Project finance models can be used for credit analysis or for structuring or for both. On this page I show some examples of credit analysis in project finance models. In the case of credit analysis, the amount and the terms of debt are given. Using the given amount of debt, different downside cases can be evaluated to see if the debt can be repaid. I have included a couple of examples of how project finance models can be in credit analysis.

Project Finance Model for Methane Plant

The project finance file that you can download demonstrates how to use a model to evaluate credit analysis in the context of project finance. The model includes a bridge loan and alternative prospective capital investments in two phases. The credit analysis and the model includes currency risk because the bridge loan is in local currency whilst the revenues are received through a contract that is fixed in USD. This means different inflation rates must be forecast and evaluated as well as the other variables. If you are interested in currency risk, this may be a file to review. An excerpt from the model demonstrates how you can use a dropdown box for different scenarios and evaluate the DSCR, LLCR and PLCR in different currencies.

Example of Credit Analysis in Project Finance Model with Methane Plant and Currency Risk

Credit Analysis with Mini-Perm and Toll Road

In the case of a Mini-perm where the loan has a maturity date and may not be able to be re-financed, credit analysis can be performed with a model. In this case, you can assume that the mini-perm converts to a cash flow sweep. Then you can evaluate whether how low the cash flow can fall and a the loan can still be repaid. An illustration of how modelling can be used in the context of a tollroad model is demonstrated in the model. In this model you can lower the level of traffic and evaluate whether the loan can be repaid after the sweep period.

This project finance model in the mini-perm is set-up so that you first design the structure of the debt repayments with DSCR or debt to capital targets from assumed cash flows. Then you press a check box and run the model for risk analysis. This means the debt structure is fixed and you evaluate if the project switches to a cash sweep after the mini-perm matures. The risk analysis tests how low variables such as traffic volumes and toll rates can be pushed down before it is impossible to fully repay the loan by the end of the project life.

Credit Analysis with Merchant Model

The third example of credit analysis is a project finance model is a case for a merchant electricity plant. The summary page in this model shows how you can compare the historic margin earned from merchant prices with the margins in the financial model. You can evaluate the level of the merchant prices with the prices assumed in the model.

Merchant Plant Model and Credit Analysis in Project Finance Model

Sensitivity Analysis with Model in Developing Country

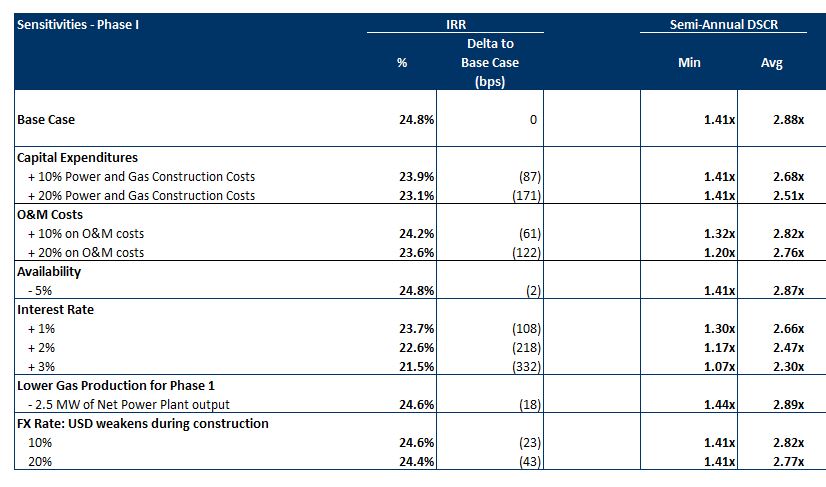

As with other cases, I have included excerpts of an actual model. If you send me an e-mail at edwardbodmer@gmail.com I may have some actual models that you can use in benchmarking. The excerpt below shows sensitivity that was part of an electricity plant model. Note the very high equity IRR in each of the scenarios. Also note that none of the scenarios produced much reduction at all in the DSCR. Finally note that the LLCR and the PLCR not presented.