I had a consulting project to evaluate how banks compute the return on risk adjusted capital. This is the return earned on a loan from the credit spread and fees but it is adjusted for the risk of the loan. In adjusting for the risk of the loan, the probability of default and the loss given default are computed. In addition the denominator of the earnings is adjusted for how much capital the bank must put in place. I have heard many bankers talk about how this is a black box and it is difficult to find readable analysis on the RORAC. By the way I was not paid for the work so I think it is find to put my attempt on this website. The file that I have created to evaluate the RORAC is attached to the button below. This file is explained in the video just below the button.

Walk Through Risk Adjusted Return on Capital Calculation

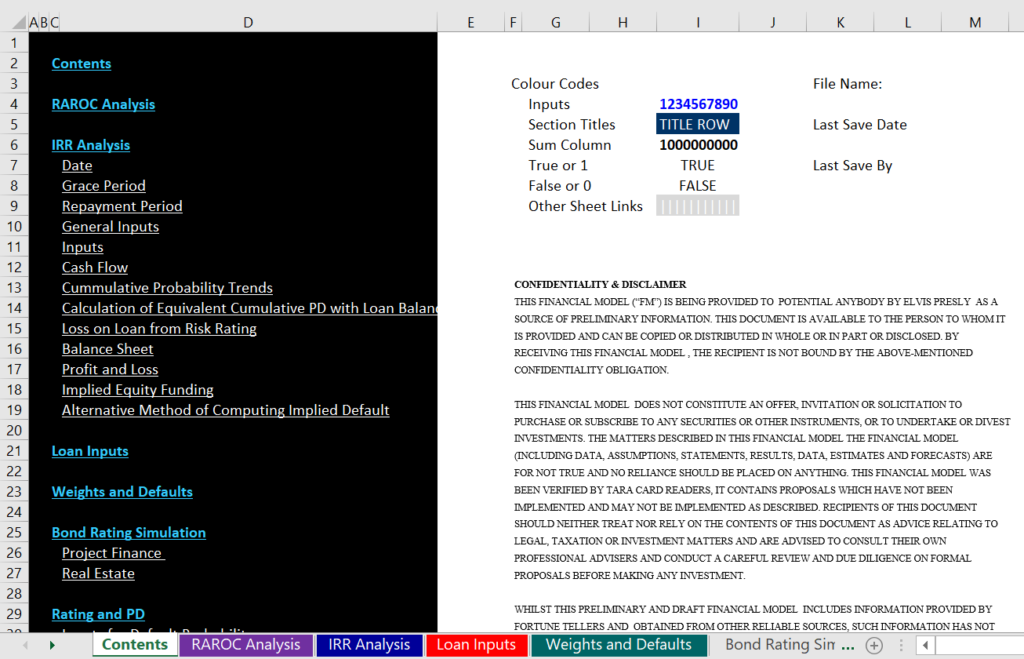

The various parts of the RAROC calculation is shown in the table of contents summary below. The table of contents can be created from the Generic Macros file.

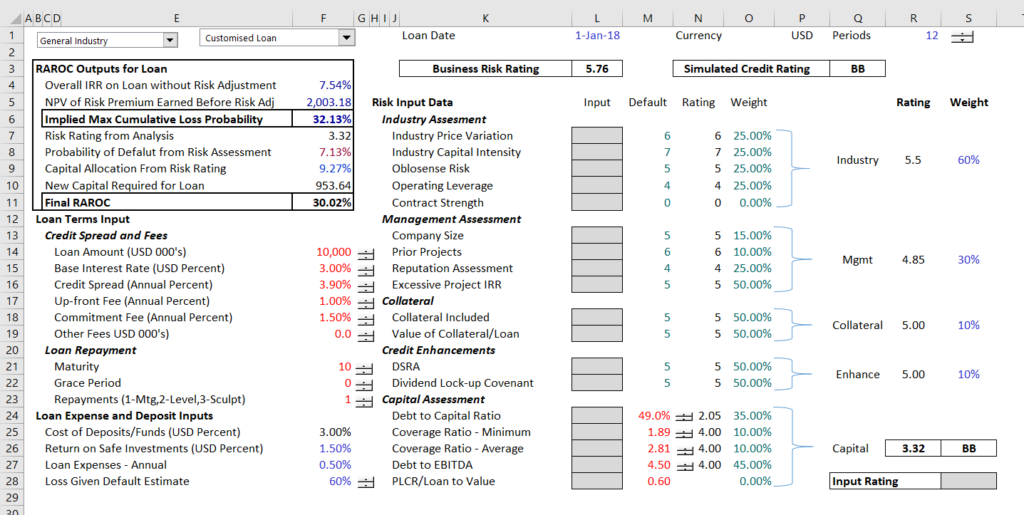

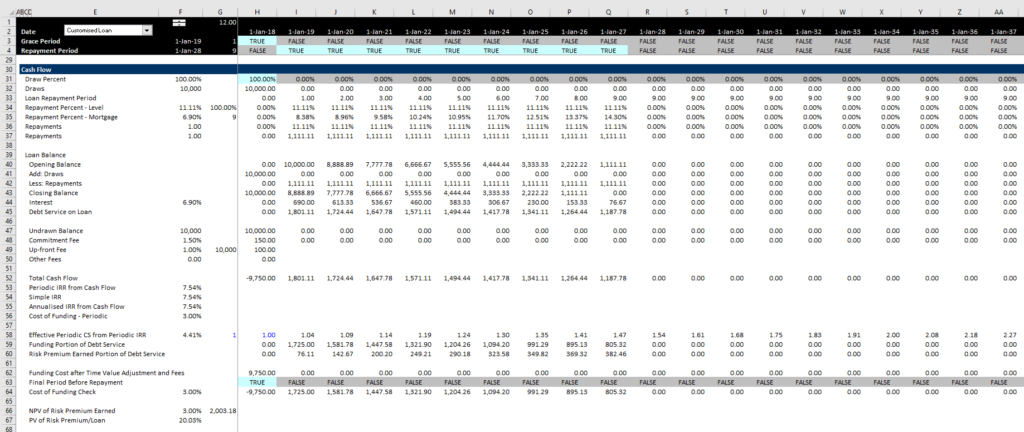

The Return on Risk Adjusted file is illustrated in the screenshots below. The first screenshot illustrates how you can compute the return on risk adjusted capital as a function of the probability of default. Note that the risk rating could come from judgmental analysis shown on the right hand side of the screenshot. The RAROC is 30% given the credit spread and the probability of default from the credit rating analysis.

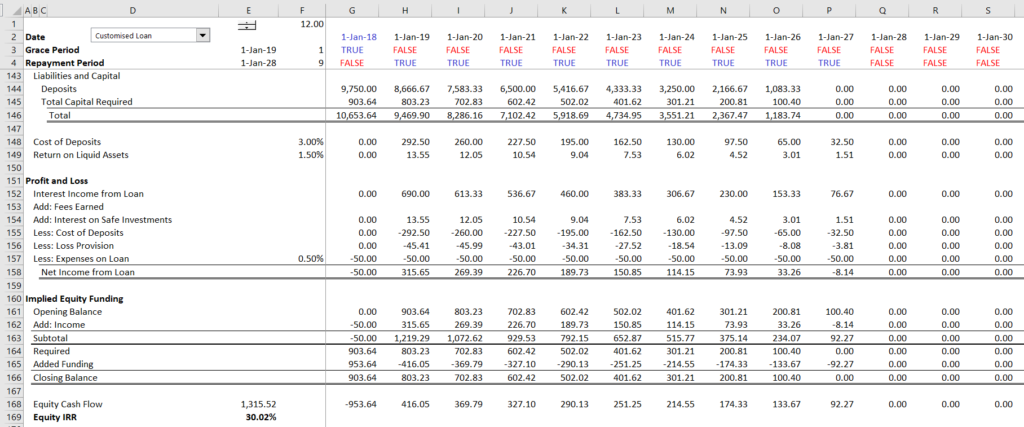

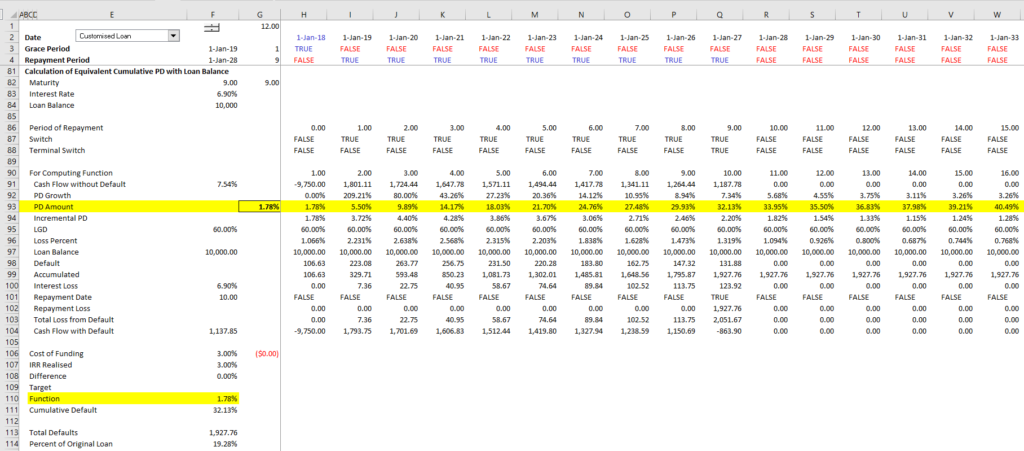

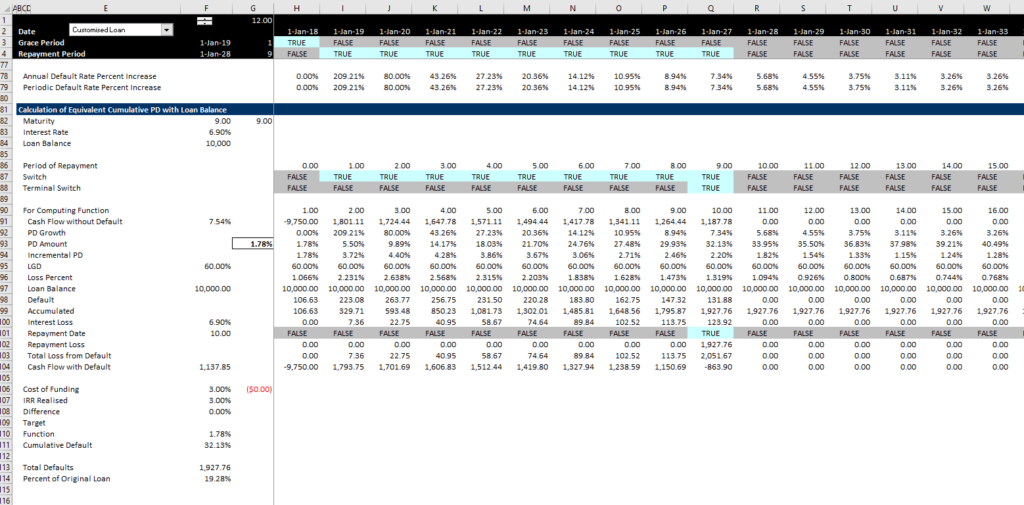

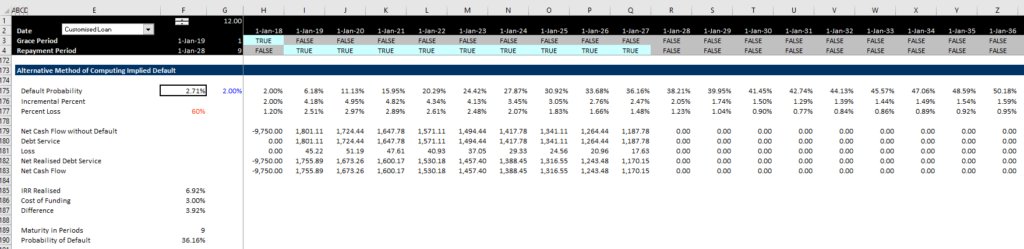

The second set of screenshots below demonstrates the calculation of the IRR on the loan which includes revenues and costs. The screenshots include the components of revenue and subtract cost from probability of default and loss given default.

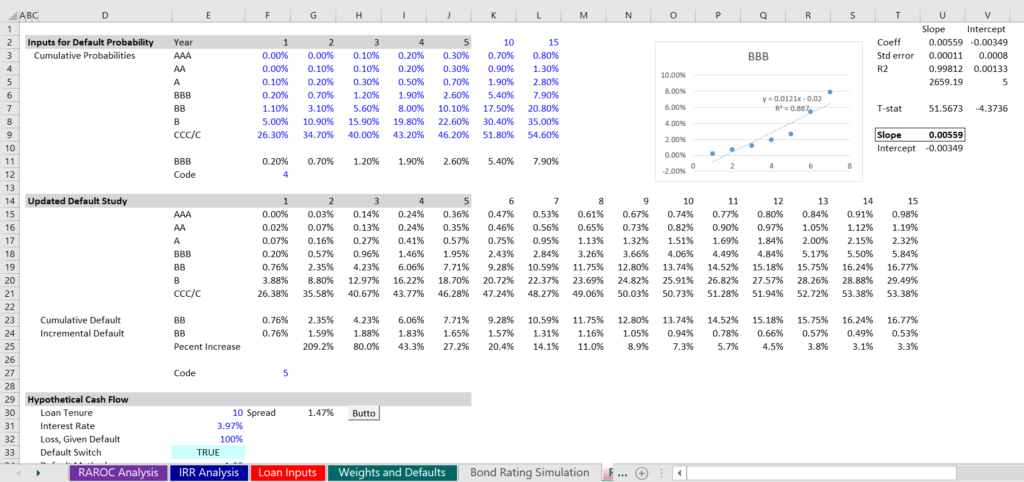

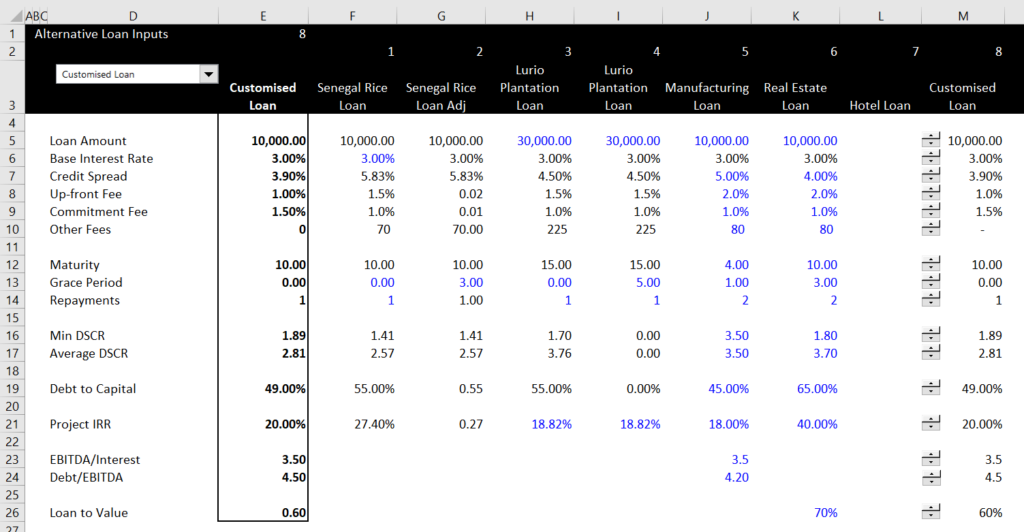

The remaining screenshots demonstrates various aspects of putting in inputs for the loans and putting in inputs for the probability of default from S&P analysis. The first screenshot illustrates how you can compute the RAROC can be computed for different loans with different credit spreads; different fees; different tenures. In the right column you can put flexible inputs.

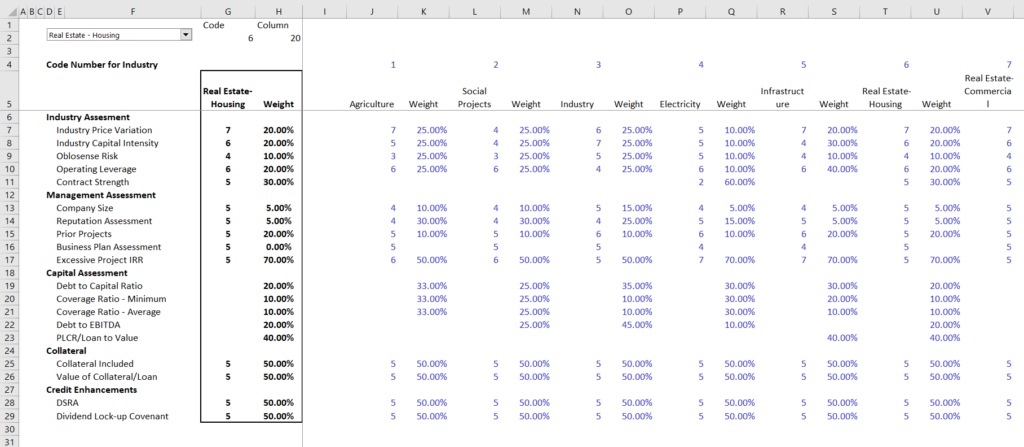

The screenshot below illustrates how you can try to evaluate different risks for different industries.