This page explains how to model a mini-perm where a loan has repayments structured with a long-term amortization schedule, but the maturity date is much shorter and a bullet payment is required for the remaining debt repayments. When you structure a mini-perm, one of the main issues for measuring the economics of the project is what kind of re-financing happens when the re-financing occurs. In evaluating the mini-perm you must make some assumptions about re-financing. The tricky analytical issue is that the mini-perm can aggravate both the upside and downside case. This page illustrates the mechanics of a mini-perm and also the theory of re-financing.

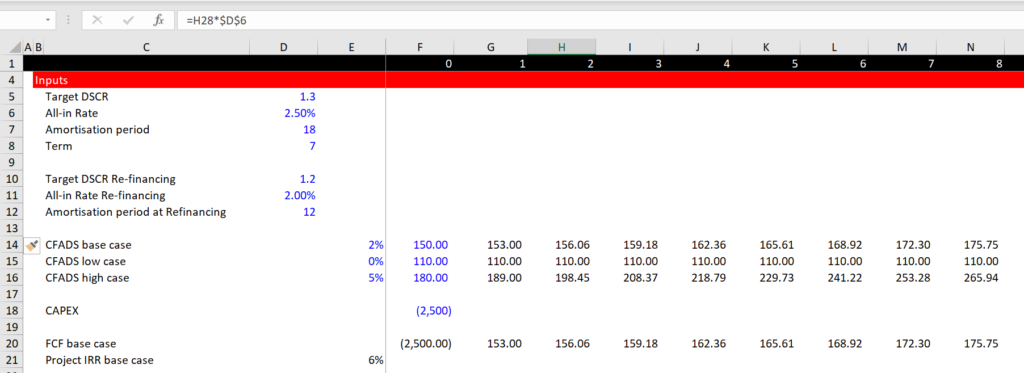

Mechanics of Mini-Perm

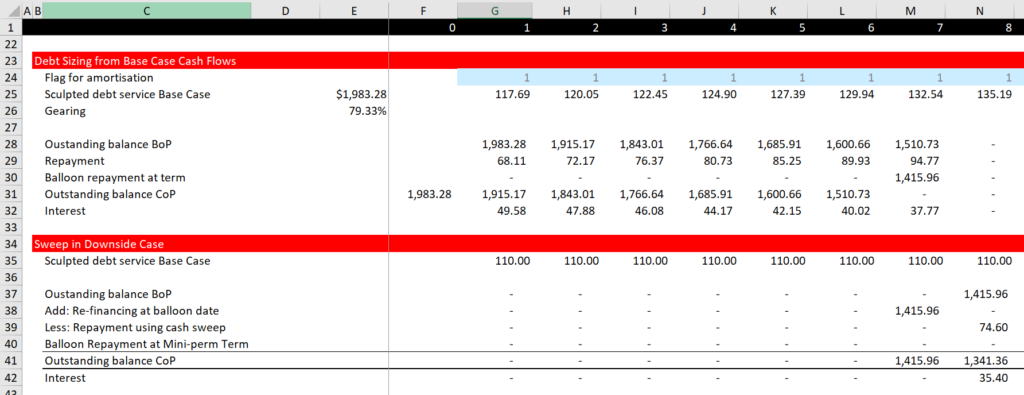

In setting-up the mini-perm you can see the inputs for the cash flow and the mini-perm term. Note that the assumed DSCR is lower for the re-financing than the original re-financing. You need first to set-up flags and then to make assumptions about what will happen when the re-financing occurs — the negative re-financing assumption is a cash flow sweep.

The video below discusses how you can evaluate credit for a mini-perm by assuming that the re-financing changes the repayment into a cash sweep.

The video below works through mini-perm debt in the context of a merchant electricity plant.

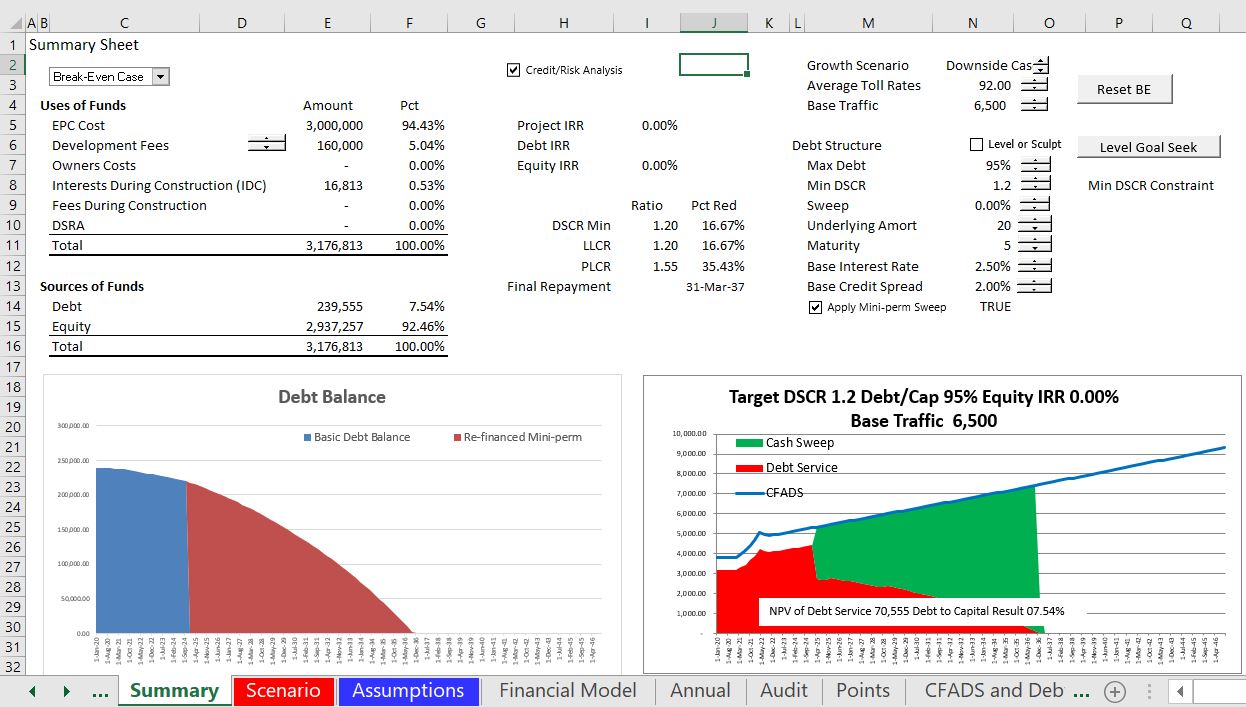

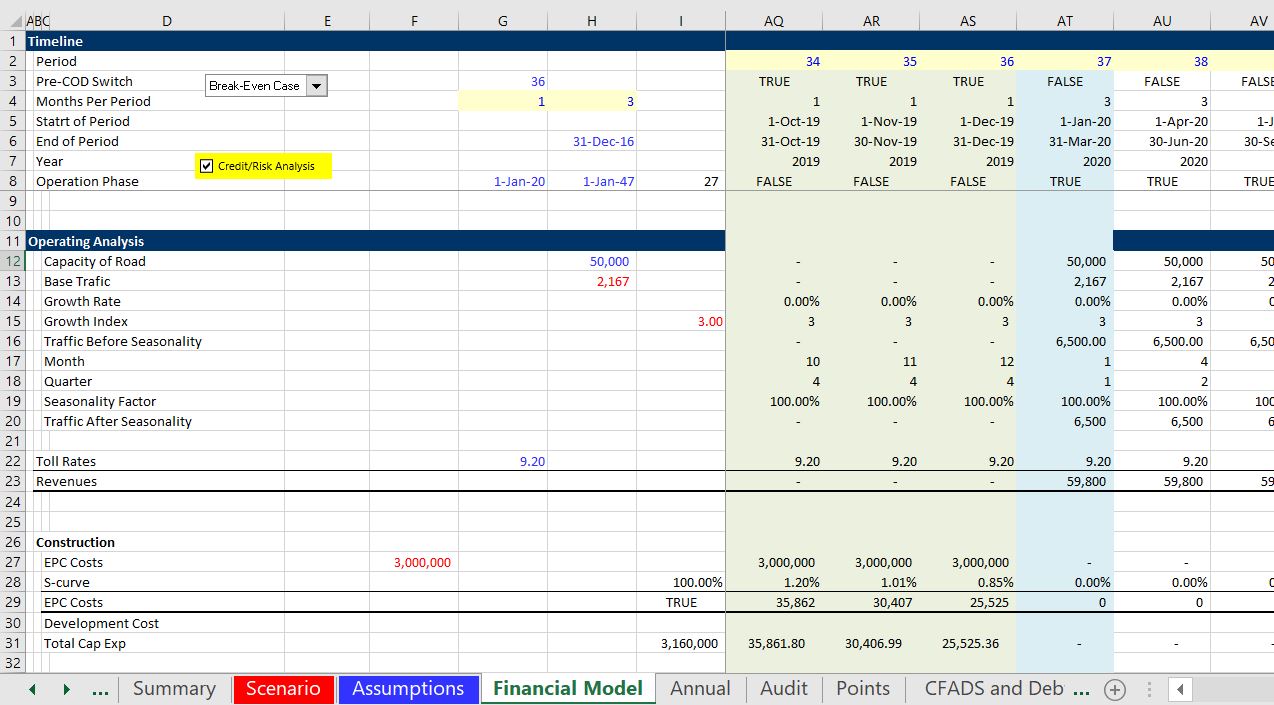

Toll Road with Mini Perm

You may think that a min-perm is a haircut. And a hard mini-perm has a lot of hairspray or something. You are probably correct. But an investment banker came up with the term and it applies to cases with built-in re-financing. The mini-perm structure can be used for toll roads where downside cases evaluate repayment of the mini-perm in lower traffic scenarios. You can press the button below to see an example of a mini-perm from a course that I had. below the button I have included a couple of screenshots from the model.

.