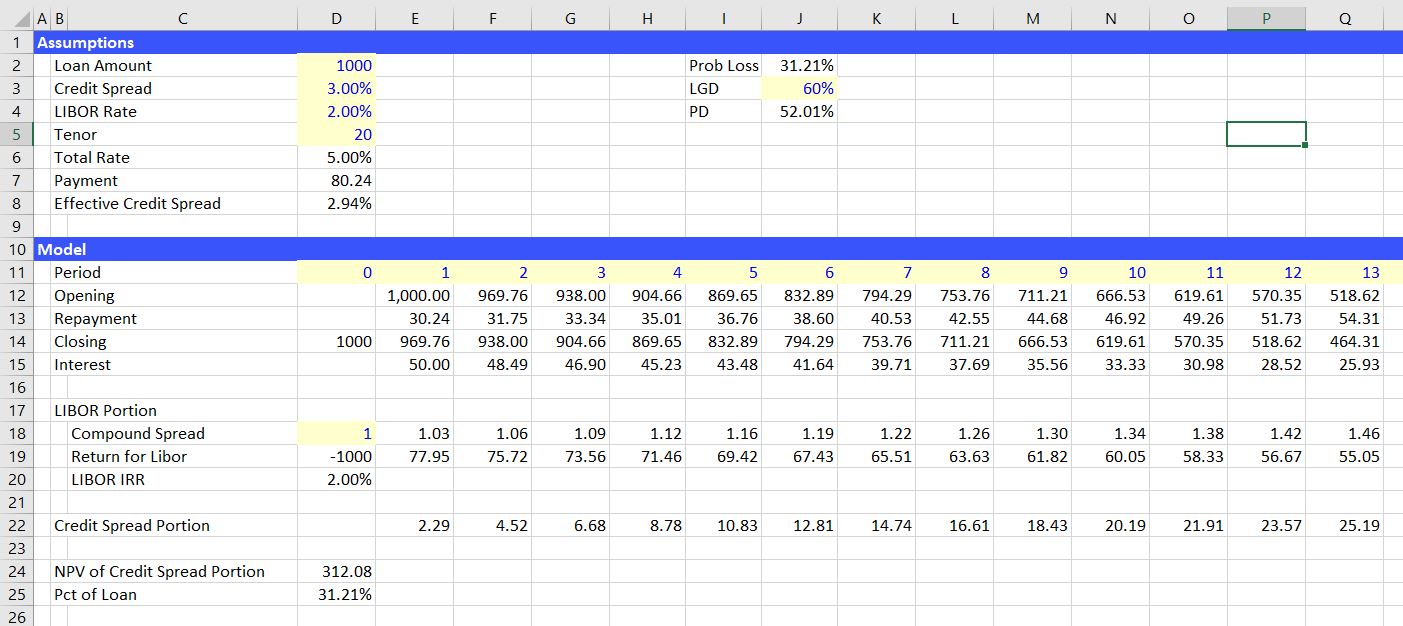

This page will demonstrate different ways to compute to implied probability of default from credit spreads. Rather than having vague discussions of credit spread levels, the analysis begins with a base level of debt. Once a base debt issue like a risk free security is evaluated as a benchmark, the risk security is presented. Then, an analysis which uses expected value or risk neutral valuation is used to derive the implied probability of default. A file that illustrates how to compute the implied credit spreads is available for download below.

Implied PD from Credit Spreads