This webpage puts together information of the Dabhol electric power plant case. The case is old, but it has a lot of project finance lessons. One lesson is the dangerous way students are taught at Harvard before they go to Wall Street. Other issues relate to the danger of a high IRR and a high plant cost. The case includes philosophical issues related to legal structuring versus economic analysis; benchmarking of costs; the use of different types of financial models evaluation of the ability of off-takers to honour contracts.

Dabhol is also an interesting case for me because it was first launched as a breakthrough in electricity investment for India and arguably was an important cause of the downfall of Enron. The central issue in the case is whether risk analysis and valuation should have involved contract evaluation and insurance on PPA contracts or whether the ultimate affordability of the produced electricity to ultimate consumers should have been the focus of the analysis.

Dabhol Case Introduction

For the Dabhol case I have made an assignment rather than just putting some of my opinions on the website. The outcome of the Dahbol case study is well known in project finance (it is difficult not to call the project a dramatic failure). I am not interested in you just telling me what happened. I am interested in how you would have assessed the risks, the contract structure and other issues at the time the loan was made (a long time ago in the 1990’s). Even though the failure of the case is well known, I would like to know how you would have evaluated both positive and negative aspects of the project financing and how you would have considered nuances involving contract structure (in particular, the PPA pricing); benchmarking of costs, rate of return analysis, and off-taker assessment.

The case is about project finance risk analysis and contract structuring. If you would like to review background in these subjects I have included power point slides that provide discussion of project finance and contracts. You can download these slides by pressing the buttons below. In particular, you need to understand that project finance does not have history and as such benchmarking may be a good idea. You should also understand why a capacity or availability payment is present in some project finance transactions. You can review project finance issues by clicking on the button below to download power point slides.

Power Point Slides that Accompany the Video Lecture Series on The Theory of Project Finance

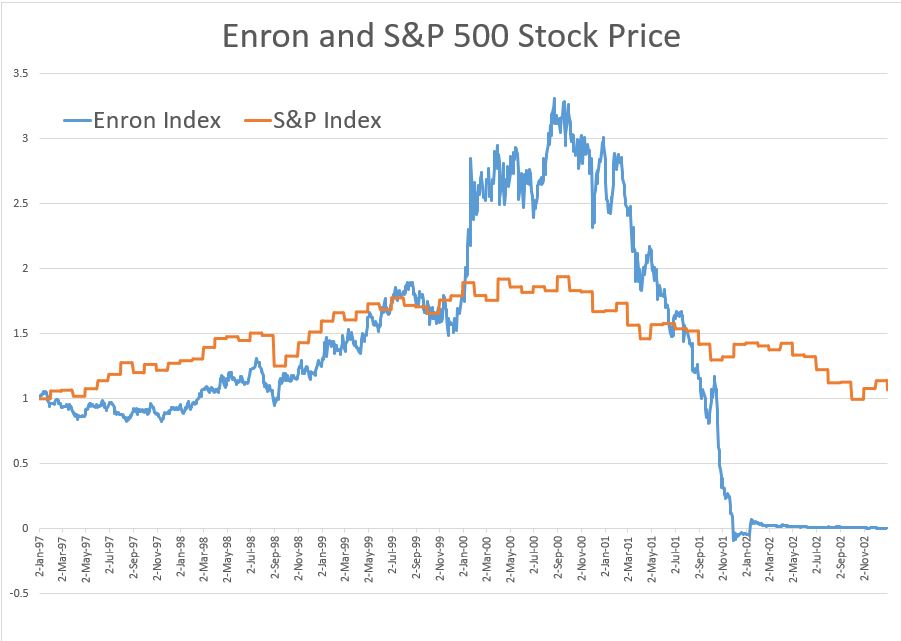

Enron Corporation was the main sponsor (owner or equity investor) and developer of the project. The plant was completed in 2001 and became a disaster at about the same time Enron collapsed. Maybe the Dabhol plant problems in India had something to do with the Enron fall. You can see the Enron stock price data below in case you are young and don’t know story.

In most places in the world (especially in India), the kind of arrangement where the revenue contract (in this case the PPA contract) is negotiated without a bidding process are no longer acceptable. This does not make the Dabhol case obsolete, as the economics of the contracts and political risk associated with the contracts still must be assessed even if a bidding process is used.

Background Resources for Completing Questions Raised in the Case

You can find many of the resources on the website except for the Harvard Business School (HBS) write-up. (I am not allowed to put the HBS case itself on the website because of copyright issues. Somebody from HBS has sent me threatening e-mails about this). I have however, put some of the information from the case in screenshots below.

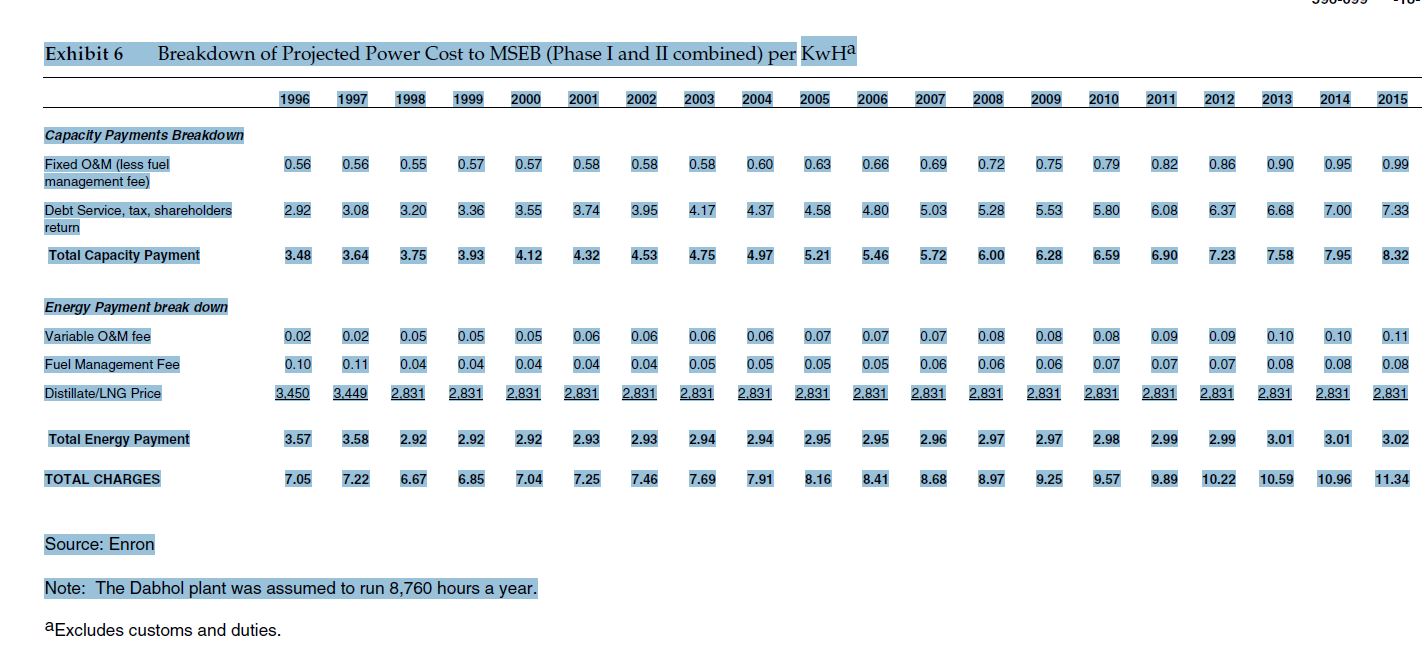

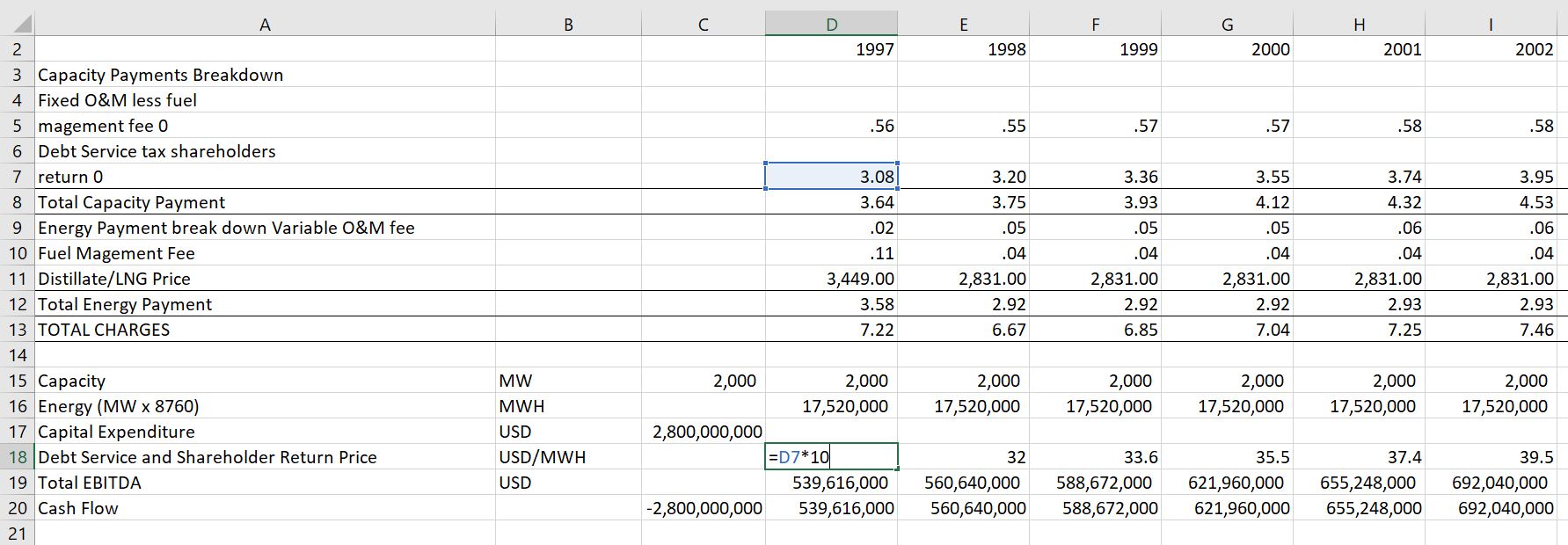

The basis for the case is the HBS Dabhol Case 1. The last exhibit in this case has numbers on the PPA agreement including the capacity charge. (In fact, the PPA was changed after the case write-up, but the re-negotiated numbers are not available). For purposes of this assignment you should use numbers and structure from the data in the HBS Case 1 that is the last page of the case.

Other than the HBS case, resources that should help you completing the case and are available download in different sections include:

- Case from India with Financial Analysis of the off-taker (the buyer of power)

- Read PDF excel utility so you can download data from the PDF to an Excel File

- Database File on exchange rates with the India/US exchange rate

- Files for benchmarking that include EIA data and Lazard

- Other case write-ups that describe various aspects of the case

You can use the buttons I have added below to download and read the background materials. (I wrote a few comments about the Dabhol case a few years ago. You are welcome to read these comments in my case studies preliminary manuscript. But please do not assume these comments are very good. I have not included my comments in the resources available for downloading below.)

Step by Step Instructions for the Dabhol Assignment

The assignment involves writing-up seven parts of the Dabhol project finance case. There are seven parts of the assignment. I would like you to write-up one or a couple of paragraphs on each section, something like a credit memo. Do not worry about the length of this page — I have tried to put a lot of details in the sections so you can concentrate on the central learning issues.

Part 1: Write-up the Summary

Write a succinct summary of the case from a credit analysis perspective (e.g. what were unacceptable risks in the loan agreement and why was the project good or bad from the perspective of risk). Include a couple of sentences in your summary about the implications of the case in the context of general project finance theory. You should probably write this up after you are finished with other parts of the assignment.

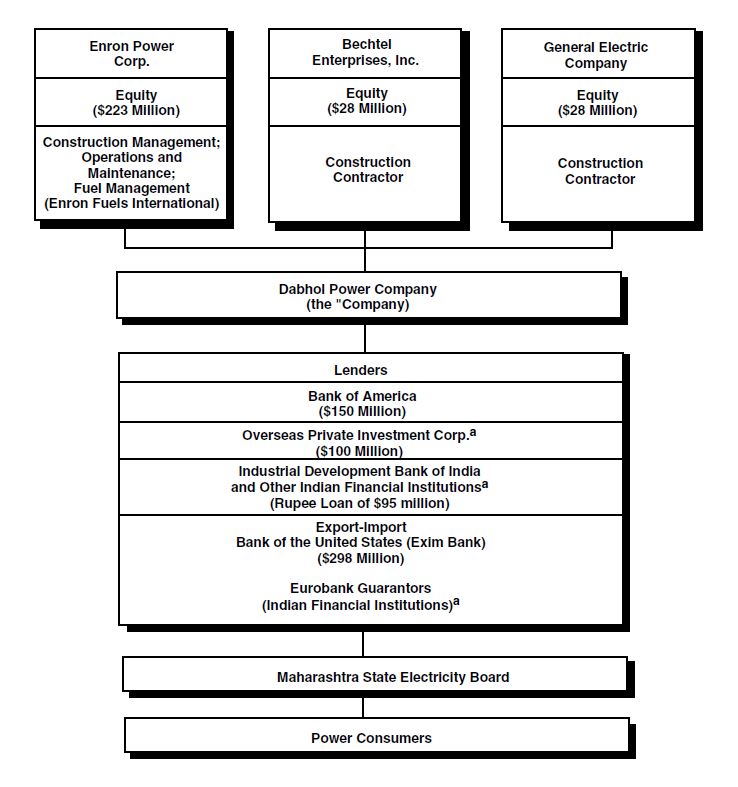

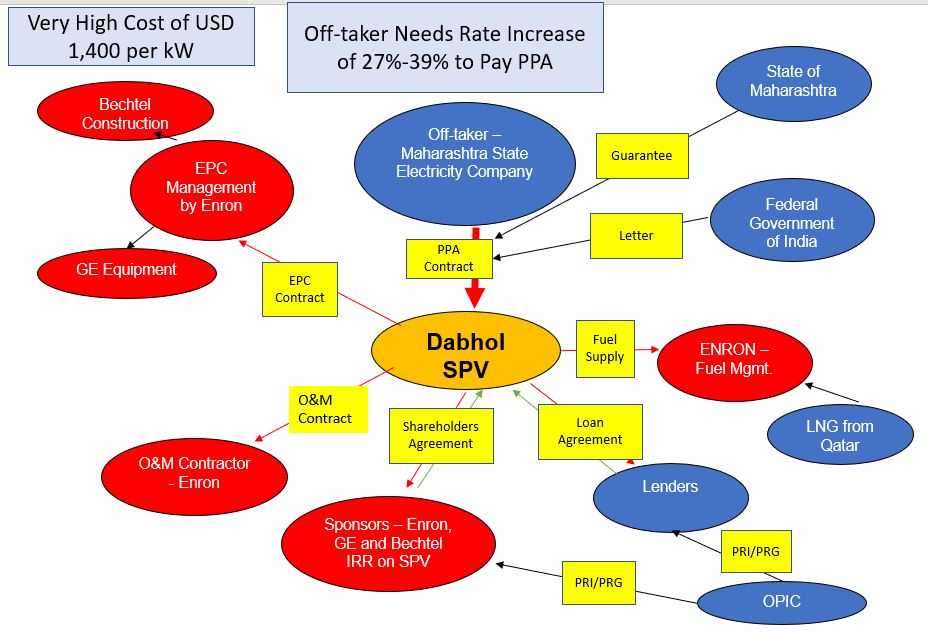

Part 2: Make a Diagram of the Contract Structure and Comment

The Dabhol project was named deal of the year for its contract structure before it imploded. In this section, I would like you to make a diagram of the structure of the contracts in the project financing — the entities and the contracts. Also, in a couple of paragraphs, discuss the general economic concepts of using a purchased power agreement with a capacity charge in an availability-based project. I am looking for a diagram that you can use to discuss risks of contracts not being honoured. I hope you can make it come alive with flows of where the money is coming from and where it is going.

I would also like you to comment on the diagram that is included in Exhibit 1 of the HBS study (shown in the screenshot below). I hope you make a much better diagram that allows the reader immediately understand risks and mitigations associated with the different contracts.

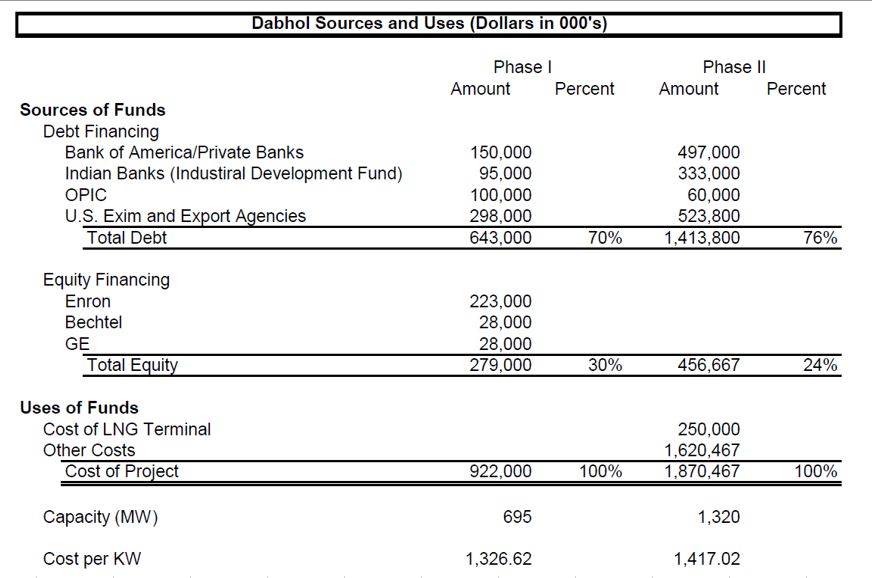

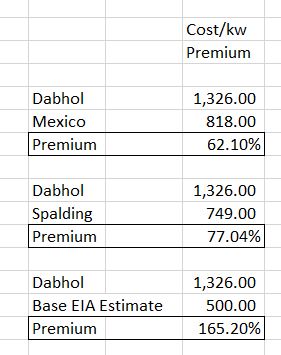

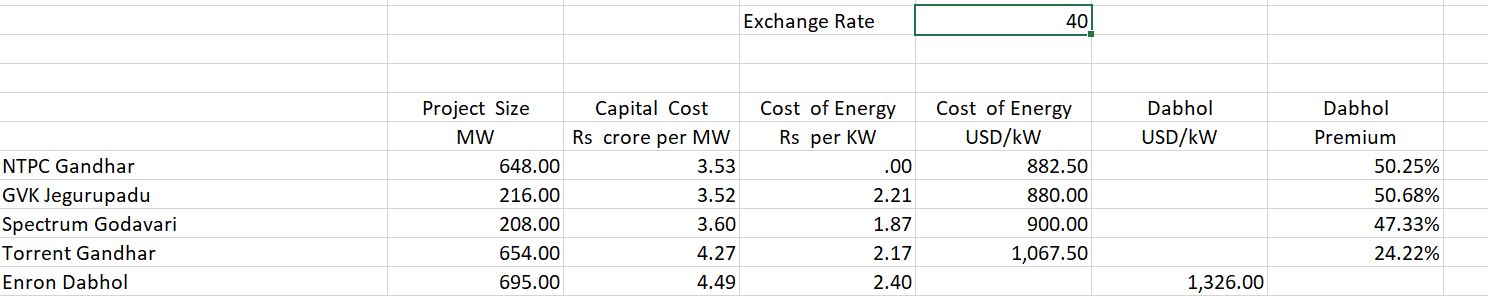

Part 3: Write a Paragraph on Benchmarking of the Cost per Unit

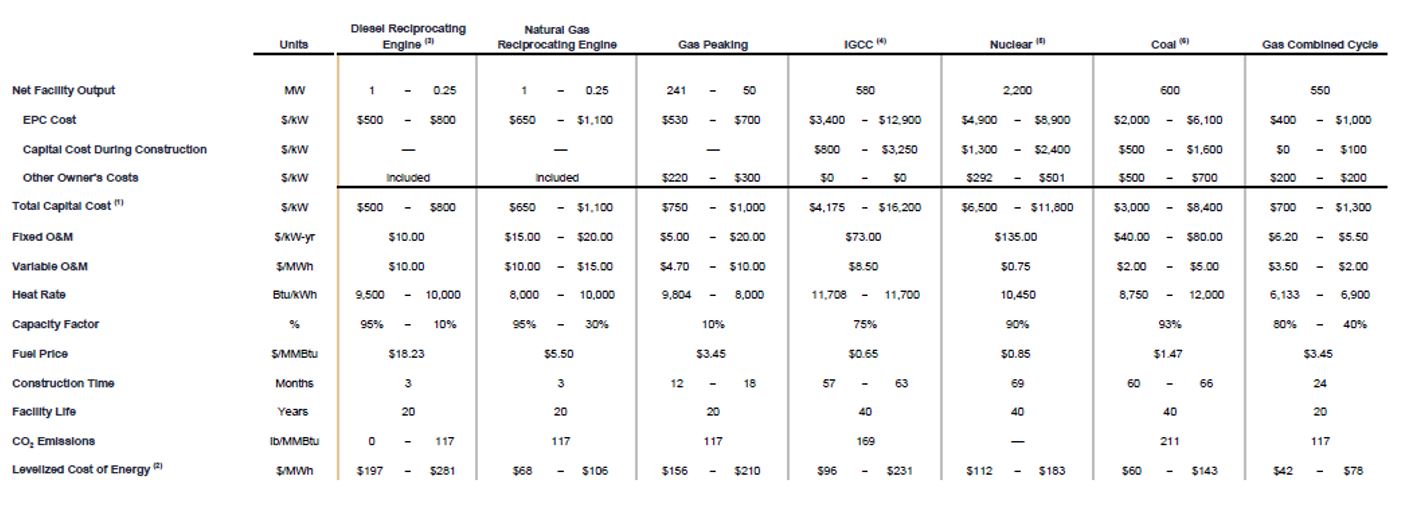

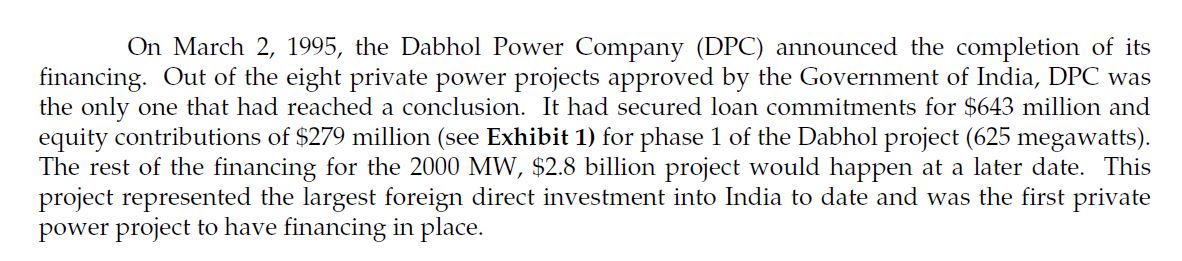

Any project finance investment includes capital expenditures, operating costs, volumes produced and prices. A lot of risk analysis depends whether the amounts for these capital expenditure, operating cost and revenue drivers are reasonable. As project finance does not include financial history, you often need to do some detective work to evaluate unit costs for capital expenditures, operating costs and other items (e.g. capital expenditures per kW). The cost and the capacity are at the top of the HBS case as shown in the screenshot below.

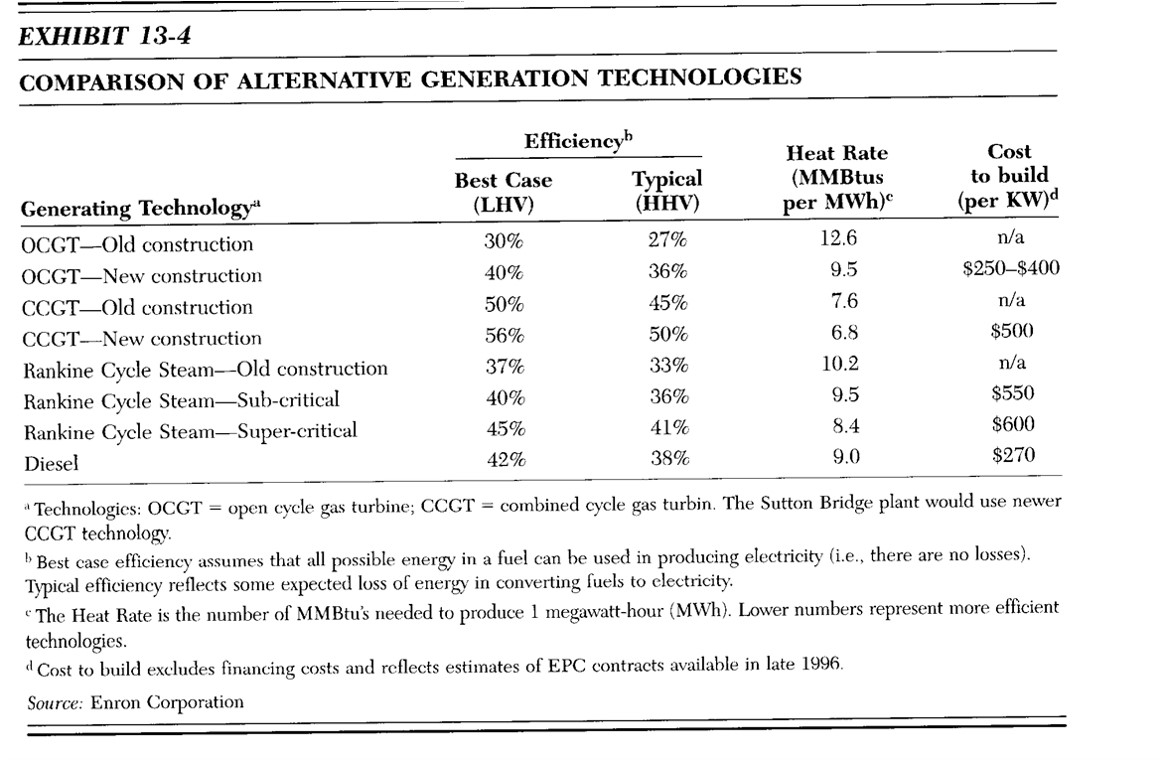

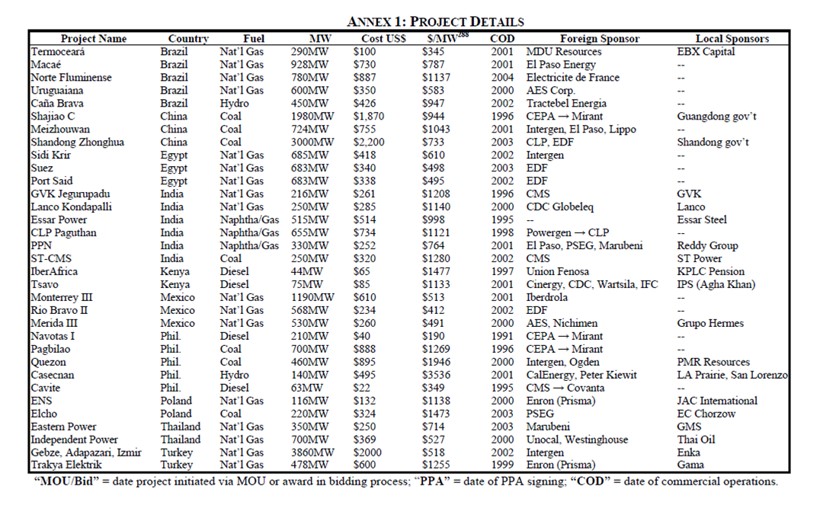

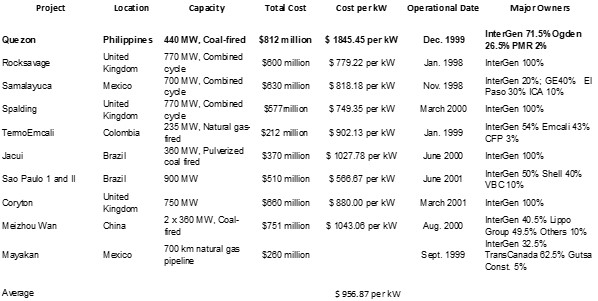

In this section, I would like you to do some cost benchmarking and compute unit costs of Dabhol. This is a bit difficult because of the age or the case, but you could start with an old HBS case that includes capital costs for different types of units. I have clipped a couple of sources in the screenshots below. Once you finished your benchmarking, comment on the reasonableness of the cost structure explain why you think the Dahbol costs are different from other plants. If you are really fancy, you could try also to benchmark the O&M cost.

I have included a photo of the plant that you can maybe use in benchmarking. Tell me if you think there is something special about this plant that makes it different from other plants around the world.

Part 4: Compute the Project IRR from the PPA numbers in the HBS Case 1

In this part of the assignment I would like you to compute the project IRR (return on investment measure in project finance) from information given in the HBS case study on the PPA. I would like you to think about the implications of different return measures. Maybe as lenders you should not care much about the return. Maybe you think a high return is good. For example, S&P includes various criteria in developing credit ratios. One of the S&P criteria is the return on investment – a higher return on investment is associated with better credit quality.

I would like you to: (1) compute the project IRR from the PPA statistics at the bottom page of the HBS Case 1; (2) discuss the difference between project IRR, equity IRR and debt IRR; (3) comment on the level of the project IRR in the context of credit analysis; and, (4) comment on whether the IRR reflects the true returns to investors.

In computing the project IRR, you can use the step-by-step process below. I do not want you to struggle too much with this. I just want you to get a very general idea of what can go into the project IRR calculation and, most importantly, how to interpret the calculation.

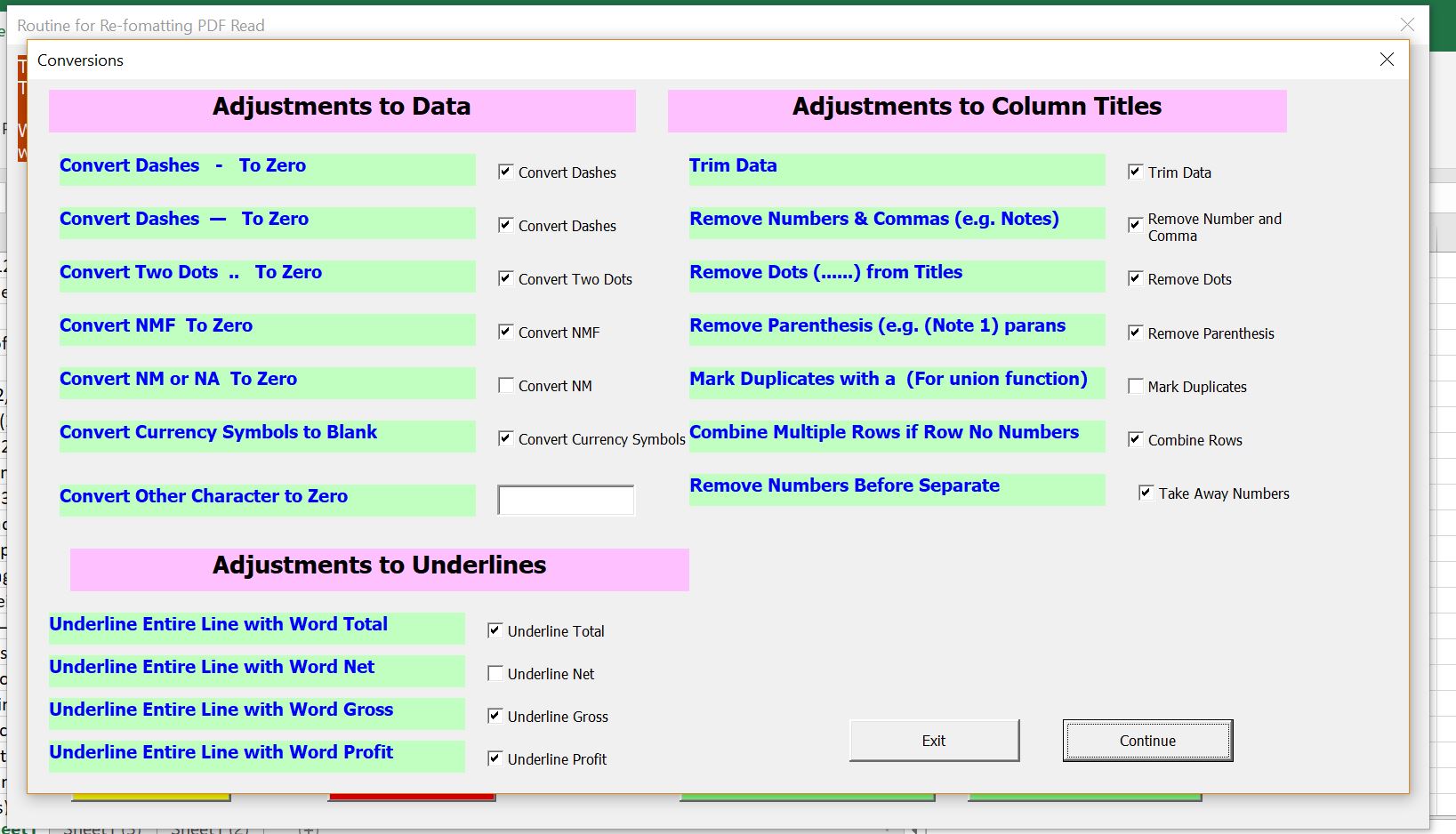

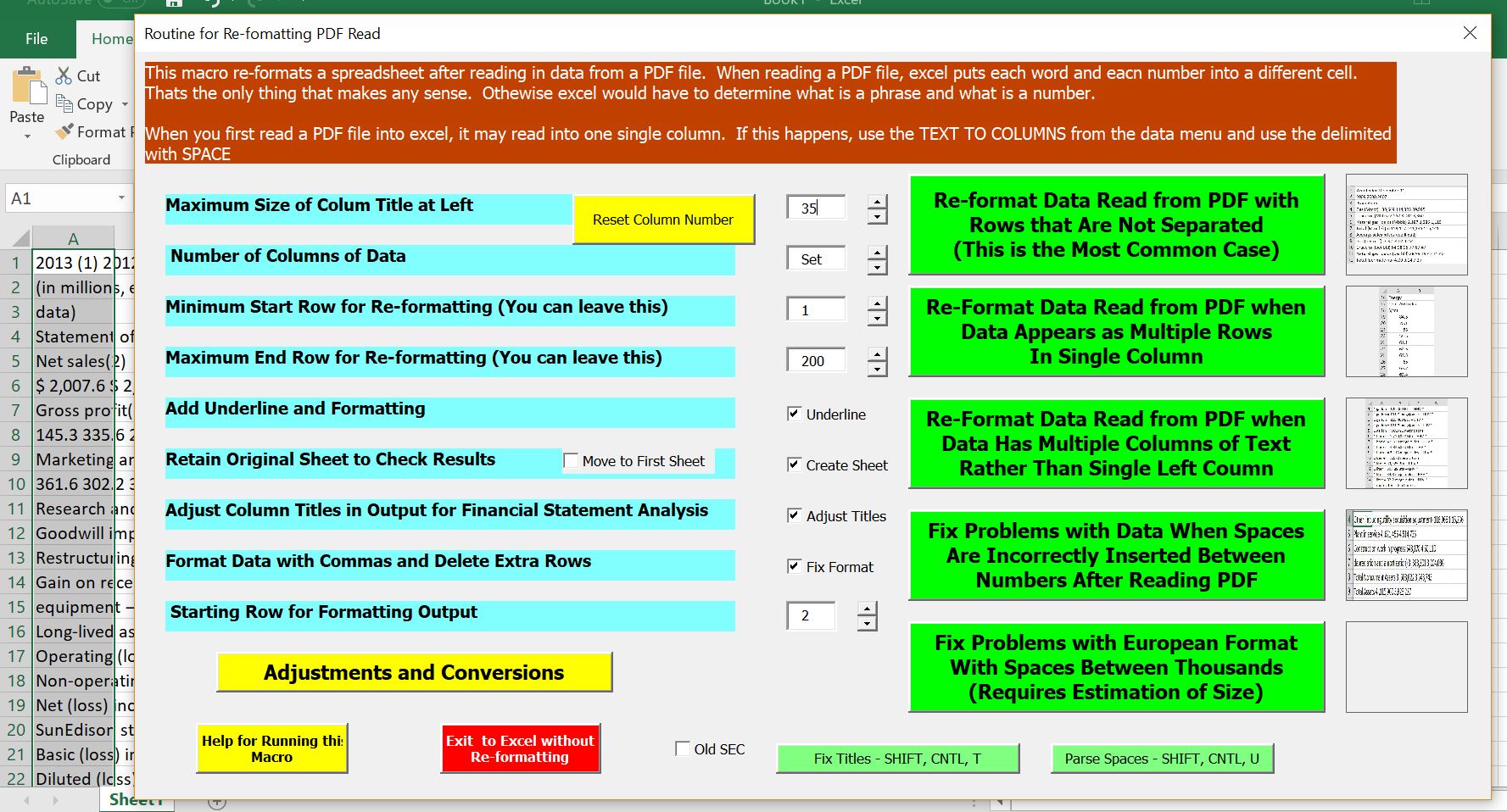

Step 1: Open the Read PDF Excel file (you can download it by pressing the button below)

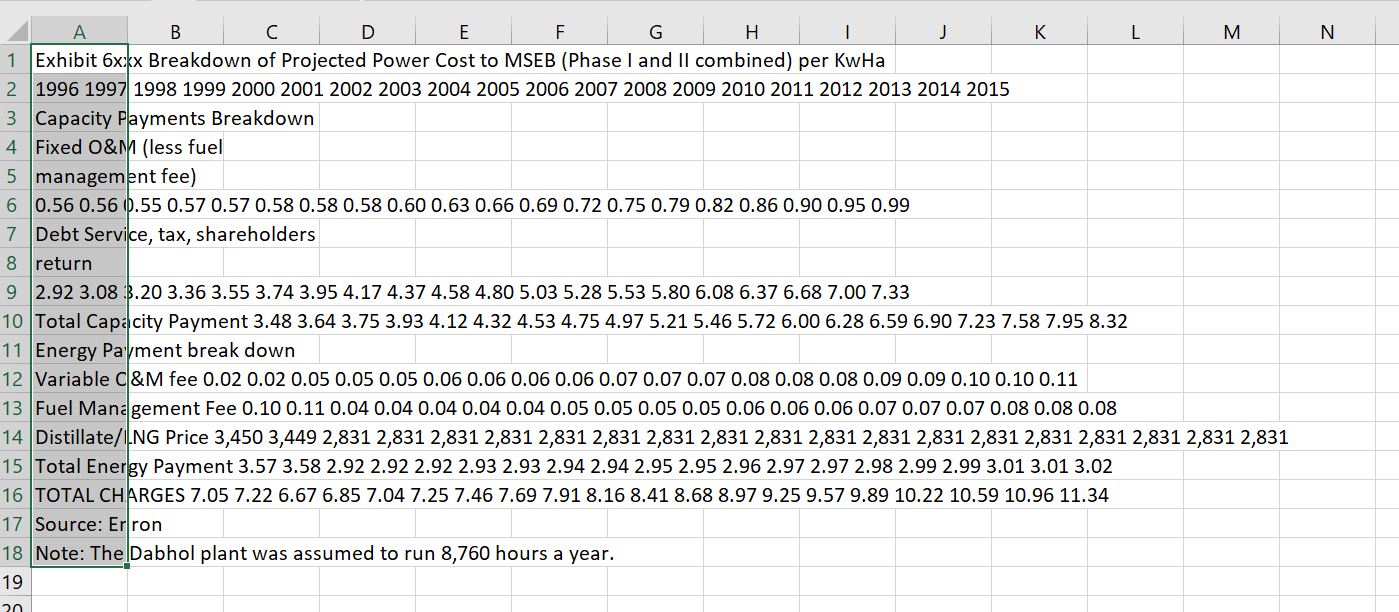

Step 2: Copy the PPA data at the bottom of the HBS case study to a blank excel sheet (the first screenshot). The second screenshot below shows the messy raw data after you copy and paste it into excel.

Step 3: Press SHIFT, CNTL, A sequence to get the menu to appear (it is essential that the Read PDF to Excel File is open and you see the SHIFT, CNTL A on the bottom status bar of excel). Then go to the Conversions and Adjustments Button and adjust the REPEAT ROW option. These steps are illustrated in the screenshots below. If you are having trouble, you can send me an e-mail to edwardbodmer@gmail.com. The menus that should appear are shown in the screen shots below.

.

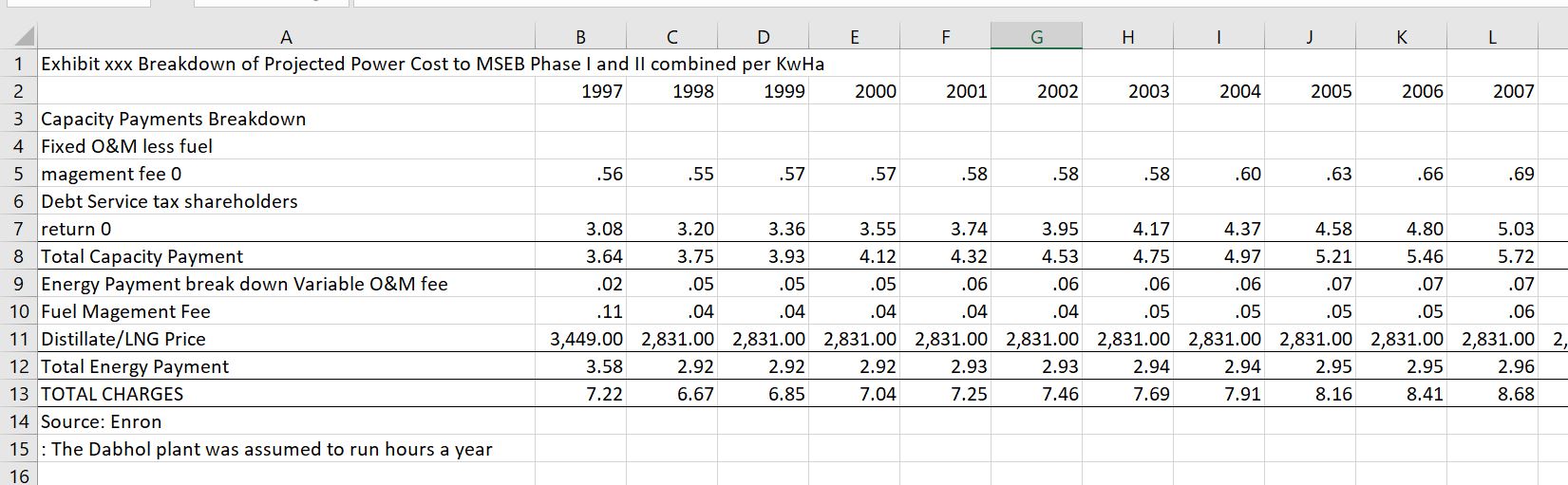

When you have finished this process, there should be a second sheet in your file that is cleaned up. The cleaned up sheet should look something like the screenshot below. Then you should add a couple of columns and you can make an analysis of the project IRR.

.

Step 4: Insert a column for the construction period (assume a 1-year period) and enter the construction cost of $2.8 billion and the capacity of 2,000 MW for both units as quoted in the case. I have illustrated a little excerpt from this below.

Step 5: Use the absurd assumption that the plant will run 8760 hours per year that is noted in the case (maybe the plant will get a sick day — have an outage of 24 hours in leap years). With this assumption, compute the volumes sold as the capacity multiplied by the hours to arrive at MWH. Assume also that the PPA applies to the entire 2,000 MW of the plant. Do all of your analysis in USD (not USD 000’s or USD millions). In the case, the contract prices are in USD cents per kWh. Convert these to USD per MWH through multiplying by 10. These few calculations are shown in the screenshot above.

Step 6: Assume that the contract structure is such that the fuel revenues in the PPA contract match fuel costs and the operating revenues in the PPA contract match the actual operating expenses. This means that the return is earned through multiplying the capacity charge in USD/MWH by the MWH.

Step 7: Compute the Project IRR on a pre-tax basis using the capital expenditures in the first year as the cash output and the combination of the capacity charge and the management fee multiplied by the volumes as the cash flow input. Use the IRR function in excel. Now do the important part.

Part 5: Off-taker Analysis

If a project revenue depends on a PPA contract, then risk analysis of the project finance should include: (1) the incentive of the off-taker (the buyer of power) is to break the contract; and, (2) the financial ability of the off-taker to honour the contract are essential elements of project finance risk analysis. The Dabhol case was a classic case where evaluation of the off-taker was a crucial element of credit analysis.

To evaluate risks of the central PPA contract not being honoured, I would like you to compute the effects of the PPA on the prices charged by the off-taker in this section. My hope is for you to think past the fundamental legal structure of contracts and the SPV and examine the economics of the project.

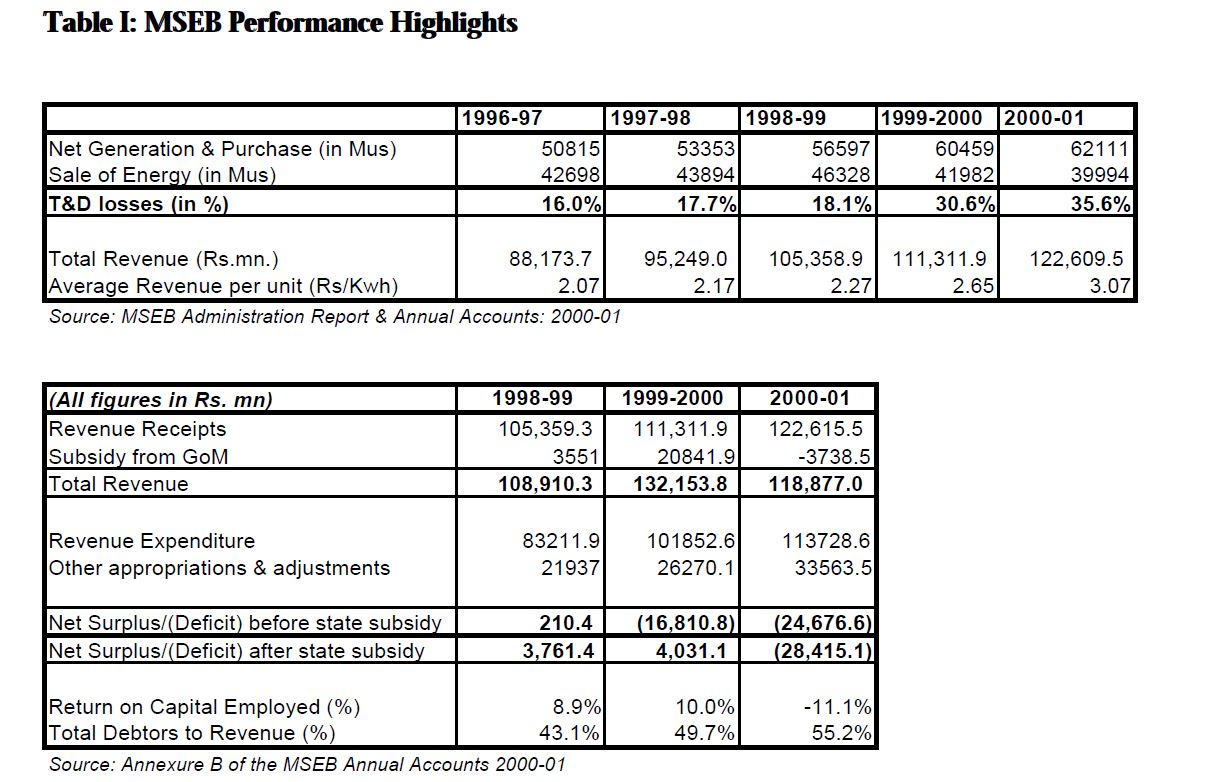

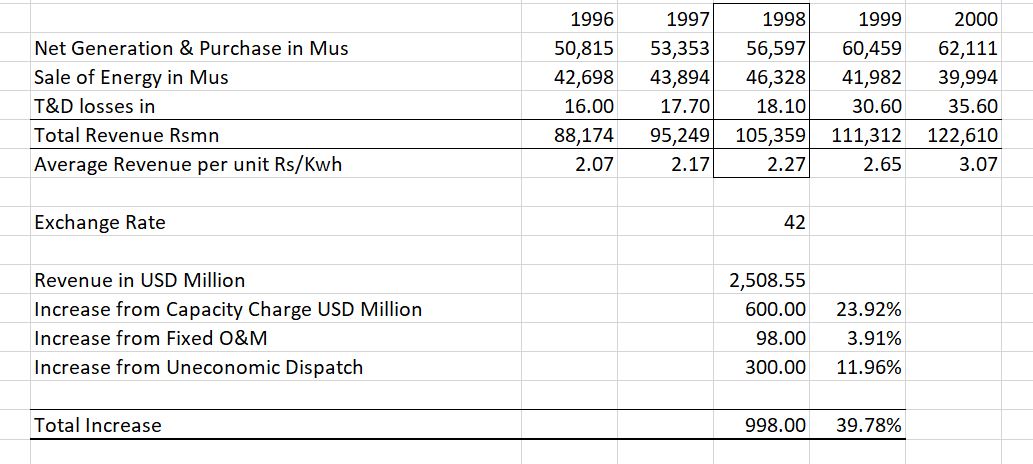

You could get very sophisticated about calculating the effects of the PPA contractor on the off-taker the calculation, but for purposes of this assignment, assume that the revenues and therefore prices charged by the off-taker must be increased by the capacity charges and the operating costs. This means you can make a pro-forma revenue calculation of the offtaker — MSEB — with and without the Dabhol plant. Once you have computed the pro-forma revenue increase, calculate the percent revenue increase that MSEB – the off-taker – must charge to its customers. Finally, as part of your write-up, comment on whether you think the percent increase in revenues will affect the non-technical losses, which is stolen electricity.

For the pro-forma calculation of the revenue increase and percent rate increase, you can use the India perspective case study that is available for download below. In this file you will find a couple of tables that show the revenue of MSEB before attempting to recover charges for the Dabhol plant. Tables that will be useful for this analysis are shown in the screenshot below the button. You can use the read pdf to excel conversion process for this just as you did for the PPA analysis file to do the analysis. Assume that the term Mus in the case study is the same as MWH.

PDF File with Dabhol Case Write-up from Indian Perspective Including Discussion of Finances of MSEB

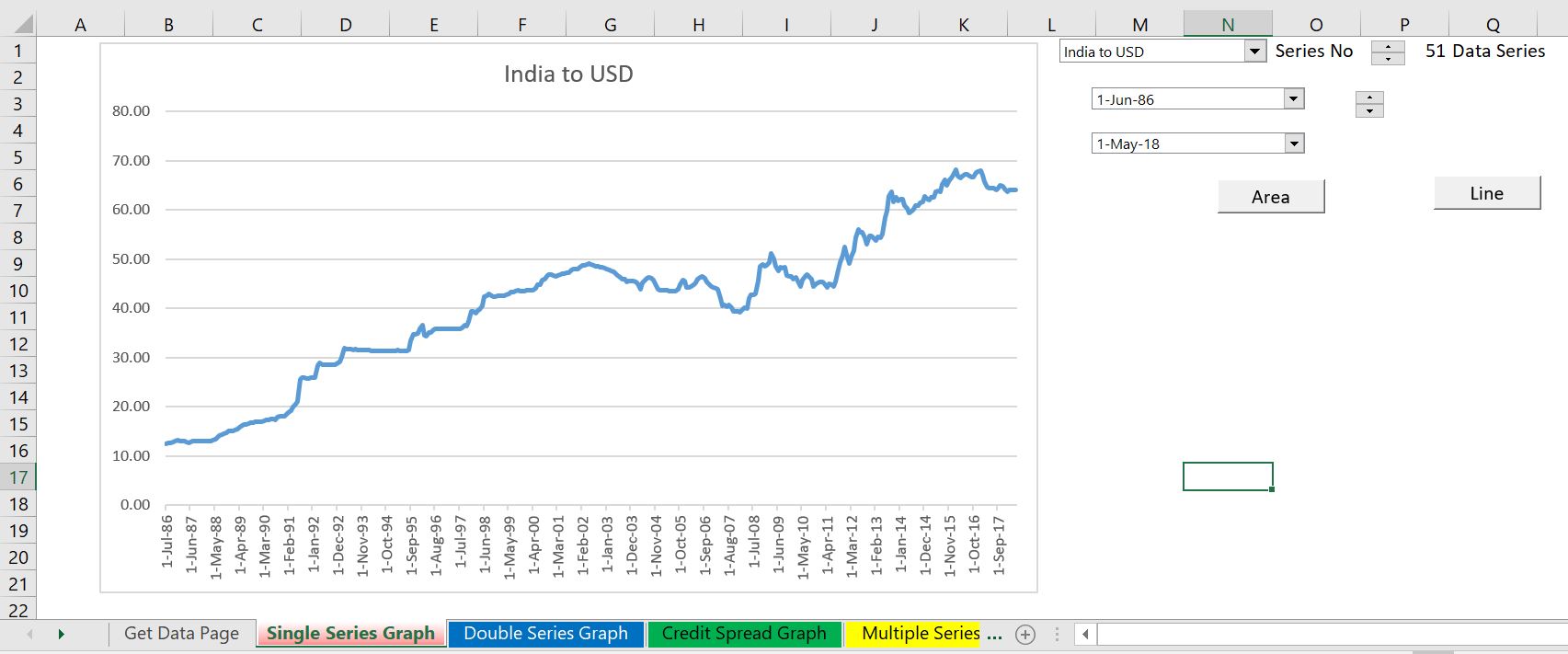

To make your analysis of how much the capacity charge for Dabhol increases rates to MSEB customers, you should first convert the Rupiah to USD in the above table. This can be done by using the interest rate database file that is available for download. Once you have converted the numbers to USD, you can then use the 1998-1999 values to make a pro-forma rate calculation (Revenues in USD divided by MWH). After that, make the same calculation, but add the capacity charges from the Dabhol plant to the revenues and compute the revenue per kWh after the plant is added. Finally, compute the percent change in prices.

In making the calculation, you will need to convert the data in Rupiah to USD. You can do this by using the file below or you can estimate the exchange rate using the graphs below. The graph can be downloaded by pressing the button below.

Part 6: Risk Analysis

Given the contract structure, benchmarking, rate of return calculation and off-taker assessment, write a short credit analysis report. In the credit analysis report, use key credit issues where you write a question (e.g. this is the first large NGCC plant in India, what is the risk of capital cost over-runs). Then you can answer how the risk is mitigated. Alternatively, or in addition, you can make risk matrix where you organise risks (construction, operation, financial) and put the name of the risk in different rows. The columns can include the name of the risk, a description of the risk, mitigation of the risk, and the potential cash flow effect of unmitigated risk.

Part 7: Conclusion and Opinions

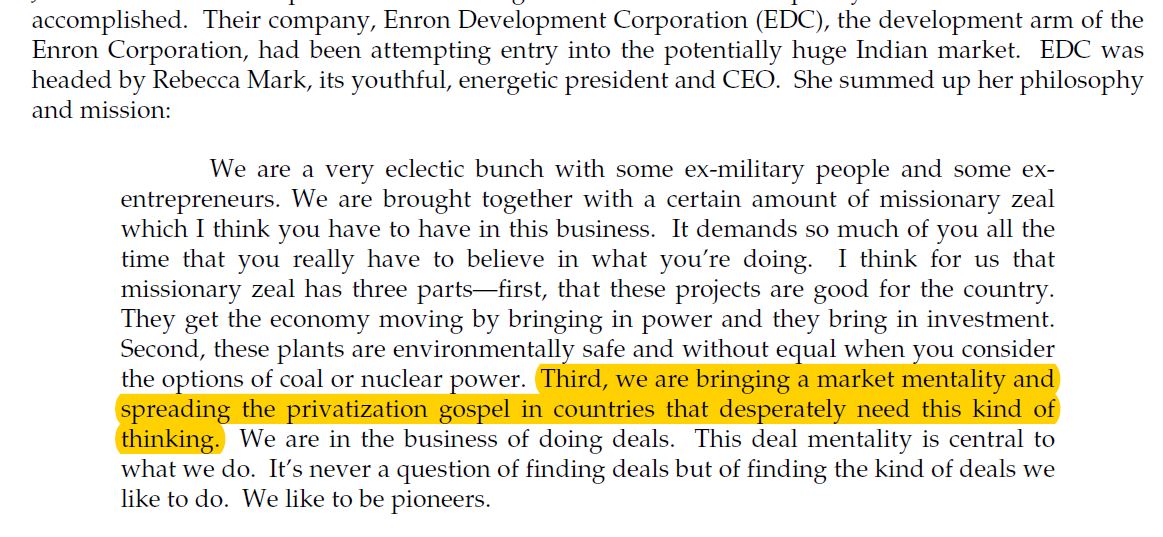

Find the article with the chronology of the project and write a sentence or two on the final resolution of the power plant. Comment on the comical jiberish (apparently taken seriously by students) that Harvard students are given before they go to Wall Street — in particular the statement that Enron was “Spreading the Privatization Gospel” made by Rebecca Mark, a Harvard Alumni who was behind the transaction. The first screenshot below is the amazing crap that Harvard students are given with the case. The second screenshot is a picture of Rebecca Mark with and Indian official.

Given your analysis, write a couple of sentences about what happened to the project and the introductory quote in the HBS case about India “desperately needing” the kind of thinking taught at HBS . Comment on what you think are the major errors that were made in the case.

Other Resources

I have included a few other articles and case studies that you can read. These articles may be amusing to read and provide some further background for the case. I even understand that there is a Bollywood film about the Dabhol project modelled after the Godfather.

Comprehensive Article on the Dabhol Project from the Asia Times

Article on Political Pressure from the U.S. on India Related to the Dabhol Project

My Comments on Possible Answers:

Part 1: Write-up the Summary

My opinions about the case are probably biased and wrong. But here they are. In terms of credit, this case demonstrates that no matter how many government guarantees, letters of comfort or other legal assurances you have, if the counterparty cannot afford to honour the contract, the project will have big problems. Further if you have promises from OPIC and other insurances, they are not like a letter of credit where you can just go and collect the money as soon as a default occurs. This is aggravated if there are published reports that can be used against you in arbitration.

Most importantly, the project reveals a fundamental question about project finance. This question is whether having really good contracts is most important or whether it is more important to evaluate the economics of the project. I hope you think that both are important. The government of India was heavily criticized for not honouring contracts. This was a valid complaint as private investment in the country dried up to an extent. Enron and its banks were criticized for not evaluating the economics of the project and relying too much on the contract structure of the project.

Part 2: Make a Diagram of the Contract Structure and Comment

I think the diagram in the case sucked. First, there was a bizarre line from the SPV to the Bank to the Off-taker. I would hope a better diagram would start with the PPA and have arrows pointing which way the money is flowing. Second, each line should represent a contract. Third, essential elements of the contracts should be highlighted. For the PPA, contract I would put right in the diagram the required price increase to consumers. I am in no way saying the diagram below is any better, but I hope it can be used to thing about risks.

Part 3: Write a Paragraph on Benchmarking of the Cost per Unit

The reason I included this question is to highlight a fundamental fact about project finance. That is that there is no history — no historical trends from financial reports — in project finance. No trends in EBITDA or ROIC to evaluate. No historic volatility in cash flows; no way to compare Debt/EBITDA ratios across different companies operating in the business. Project finance involves large capital investments that must be maintained and produce not very exciting products such as roads, electricity, oil, prison buildings, hospitals, LNG plants etc. The differentiation between projects generally comes down to cost structure and efficiency.

The second point about benchmarking is that it is very difficult to do on an objective apples-to-apples basis with real data. Maybe there are customs duties; maybe added transmission facilities must be built; maybe labour costs are different. In the case of Dabhol, the cost of $2.8 billion relative to capacity of 2,000 MW or a cost per kW of USD 1,400 per kW is very high. This is demonstrated in the table below.

While you may say the comparison with plants around the world is not appropriate; you could also say that comparison with other plants in India is not appropriate because other plants in India were charging high EPC profits and using the political risk premium excuse. The two tables below demonstrate premiums of the Enron plant compared with other plants.

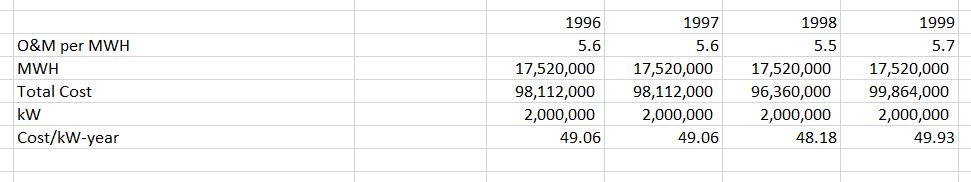

In addition to benchmarking plant costs, the O&M costs should be benchmarked which in general is even more difficult. The Dabhol fixed O&M costs appear surprisingly high. This is demonstrated by comparing the cost per kW-year in the HBS case with current costs that are published by Lazard. Costs in the case study were

Part 4: Compute the Project IRR from the PPA numbers in the HBS Case 1

In response to my question for this section, I was hoping for comments that the IRR was very high. I was also interested in statements that IRR does not measure the real profit because profit is made from O&M and EPC contracts. You could get even fancier and discuss upside IRR options from continuation of the PPA; use of the LNG terminal for additional business ventures; and, increasing the IRR from re-financing.

There is an issue in project finance that economic rents that are in the IRR amount to transfer of wealth from consumers of electricity in India to investors in the U.S. A high IRR may be suggested to compensate for political risk; but it also increases political risk.

In project finance there is a basic rule. the project IRR must be higher than the cost of debt which is the debt IRR.

Now, some people have mentioned that the IRR as a statistic has flaws. This is true. There is the famous problem of multiple IRR’s when cash flows are positive, then negative, then positive. There is the re-investment rate. There is the theoretical problem of project ranking discussed by McKinsey that almost never happens. But the IRR still provides a good measure of growth in future cash flows. The real problem with IRR is that: (1) it does not account for changing risk of the project; (2) it undervalues far-out cash flows when the IRR is high; and (3) it does not account for probabilities in staged investments. You can find further discussion of this on another page of this site:

Part 5: Off-taker Analysis

My hope in getting a response to this question is that you think about ways to evaluate risks of project counter parties in an objective manner. The idea of the structuring diagram is to show that projects depend on revenues. If there are no revenues, there is of course no money to pay O&M; no money to pay debt service; no money to pay taxes; and no money for equity. When you perform risk analysis, the question is how to do it on an objective basis. I think a good answer to this question would be to try and evaluate what will happen to the off-taker as a result of signing the PPA contract. This is not an easy task as the MSEB, the off-taker may be able to sell more energy because of surpressed demand. But if the demand is not surpressed, then the following four things could happen that would increase rates:

- MSEB must pay the capacity payment of almost USD 600 Million

- MSEB must pay the fixed O&M payment of about USD 98 Million

- MSEB must pay the additional cost of Gas Fuel compared to Coal Fuel if the plant is forced to dispatch. This could cost another approximately USD 300 Million

The next task is to see how much consumers are currently paying to MSEB. This is a bit tricky because you want to find the time period before Dabhol had any effects on revenues and you need to find the number that is not distorted by subsidies. Finally, as the numbers are in Rupee and not in USD, you need an exchange rate adjustment.

Part 6: Risk Write-up

For this section I expected a write-up that ultimately (with hindsight), recognised that the off-taker risk was not really mitigated. It was not even mitigated with the state guarantee. For this you could walk through a scenario where MSEB cannot pay the PPA agreement and then political issues regarding whether three big American companies would not be paid.

In writing up the risk it can be good to state the risk as a question and then answer the question with potential mitigation. If the risk cannot be mitigated and it is a large risk, the loan may not be acceptable.

It may have been good to create a credit issue and then answer the question. For example a question may have been phrased as follows: MSEB will have difficulty paying the PPA contract. In this scenario will the state government honour its guarantee. The answer could then be your discussion about the recession etc.

Another question could relate to the World Bank report — The World Bank issued a report stating that the Dabhol plant is uneconomic. Does the World Bank report provide a means by which the government guarantees may not be honoured if MSEB defaults on the PPA contract.

I made a few comments about the issue of whether the plant was really economically viable and whether the whole thing made economic sense. If the plant does not make sense should the bank lend money.

Review Concepts

In this final section I have included a couple of ideas that I think are important in project finance analysis. I have listed a couple of bullet points and some ways that you may think about the issues. I have also included references to my set of power point slides that describe project finance theory.

- The difference between the structure and analysis of availability projects and output projects — see slides 8-13.

- DSCR definition and use in project finance — see slides 67-74.

- Use of DSCR, LLCR and PLCR in different projects — see slides 75-84.

- IRR in project finance and why IRR is different from ROIC — see slides 89-94.

You can find some of these review concepts in the power point slides that are available for downloading in the button below.

Power Point Slides that Accompany the Video Lecture Series on The Theory of Project Finance