On page I try to explain modelling of inverted leases (also called sandwich leases) in the context of U.S taxes. These transactions are also known as lease pass-through agreements and I was initially very confused in part because of the absurd name “Inverted Lease.” As with other pages that become very arcane and confusing, I try and explain this inverted lease with a simple example. It initially seemded to me that the inverted lease was counter intuitive were the financier — the tax investor makes payments to the developer/sponsor even though it is the developer/sponsor who needs to get paid for their investment. I was confused because the discussion of the inverted lease generally comes after the discussion of a more classic sale leaseback where there is a big payment to the developer after the developer has made the investment in the solar project.

I finally started to understand the inverted lease by thinking about a regular automobile lease. Think of the dealer as the developer and pretend that the car dealer bought the car from the manufacturer. Think of the person who drives the car and is the lessee as the tax investor. Pretend that no money changes hands other than the lease payment made from the lessee (car owner or tax investor) and the dealer (sponsor/investor) until the monthly lease payments (car payments) are made. At the end of the lease you return the car to the dealer (developer) and there are all sorts of limits on mileage and insurance issues to deal with. The car lease in theory could have all sorts of different lease structures. There is nothing inverted that I can see about the process.

.

In the case of the inverted lease, continuing with the car analogy, the person who drives the car would get the ITC at fair market value. The dealer would continue to own the car. I could speculate on why this happens, but we can just consider this as a rule (and we should not be proud of being able to recite the specific tax code behind this rule — leave this to an overpaid lawyer).

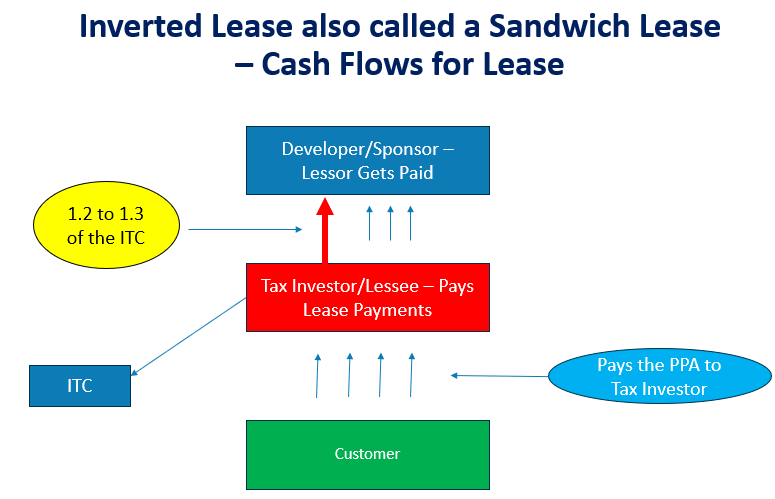

In the case of an inverted lease, there is a third party. This is the customer who pays for the solar power (maybe you could pretend you are using the car to earn money as an Uber/Grab/Lyft/Free). Extending the analogy, if the car driver (the lessee/tax investor) collects the Uber payments. Then he uses these payments to make the lease payment to the dealer (the developer/sponsor). This means the developer receives lease payments over the lease term rather than the ultimate PPA payments. As I have already stated, the tax investor receives the PPA payments directly and gets the ITC.

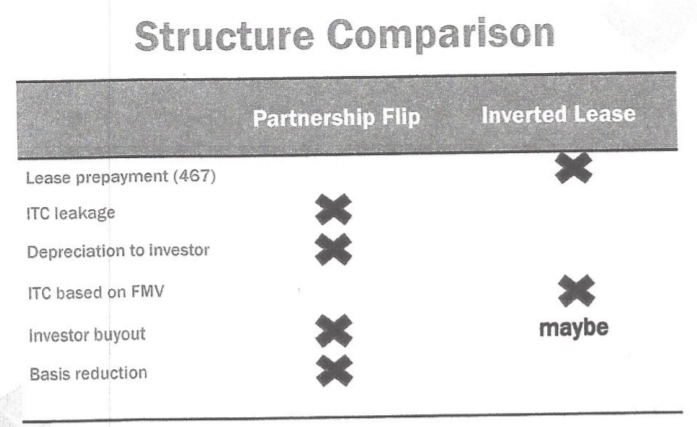

Just as the case for the car lease, the dealer (or developer) continues to own the asset at least from the perspective of the tax authority. If the developer owns the asset, the developer can depreciate the asset. Again, I am not trying to understand the tax theory, but if the developer does not write-up the asset to the fair value, but depreciates the assets at their cost, then the gain on the implict sale of assets to fair value is avoided. This means that the inverted lease seems to have the advantage for the sponsor/developer by not creating an up-front gain. Stated differently, an inverted lease has an advantage relative to a standard sale/leaseback because in the sale/leaseback, where the asset is directly sold there is a gain on the sale. The biggest other advantage is that the developer/sponsor retains ownership of the facility.

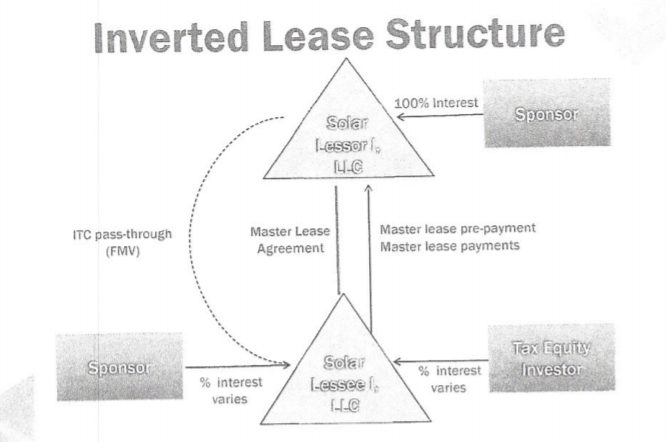

I had no idea why the inveted lease is sometimes called a sandwich lease, but by looking at the very simple diagram below, you can see that the lessee/tax investor is sanwiched in between the customer and the developer (I made the picture before I thought about why wyou would call this a sandwich lease).

Benefits of a Sandwich Lease

In discussing any of this, we assume that the developer/sponsor/lessor cannot efficiently use the ITC. Maybe this entity could use some of the tax tepreciation. At the end of the day:

- Tax Investor/lessee/car dealer or Owner of Master Tennant Receives the ITC at the Fair Market Value

- Tax Investor arguably takes some of the Operation Risk of the Project as it Recieves the PPA payments

- The Tax Investor does not get the 5-year tax depreciation but it is diffucult to get the benefits of the tax depreciation because of absorbtion issues.

- The Lease Payments that are Received by Developer and Paid by the Tax Investor can be Structured to Produce a Target After-tax Return like 7%.

- This may avoid the taxable gain on the sale for the fair market value write-up. I do not understand fully the tax theory associated with this.

.Solar companies like inverted leases because they get the asset back without having to pay for it, and the investment credit is calculated on the fair market value of the solar equipment rather than its cost. Unlike a sale-leaseback, the step up in asset basis does not come at a cost to the solar company of a tax on a commensurate gain.

Lease Pass-Through structures may consist of nested Master-Tenant partnerships, which adds significant complexity that is not addressed by this discussion; nonetheless, the basic concepts apply.

Inverted leases are used mainly in the rooftop market, although some utility-scale transactions have been done, including with debt that is effectively senior to the tax equity as the debt service must be paid by the recipt of PPA payments before the lessee/tax investor gets paid.

Think of a yo-yo. A solar rooftop company assigns customer agreements and leases rooftop solar systems in batches or “tranches” to a tax equity investor who collects the customer revenue and pays most of it to the solar company as rent. The solar company passes through the investment tax credit to the tax equity investor. It keeps the depreciation. The solar company takes the asset back at the end of the lease. The transactions work the same way in the utility-scale market, except that the tax equity investor is assigned a long-term power contract and then leased the solar project.

.

ITC is received by Tax Investor and At Risk Issues in Sandwich Lease

This kind of lease pass-through provides a special exception that allows the

Lessee to claim the ITC even though it is not the tax owner of the

property. For purposes of determining the amount of the ITC the lessee (the tax investor or the car driver) is deemed to be the purchaser of the leased assets with a tax basis equal to the “fair market value” (typically determined by appraisal). The developer/sponsor/lessor/car dealer can pass-through the ITC, but not depreciation or state tax

credits

50% of Tax Basis Income to the Tax Investor/Lessee

Apparetly the American congress determined that claiming the investment tax credit by the lessee/tax investors/car driver should come at a cost. In a typical transaction, that cost is the reduction of the basis of the eligible asset by half of the amount of the credit in the case of energy investment tax credits. However, that construct does not work when the lessor makes an election to pass through the investment tax credit to a lessee, as the lessee is not the owner of the asset and, therefore, has no basis in the tax credit-eligible asset. Thus, in the case of a pass-through lease, rather than reducing the basis of the asset by the full amount of the credit in a historic tax credit transaction (or half of the credit in an energy tax credit transaction), the lessee/tax investor/car driver includes the comparable amount in income pro rata over the depreciable life of the eligible asset.

Developer or Lessor does not reduce its tax basis, instead, Lessee who is the tax investor reports income equal to half of the ITC ratably over the 5 year recapture period (seems to be different than the recording of income in the capital accounts for the tax equity partnership).

The receipt of ITC usually results in a reduction in the depreciable basis equal to half of the ITC. Because the tax investor lessee has no depreciable asset, he reports income of that amount spread straight-line over the life of the corresponding asset, which is five years for solar assets. Since the lessee reports income equal to the required basis reduction, the sponsor/developer lessor depreciates the full value of the asset.

Some Terms of the Sandwitch Lease to Work With

In this section I try to create a hypothertical transaction with different lease terms to set-up as inputs to a financial model. The input include lease rates, a lease term. a potential buyout value, an early payment lease and a target IRR for the lessee/tax investor that includes the ITC at fair market value and the the effect of the ratable taxable income at 50%.

Credit Price — Lease Prepayment

The sponsor/developer enters into a lease passthrough with the tax investor (who can use the ITC). In addition to on-going lease payments, the tax investor/lessee pays an up-front payment. To make things confusing you can call this a credit price (I have no idea why). The amount that the tax investor pays the sponsor/developer as an up-front lease payment is usually in the range of 1.2 to 1.3 times the ITC and is referred to as the credit price.

Lease Tenor and Deriving the Lease Term

The PPA term is typically much longer than the sandwich/inverted lease lease term. For example a 30-year PPA with an 10-year lease. At the beginning of the lease, the tax investor lessee makes a prepayment of rent equal to the credit price (i.e. 1.2 to 1.3 time the ITC). For the remainder of the lease (e.g. 10 years), the tax investor receives the EBITDA, using a portion of this to make the lease payment to the developer and retaining the balance. The tax investor lessee of course requires a return on his investment. This could be expressed as a return on on his pre-tax cash flows including the ITC. According to one source, typical returns may be in the 2.00% to 3.00% range. This IRR can in turn be used to evaluate the on-going lease term.

Tax Aspects of Lease from Develoer/Lessor/Dealer Perspective

Developer/Sponsor – Lessor

• Deductions for depreciation

• Tax on rental income from master lease

Tax Equity Investor – Lessee

• Claims the ITC

• Income from host customer contracts

• Deductions for rent payments to Lessor

• Five year income inclusion equal to 50% of ITC. This is income not tax credit

Computing Lease Rate from After-tax IRR

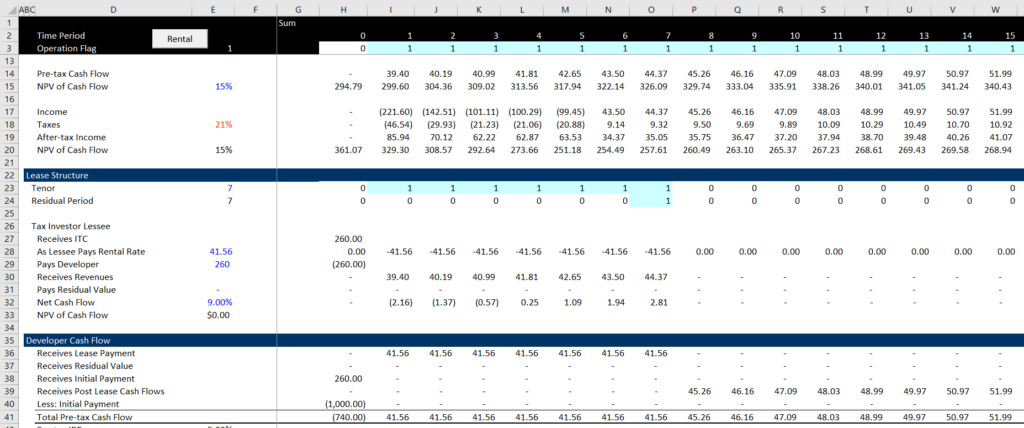

If you work through the cash flows including the realization of the ITC, the up-front lease payment made by the tax investor/lessee/driver of the car to the lessor, the term of the lease, the 50% basis adjustment and the receiving of the EBITDA over the term, you can easily derive a lease rate that produces an after-tax rate of return to the tax investor. This calculation is demonstrated screenshot below and I have included it in the file that I use to illustrate the process.

Financial Modelling of a Sandwich Lease

The economics for the lessor are different from a traditional lease since the lessor’s return is calculated over the longer PPA term. During the sandwich/inverted lease lease term, the lessor receives a portion of the EBITDA as rent, but from the end of the lease until the end of the PPA term the developer/sponsor/lessor/car dealer receives all the EBITDA. Because of a very large prepayment of rent equal to the credit price and rapid depreciation on the full basis of the asset, the developer/sponsor/dealer/lessor’s initial investment can be paid down quickly. As a result, these leases seldom include any borrowing and accounted for as direct leases.

The tax equity investor must have upside potential and downside risk to be considered a real lessee. Some tax counsel like to see a “merchant tail,” meaning a period after the customer agreements or power contract ends when the lessee is exposed to market risk on electricity sales. Others focus on the amount of prepaid rent paid by the lessee and want to see at least a 20% rent prepayment on the theory that the more skin the tax equity investor has in the game, the more likely the lease will be respected.

Inverted leases raise the least amount of tax equity. The central challenge in inverted leases is how the capital raised by the structure moves from the tax equity investor to the solar company.

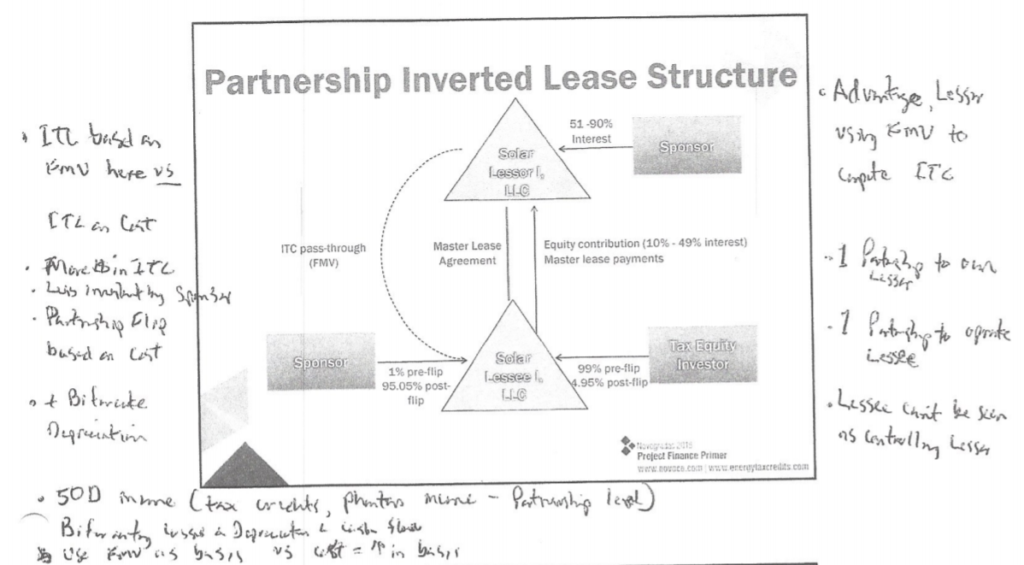

In the conservative form, the tax equity investor contributes the tax equity investment to a lessee partnership that is owned 1% by the solar company and 99% by the tax equity investor, and the capital contribution moves to the lessor (i.e., the solar company) as prepaid rent.

In an overlapping ownership structure, the tax equity investor makes a capital contribution to the lessee partnership, and the lessee partnership contributes it to a lessor partnership that is owned 51% by the solar company and 49% by the lessee partnership. This structure raises more tax equity because the tax equity investor claims not only the investment tax credit, but also 49% of the depreciation.

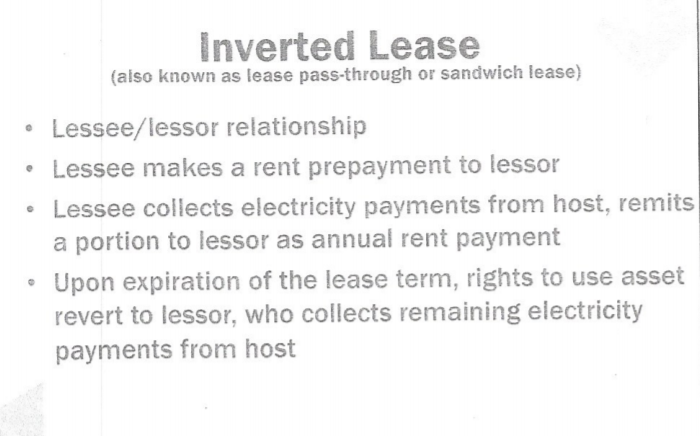

Inverted Lease (Lease Pass-Through)

In this case the tax equity investor acts as a lessee (paying the rental payment) rather than the lessor. This seems very confusing because it is as if the tax investor is the borrower and user of money rather than the lender. The tax investor pays rent to the sponsor/developer rather than just receiving cash distributions as with the typical partnership structure. But the tax investor receives revenue from selling electricity. The key is that the sponsor/developer is allowed to transfer the ITC to the tax investor who is not a lessee. This means that the tax investor is allowed to keep the ITC benefits and also the rental income. But the tax investor (lessee) makes a really big rental payment up-front. The developer/sponsor owns 100% of the asset.In this structure the tax investor never owns the asset.

The real problem with this method is that the tax investor does not get the accelerated depreciation. Unlike the normal leveraged lease, the sponsor/developer keeps a controlling interest in the project.

I summarize the inverted lease with bullet points below so you can better understand the modelling:

- The tax equity investor acts as a Lessee. He pays rental payments to the sponsor/developer who is now the lessor (like lending money).

- The tax investor pays rent to the sponsor/developer rather than receiving cash distributions.

- The tax investor receives revenue from selling electricity.

- The sponsor/developer is allowed to transfer the ITC to the tax investor who is not a lessee.

- Tax investor (lessee) makes a really big rental payment up-front to the developer — this is like buying the project.

- The developer/sponsor owns 100% of the asset.

- The tax investor does not get the accelerated depreciation. Unlike the normal leveraged lease, the sponsor/developer keeps a controlling interest in the project.

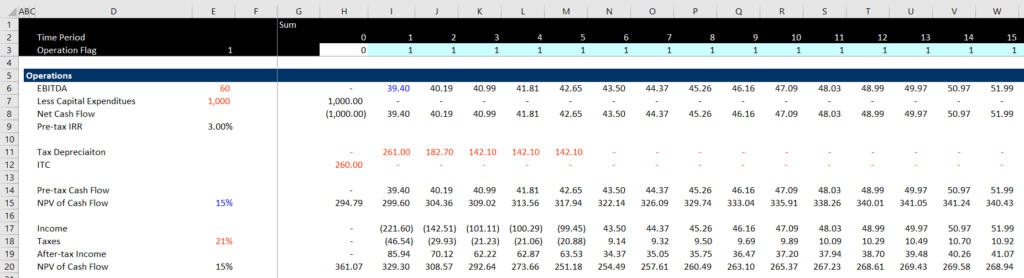

I have made a simple model that illustrates how an inverted lease could work. I begin with cash flows that generate a 3% pre-tax IRR with inflating cash flows as in the leveraged lease case. These cash flows that begin the analysis are repeated in the screenshot below.

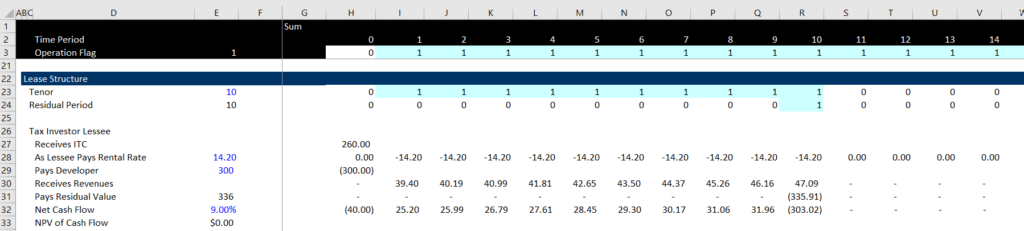

In the first case I assume that the up-front payment is equal to the ITC. I also assume that the lease term is 10 years and the tax investor lessee must pay a residual value. In this case I use the goal seek to obtain a NPV as with the other case. If you assume a different discount rate than the 9%, then the economics change to the developer.

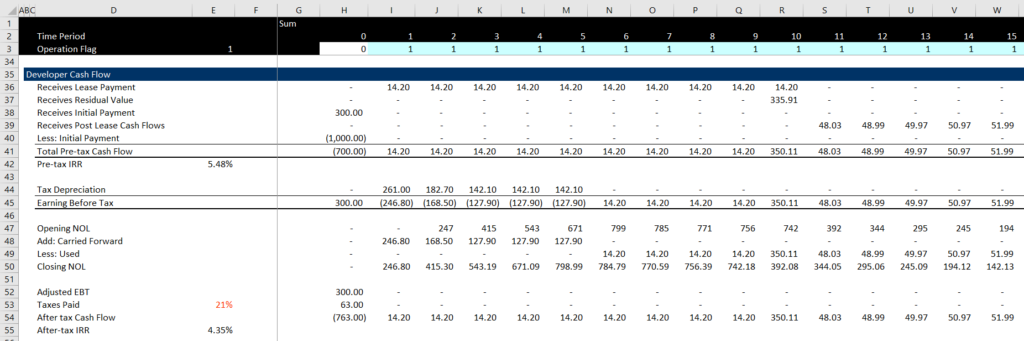

Now lets take the tax investor lessee and look at the developer/lessor. In this case the cash is received for the lease but the developer does not receive the operating cash flow. Recall that the developer/sponsor does get to deduct the accelerated depreciation. This developer perspective is illustrated in the screenshot below.

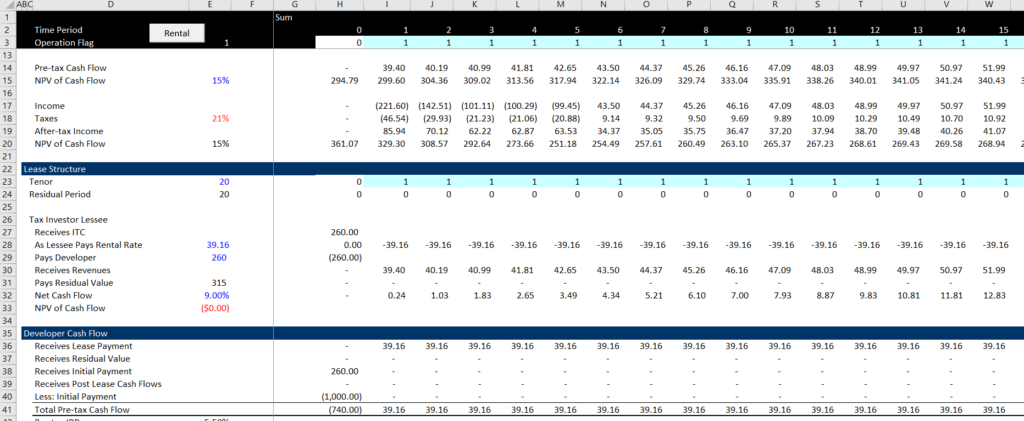

Now lets change a couple of things. The first screen shot is for a case with 20 year lease. In this case the lease rate is higher and close to the operating cash flow.

The final case is for 6 years and has no residual value.

The inverted lease is illustrated in confusing diagrams. In the diagram remember that the developer/sponsor is the lessor. The developer receives money from the tax investor as rental payments. Note that the ITC is passed from the developer to the lessor.

.

.

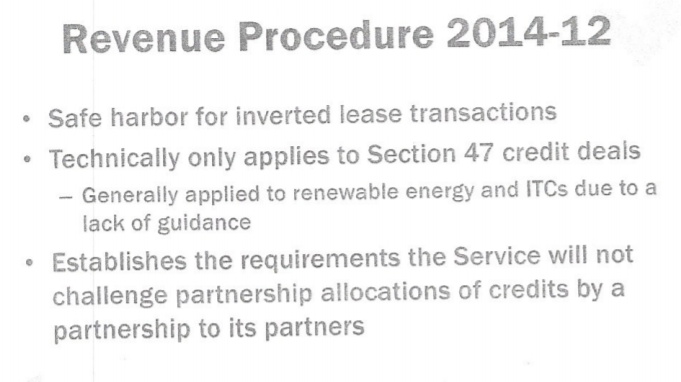

Note below that there is a safe harbor for the inverted lease transactions (I don’t know what section 47 credits are). The last point can be re-written that the IRS will not challenge allocations of ITC by a partnership LLC to the tax investor.

ITC based on the FMV of the project rather than the cost

Lessor (the developer/sponsor) using the FMV to capture the ITC

Some people believe the B.S. — one quote a publication called “North American Clean Energy”. A number of large corporate investors with tax appetite, known as “tax equity”, have consistently reduce the cost of project development by monetizing tax benefits that developers (“cash equity”) are unable to initially utilize. By passing on some of this benefit to the cash equity and by receiving some of the pre-tax cash from operations, tax equity can provide a project with much more favorable financing than traditional borrowing.