This page contains basic hotel project finance models and associated videos. Hotel project finance is much like standard project finance with the construction of one large asset, time lines with flexible dates, debt schedules and IRR’s. If you are beginning in real estate finance, the exercise of building a model of a hotel may be a good idea to demonstrate the fundamentals. The models presented on this page demonstrate how to address modelling of construction periods, utilisation and pricing issues.

This page is arranged by first presenting a set of exercises and then presenting a few completed models. The hotel exercise is divided into separate parts that begin with setting-up assumptions and then moving to time lines followed by operating analysis and financing analysis. Each exercise section includes discussion of the model in an associated video.

Hotel Economic Analysis Case Study

.

Hotel Project Finance Exercises – Assumptions

The hotel model begins with a discussion of model assumptions. The modelling and discussion is quite simple. More difficult real estate issues consider mixed development, complex cash flow waterfalls, lease rolls and portfolios of SPV’s. Subsequent sections address the following. The first file for the hotel project finance exercises described in the video can be downloaded by pressing on the button below.

Excel File with Hotel Project Finance Assumptions that is First Part of the Hotel Exercise Series

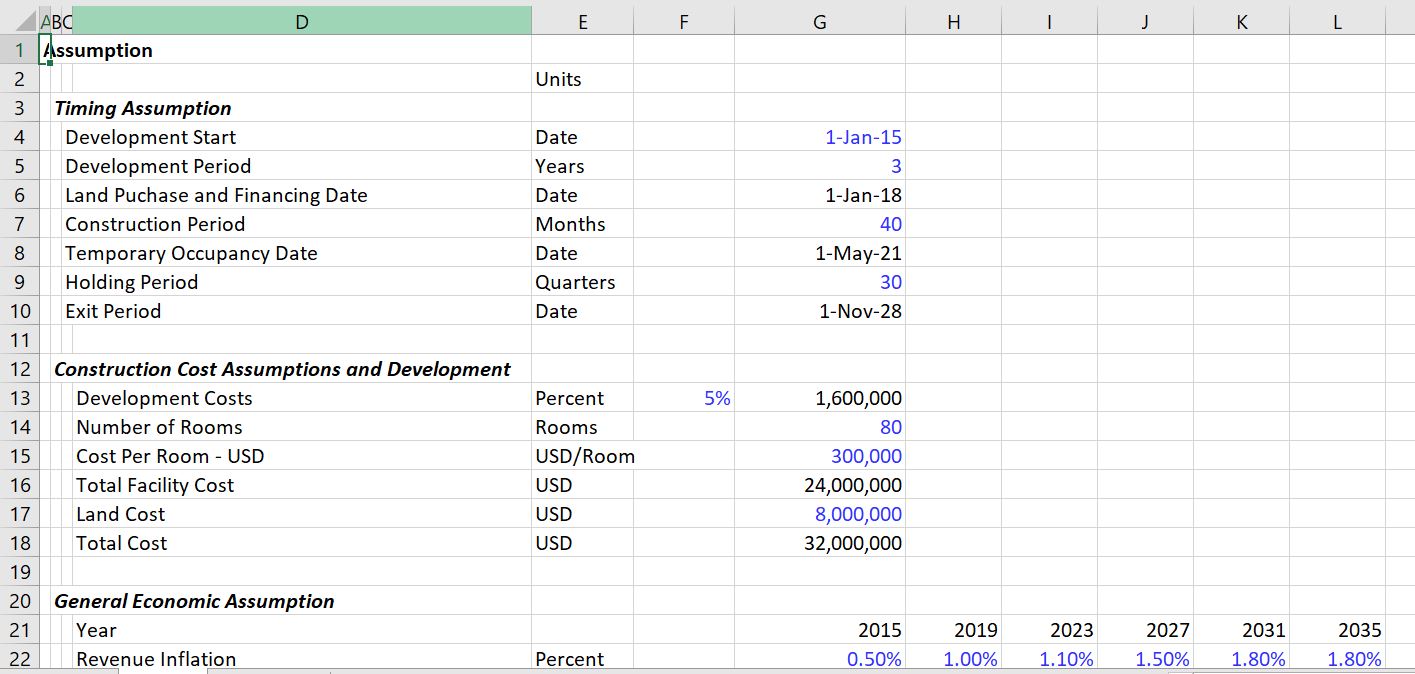

The screenshot below illustrates the assumption set-up beginning with dates. You can use the generic macro file with CNTL, ALT, C to make the colours for the inputs. A video discussing the inputs including style issues with the layout is below the screenshot.

.

Hotel Model – Timeline

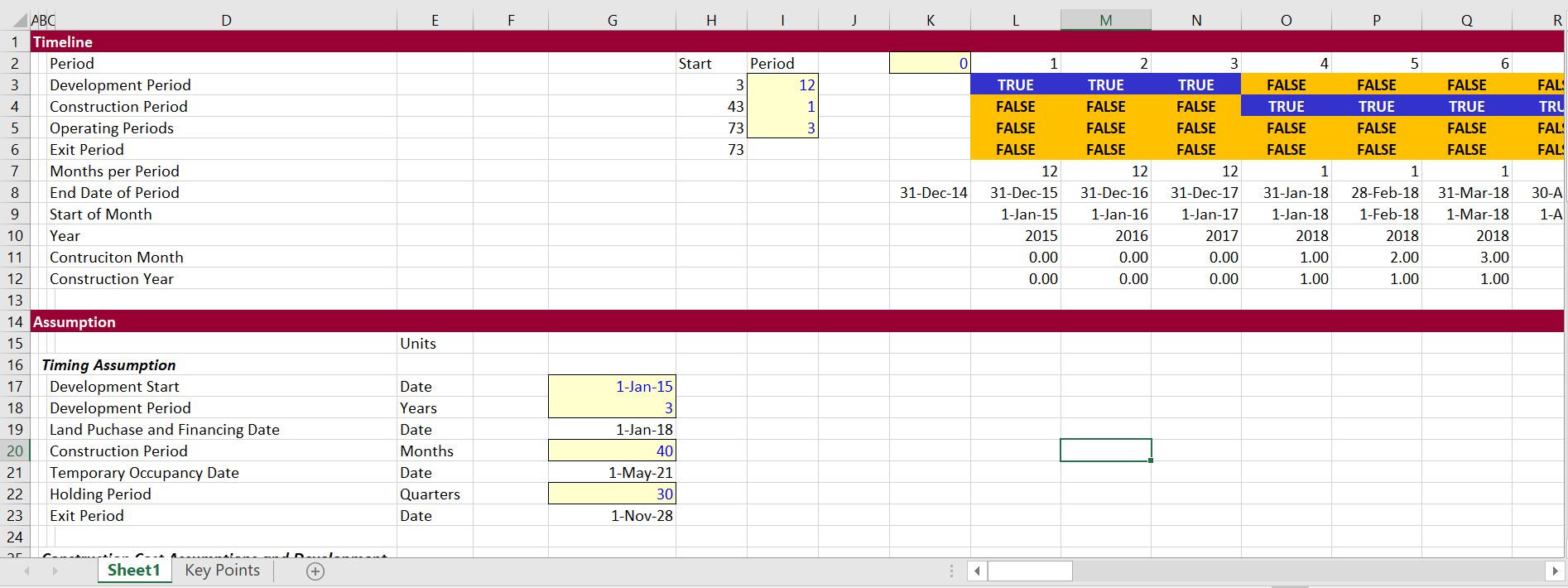

In any model where a single asset is being evaluated with different possible sale dates or holding the asset over its entire life, carefully structuring an time line is essential. The exercise file below and the associated time line work through time lines in the context of constructing and financing a hotel. The file that is associated with the time line exercise can be obtained by clicking on the button below. The screenshot below illustrates the time line and associated TRUE/FALSE switches. I included some colouring with the generic macros.

Excel File with Time Line Exercise for a Hotel Investment that is Associated with Video Series

.

Hotel Model – Operations with Room Rates, Other Revenues and Operating Cost

Hotel Exercise on Including Debt Financing in the Analysis and Computing Equity IRR

.

Excel File with Demonstration of Hotel Financing that Accompanies Video Describing Model

.

.

Hotel Exercise on Summarising Model Results

Sample of Completed Hotel Model Files