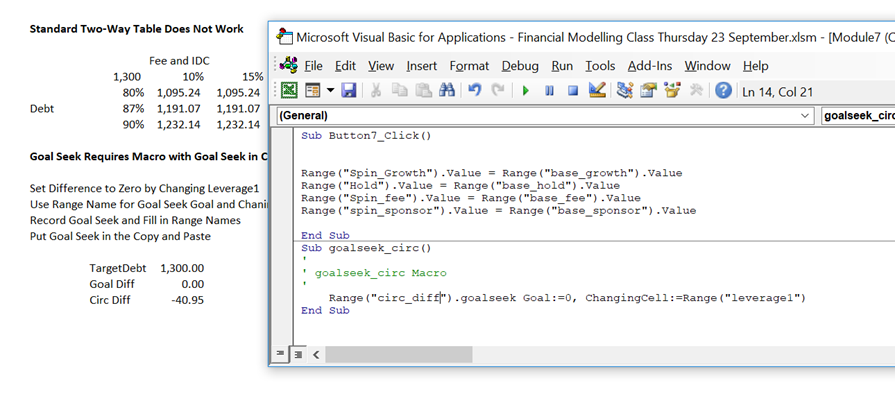

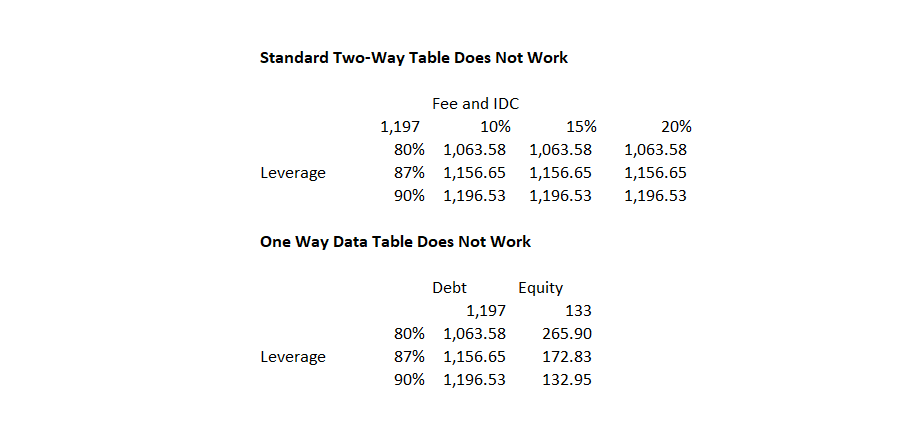

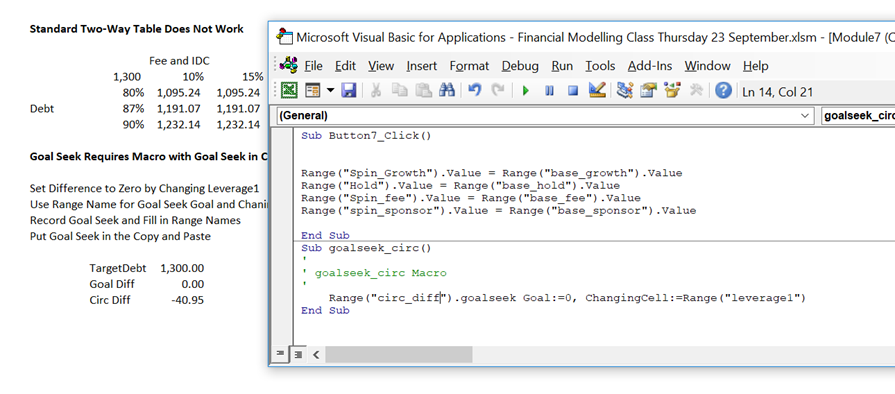

Advanced Issue 22: Creating Data Tables using VBA to Resolve Data Table Problems

https://edbodmer.com/data-tables-with-goal-seek-using-vba/

.

Advanced Issue 23: Time Lines with Different Periods and Required Sums

https://edbodmer.com/timelines-in-project-finance-models/

.

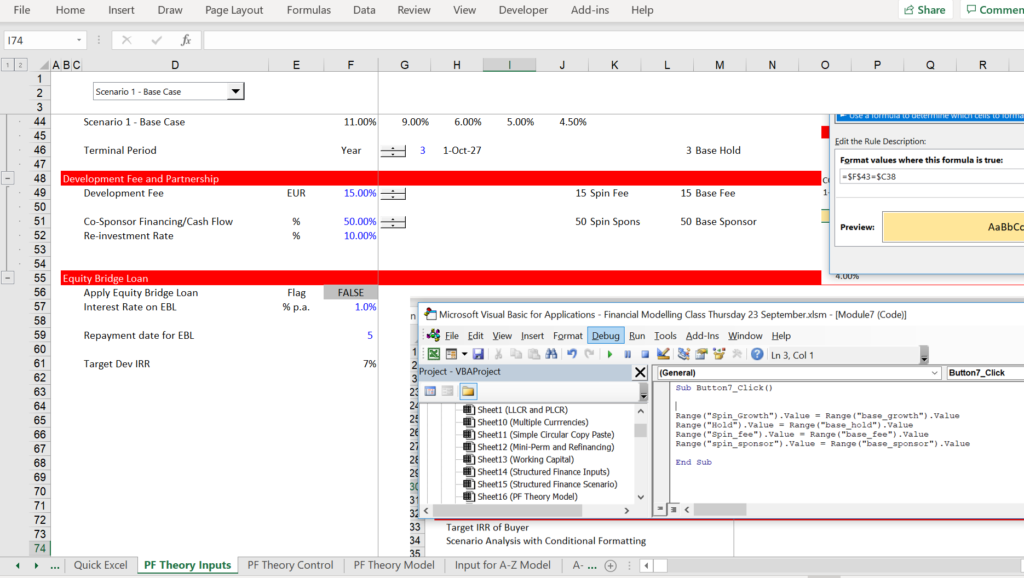

Advanced Issue 24: Effective Control Pages where you can Evaluate Changes to Inputs and Properly Include the Inputs in Relevant Input Sheets

https://edbodmer.com/scenario-analysis-with-diagrams-spinners-and-reset/

Playlist on Sculpting Issues

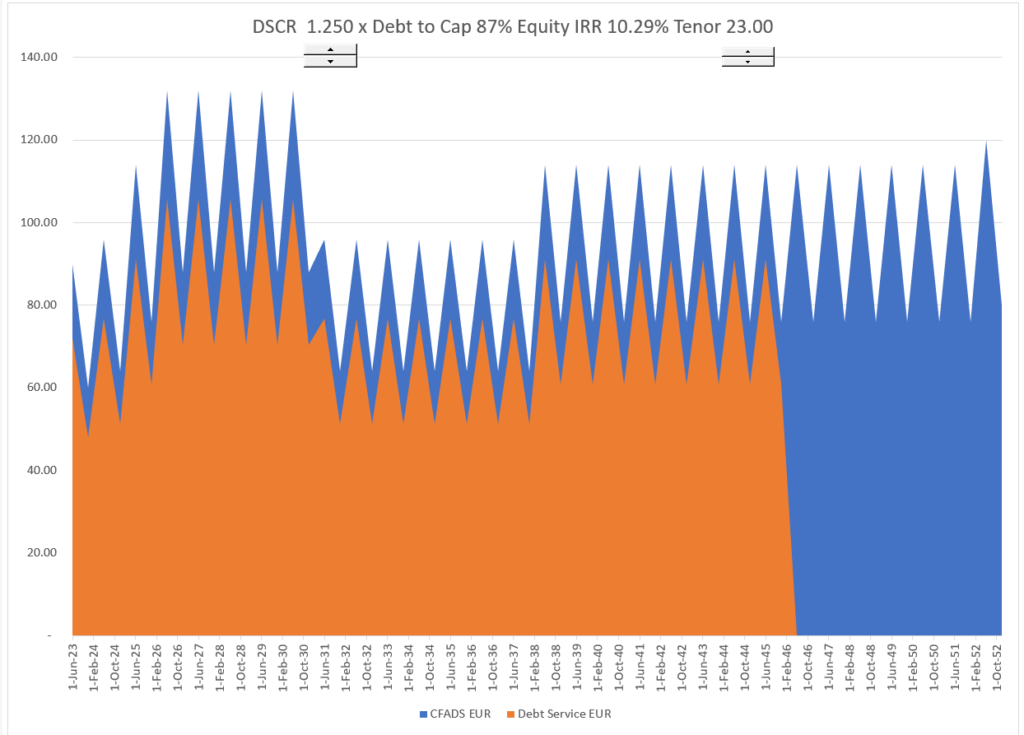

If you are in the mood for torture or maybe if you are having trouble sleeping, you can look through the sculpting playlist. I have put together various sculpting videos that I have made over the years. I have tried to put the more basic videos first (with the exception of the very first). The videos all apply the fundamental formula that the PV of debt service over the repayment period is equal to the debt size at the beginning of the repayment period (i.e. the period just prior to the commercial operation date). Over time I have learnt more about sculpting issues that can involve curved DSCR’s, multiple debt issues, incorporation of on-going fees, alternative debt sizing options, complex income taxes and computation of DSRA moves as part of the CFADS. I hope I have covered a lot of these issues in the videos. As with other items, you can always send me an email at edwardbodmer@gmail.com.

.

.

.

Instructions for Downloading Files with Macros

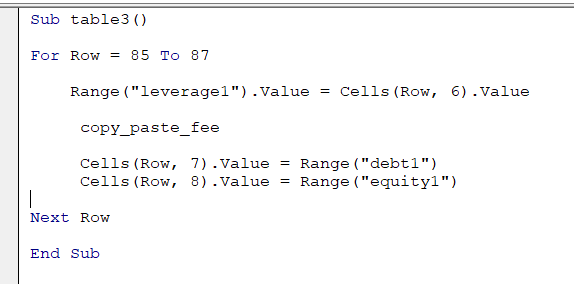

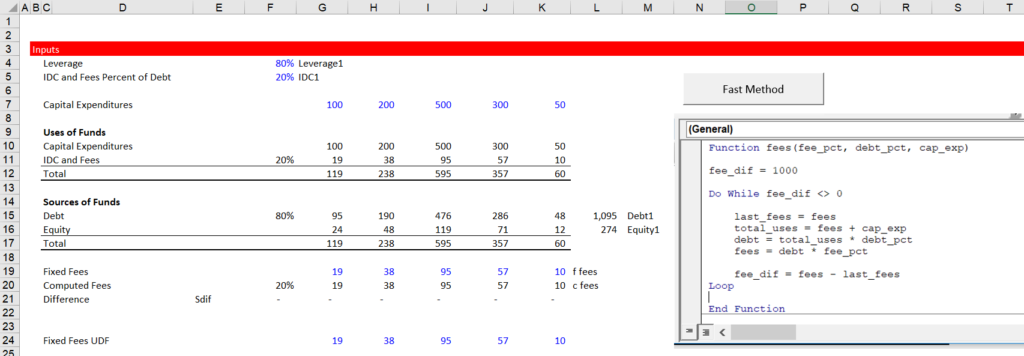

VBA

Changing Value

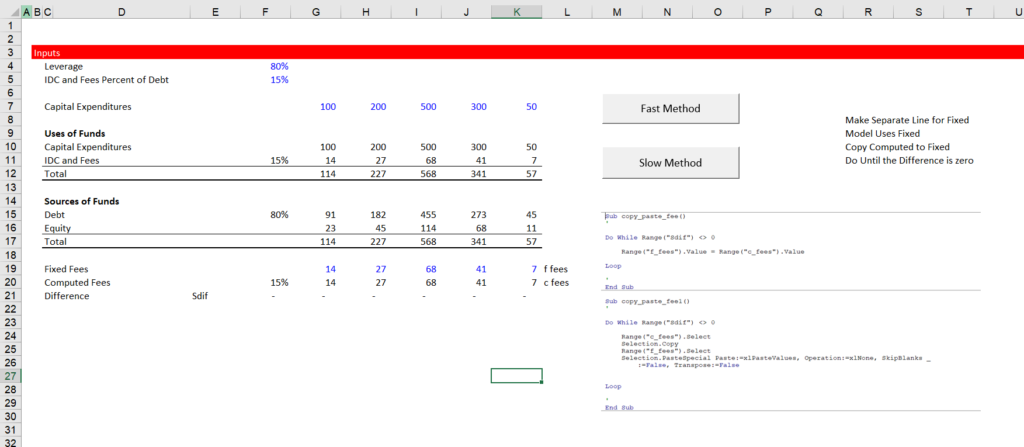

UDF versus Copy and Paste

Goal Seek must be added to copy and paste

Sub table2()

For Row = 72 To 74

Range("leverage1").Value = Cells(Row, 6).Value

For col = 7 To 9

Range("idc_1").Value = Cells(71, col)

copy_paste_fee

Cells(Row, col).Value = Range("debt1")

MsgBox " row " & Row & " col " & col & " " & Cells(Row, col) & " Range idc1 " & Range("idc1")

Next colNext Row

End Sub