This page describes how to compute sculpted repayment where there are multiple debt issues; the amount of debt is fixed, the minimum DSCR is given in the term sheet. There is also a constraint that repayment is driven by the average life. I explain this issue and problem with a simple example and then address the process of sculpting multiple issues is demonstrated in the context of the parallel model concept. While the process of computing curved DSCR is complicated, the process of putting together different debt service for different issues is more simple than the case where the DSCR drives the amount of debt.

The two files that you can download below illustrate the process of sculpting multiple debt issues where the size of the debt is fixed with the debt to capital ratio, but the minimum DSCR and the average debt life are defined. The general process involves the following steps:

- Compute the sculpting with curved DSCR for debt issues that are not the final defined capture issue (the issue with the longest debt tenure). For this issue you may need a minimum to LLCR to DSCR because the ultimate minimum DSCR is only computed for the final capturing debt issue.

- For the capturing debt issue, compute the curved DSCR as explained on the associated page using the minimum DSCR and the other factors. But subtract the other debt service that is computed from this debt issue.

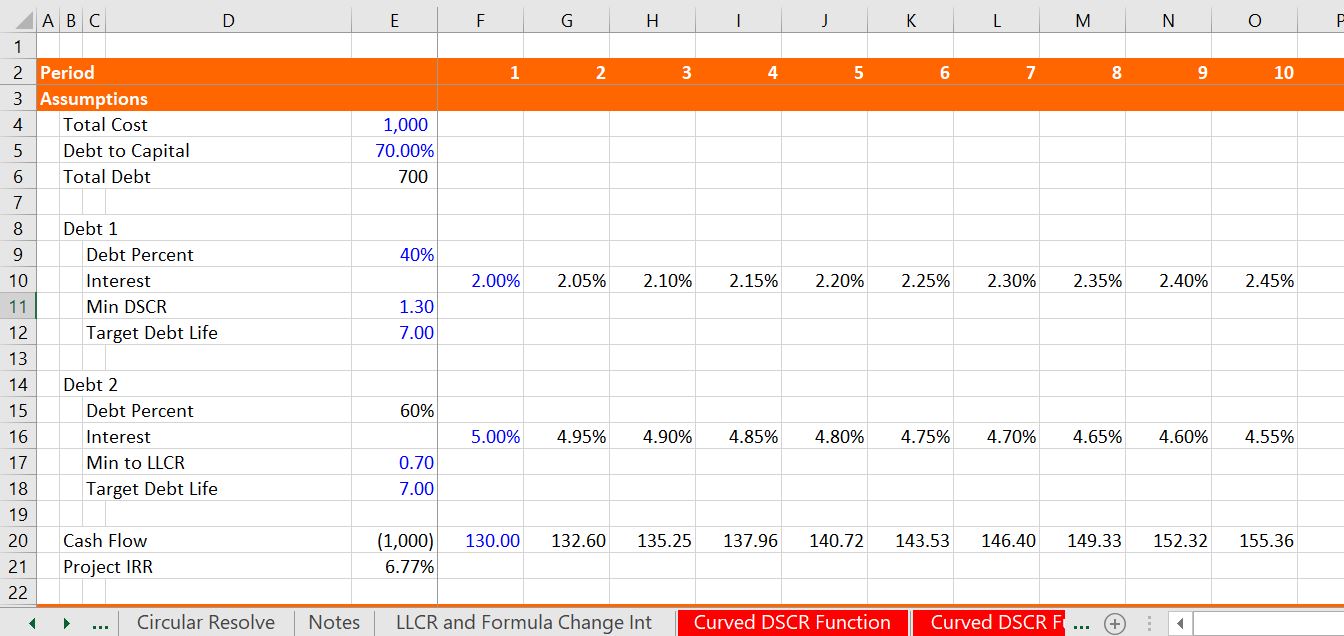

Simple Example

In the simple example, there are two debt issues with different interest rates as illustrated below. The first issue is the capturing debt issue.

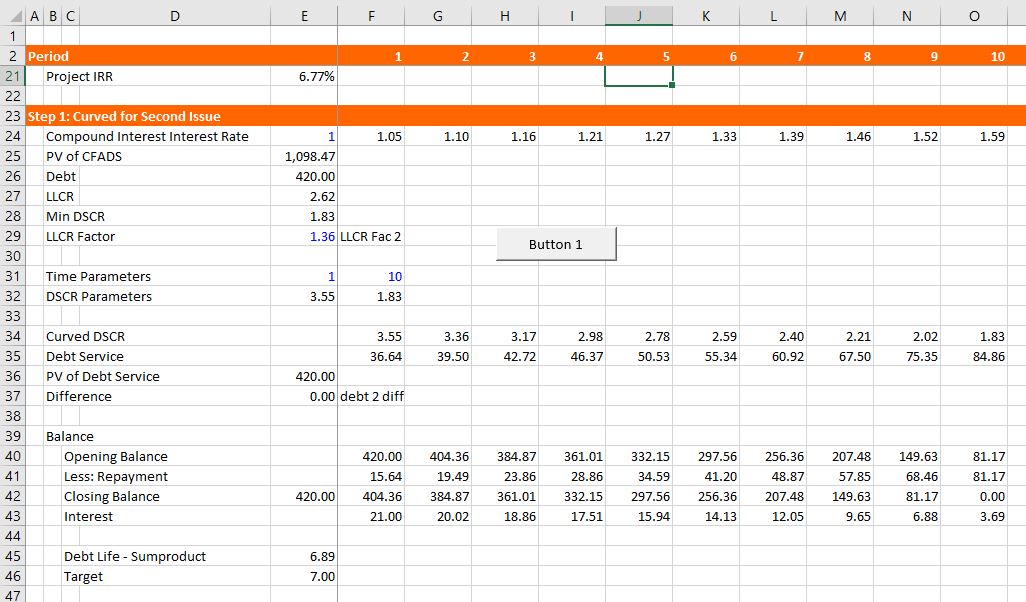

The next screenshot illustrates how to compute the non-captured debt issue with shorter tenures or that is defined as the non-capture debt issue.

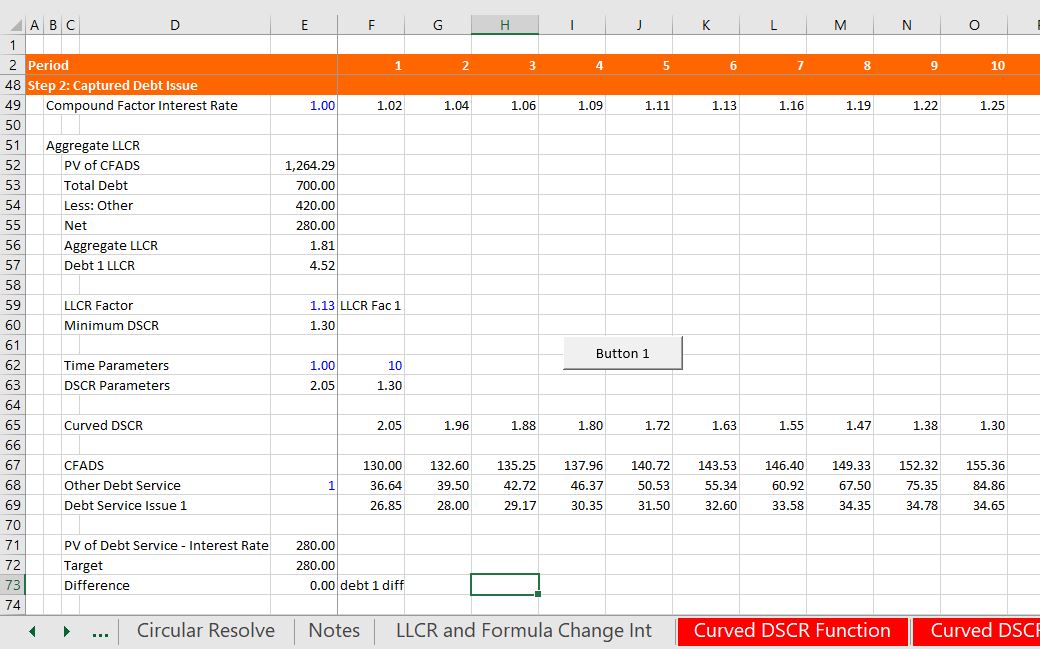

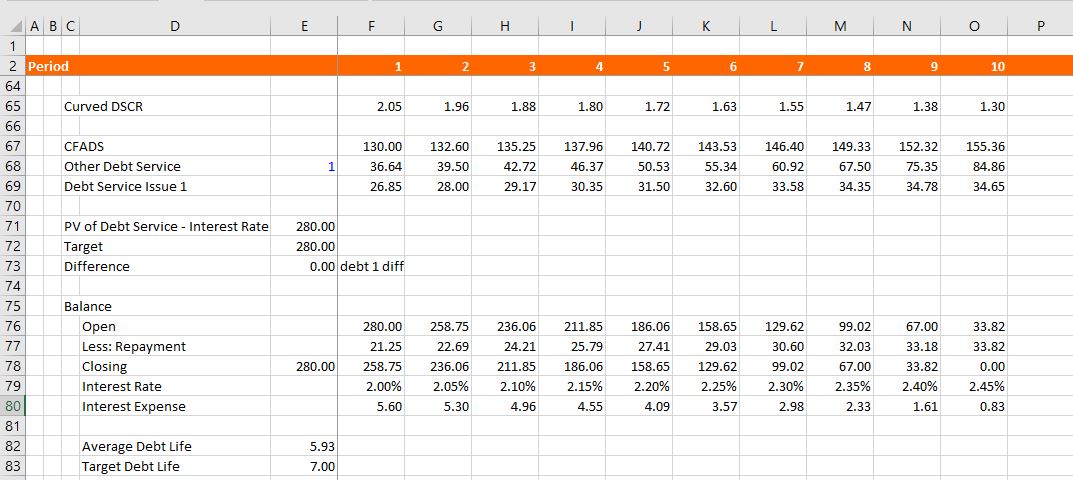

Next you can look at the capturing debt issue.