In applying the equity market risk premium or EMRP in the CAPM estimates, I first note how difficult it is to get your head around what this mysterious number is. If you could somehow pretend there was some kind of marginal investor who is the person or institution who is buying or selling shares, the equity market risk premium would be the minimum extra expected return that theoretical investor would need to take his money out of risk-free investments and invest in a portfolio of shares. Just writing these words can make your head spin. Historically the volatility of US stocks has been about 20%, while long-term bonds have a volatility of 7.6% and short-term bonds have a volatility of 3%. In my opinion, the equity market risk premium is somewhere between a psychological concept and a philosophical idea. But note a couple of things. First, the EMRP is about future returns and not about past experience, it is about expectations. I have written that the EMRP is affected by changes in the cost of capital itself and that returns earned from making an investment should not be distorted by changes in the cost of capital itself. Second, as the EMRP reflects the returns or rates of growth to a group people in the economy, if the returns and the EMRP is greater than the real growth in the economy, then investors as a group will always get richer at the expense of everybody else. I leave it to the reader to contemplate whether this is sustainable in the long-run. Third, any discussion about using geometric versus average returns should have been resolved ages ago. Returns are measured on a compound basis. Fourth, the portfolio of stocks that evaluate the return on stocks relative to risk free bonds should not be limited to a particular geographic location. For example, there is no reason to expect an investor in Pakistan who can invest in stocks all around the world to have a different minimum required criteria for taking equity risk versus bond risk than any other investor in the world. Both investors can invest in the same portfolio.

When thinking about the risk premium without getting trapped by technical discussions of items such as the geometric mean versus the arithmetic mean you can think of some very basic economic analysis of the supply and demand for capital supplied by people who what to invest in the market rather than in risk free securities that are earning almost nothing. You can think of pension funds or insurance companies for example. As the supply of capital increases and the alternatives of investing in bonds produce low returns, the mysterious risk premium which is the minimum acceptable return will decrease. This indeed is just about the only way to explain increases in market indices.

A few things that should be considered in evaluating the EMRP include:

- If the EMRP is higher than the real (not the nominal) growth rate in the economy, investors as a group will continue to get richer while the rest of the economy will become poorer. This means that assuming an EMRP much higher than the real growth in the economy is a very questionable idea.

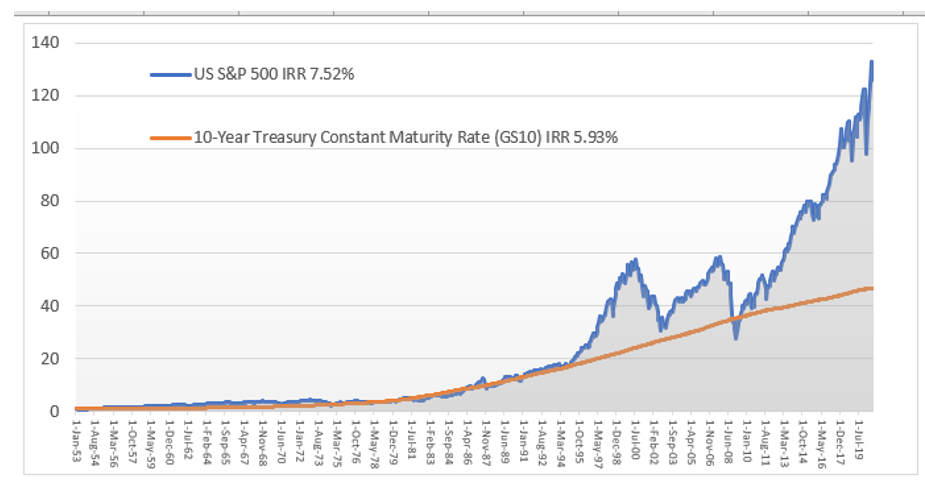

- As money grows in a non-linear manner with increasing returns, the amount of money that you generate from the risk premium produces a dramatic number relative to the risk-free rate.

- If there were no changes in the cost of capital and investor supply and demand for risk did not change — two completely unrealistic assumptions — then the historic difference between the market portfolio and the risk-free rate could represent an equilibrium payment for risk. If the return was lower on stocks, then investors would move out of stocks and the return would increase. The problem is that the cost of capital changes as well as the supply and demand for risk capital.

- Changes in the cost of capital produce capital gains or losses that are measured in the market index but do not have anything to do with the earning power of a company. For decades, declines in the cost of capital have led to increases in market indices.

- In comparing the EMRP with credit spreads on risky bonds, it is not appropriate to assert that bonds have lower risk than equity. Bonds with a rating such as B or BB have downside risk but no upside potential other than the credit spread. Stocks have expected returns with both upside potential and downside risk with an expected return equal to the EMRP. The EMRP compensates for upside and downside volatility while the credit spread deals with only with downside risk.

If somebody wants to criticize the CAPM, they could point to the uncertainty and variation in measurements of the EMRP. The following quote illustrates the problem: “While users of risk and return models may have developed a consensus that historical premium is, in fact, the best estimate of the risk premium looking forward, there are surprisingly large differences in the actual premiums we observe being used in practice. For instance, the risk premium estimated in the U.S. markets by different investment banks, consultants and corporations range from 4% at the lower end to 12% at the upper end.” With this kind of range in the equity market premium, the CAPM becomes useless. The range in the EMRP is the primary argument for deriving the implicit cost of capital from cash flow forecasts.

This page discusses in issues associated with measuring the EMPR in the CAPM.

- The intuitive part of the CAPM is that the method begins with a risk-free rate and then adds a premium for risk. The risk premium (without country risk) consists of two parts, both of which are controversial. The first is an overall estimate of the return required for stocks in general called the equity market risk premium (EMRP). The second is the company specific factor measured with beta. The overall risk for investing in stocks relative to long-term risk-free bonds – the EMRP — is a mysterious number that supposedly reflects risk and volatility of stocks in general relative to safe and stable bonds. The mysterious risk premium that drives much of the CAMP analysis is often the most controversial and difficult part of the CAPM is measuring the EMRP except for the country risk premium.

Estimates of the market risk premium can vary by a wide margin and some analysts have used estimates have been more than 7% in the past. In Section 4, I suggest that estimates of the general EMRP of more than 5-6% are not realistic in the context of an economy that grows at 2-3% on a real basis. But as market participants use the EMRP numbers, I have accepted the high end of estimates made by surveys and that a separate EMRP is not necessary for Pakistan. I emphasise that the EMRP estimated from the value of a stock index less the risk-free interest rate is completely distorted by capital gains caused by the change in the cost of capital itself. For example, if the value of stocks increases by 10% because of a decline in the cost of capital, this change in the value should not be included in the risk premium.