This page describes the mechanics and the theory behind assuming different holding periods and different discount rates in computing project value and in computing holding period IRR’s. The idea of holding period returns is directly related to the fundamental notion that the risk of a project changes over time from the development phase to the construction phase to the initial operations and to the mature operations. Different projects have different changes in the risk profile, but virtually all projects have this characteristic. The reduction in risk can be measured from the decline in the target IRR required by a potential buyer of the project such as an insurance company or a pension fund. This webpage illustrates the mechanics of how to compute the IRR when the risk of cash flow changes over the life of a project. You can put in different assumed buyer discount rates and evaluate the IRR over a holding period.

Mechanics of Computing Project Value and Holding Period Returns

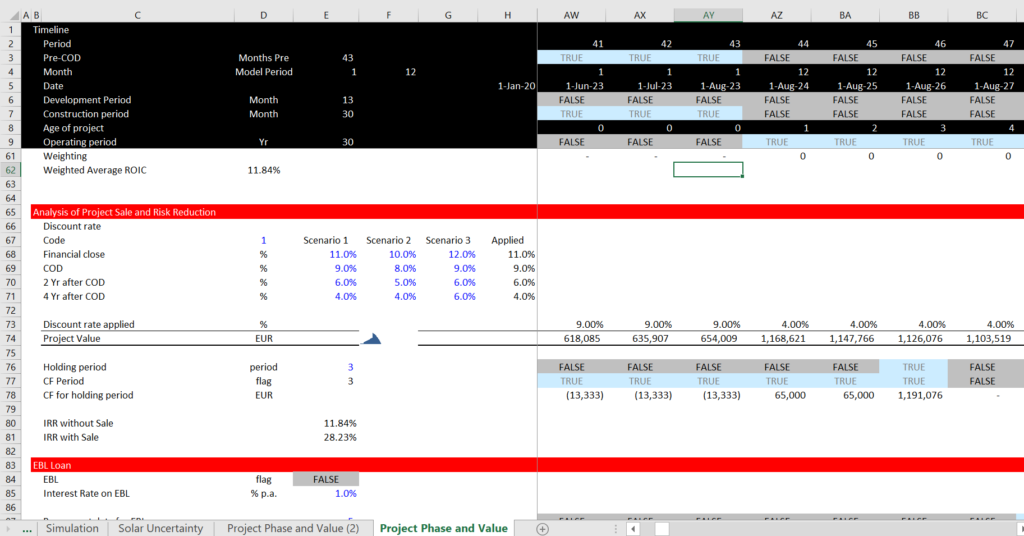

The screenshot below illustrates the general process of computing different project values and holding period returns. In the screenshot below you can see the flags that are used for the sale date and the holding period. The value of the project is computed from the prospective cash flows as follows;

Value = NPV of Cash flow at discount rate starting in subsequent period

In this way, the valuation is computed at the end of each period. Note that there are alternative scenarios for the discount rate with some scenarios resulting in a more steep decline in the discount rate than others. The cash flow in row 78 stops after the plant sale, but it includes the value of the project at the sale date. In the example, because of the steep decline in the target IRR, the IRR over the holding period jumps.