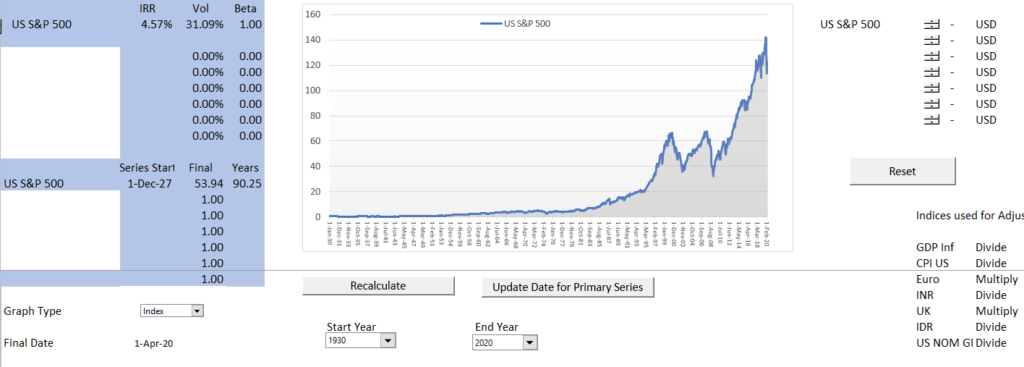

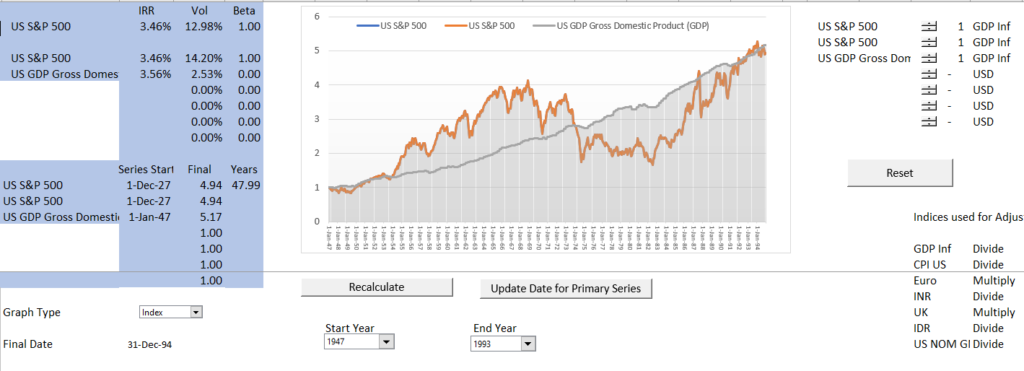

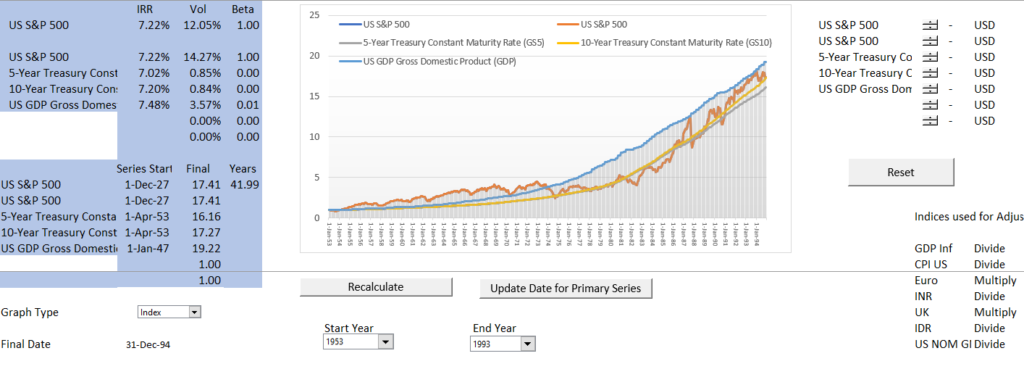

The first graph shows the IRR earned since 1930. Notice that the nominal IRR is 4.57%. If you take away inflation, the IRR since 1930 was ___. This is compared to the real GNP since ___.

Chapter 1: The Dabhol Project Financed Project and why Dr. Phalippou of Oxford and other academics labeling of IRR as Bull Shit is academic arrogance

Quote and how I teach the case.

Introduction to case and project finance versus finance. Why the MM theory does not apply to project finance.

I admire Merton Miller and the fact that his idea on the irrelevance of debt does not apply to project finance does not change my opinion of his ideas. His idea that you should focus on what a company really does rather than how it is financed. The quote of Yogi Berra that I am really hungry so I will divide the pizza into twelve instead of six pieces was his favourite quote. This idea that you should focus on the real economics can be applied all over finance. Not only should you apply this to debt and loan agreements, but to any contract. A contract does not change the fundamental economics, it only allocates costs. For the Dabhol case, the fundamental question is whether the plant made economic sense. If it makes sense, the contracts can allocate risks to different parties but not change the economic value. If the plant is bad for the country, a series of contracts cannot change that.

But Miller’s theory is violated in project finance because the debt is a test that verifies the project. It is like getting your passport stamped.

IRR versus ROI and weighted average ROIC.

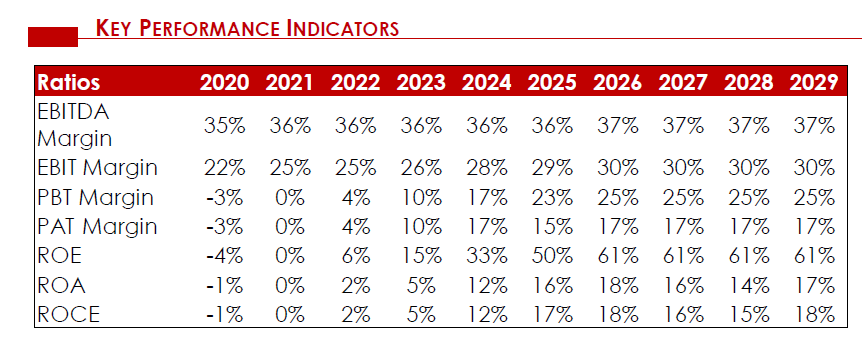

I received information about a project finance and the following statistics were presented. This would be the same as the Dabhol case. Not the return on capital employed begins as a negative number and then increases. This number which is essentially the same as the

Immediately go to end of the case and compute the project IRR and the equity IRR. Why these IRR’s are so important to understand the project.

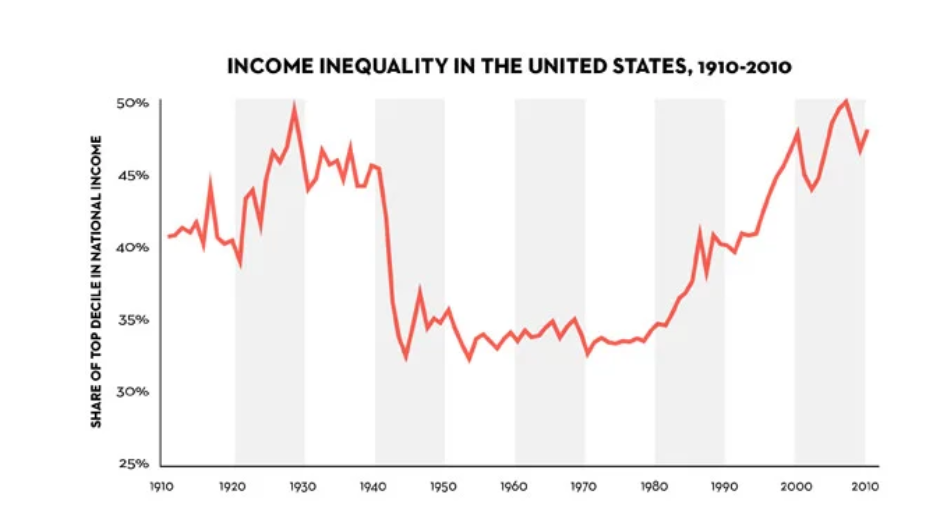

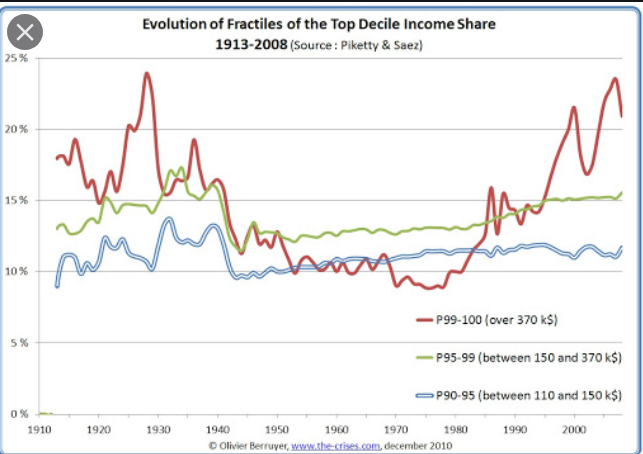

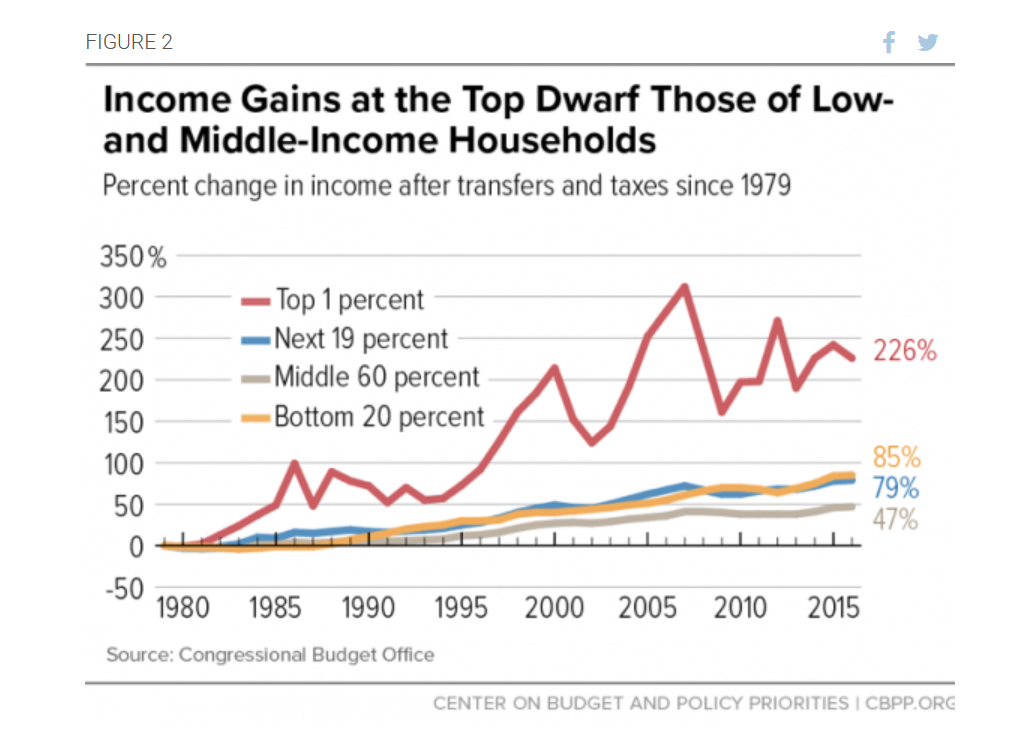

Biggest Variable in Finance – Real Return above Economic Growth. Philosophy and distribution of income. Come back to this.

Productivity and population growth. What happens when large payments made to foreign investors.

Project finance versus corporate finance

Changing risks. Irrelevance of WACC

Measurement of Value

Understanding probabilities and development costs

Creating a structure diagram

What is a reasonable return for the project, for equity investors and for debt providers?

Credit Spreads, probability and required return

Measurement of MIRR instead of IRR

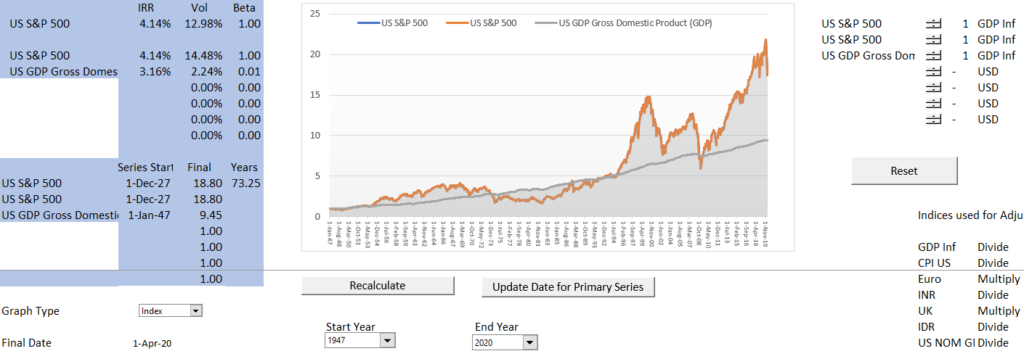

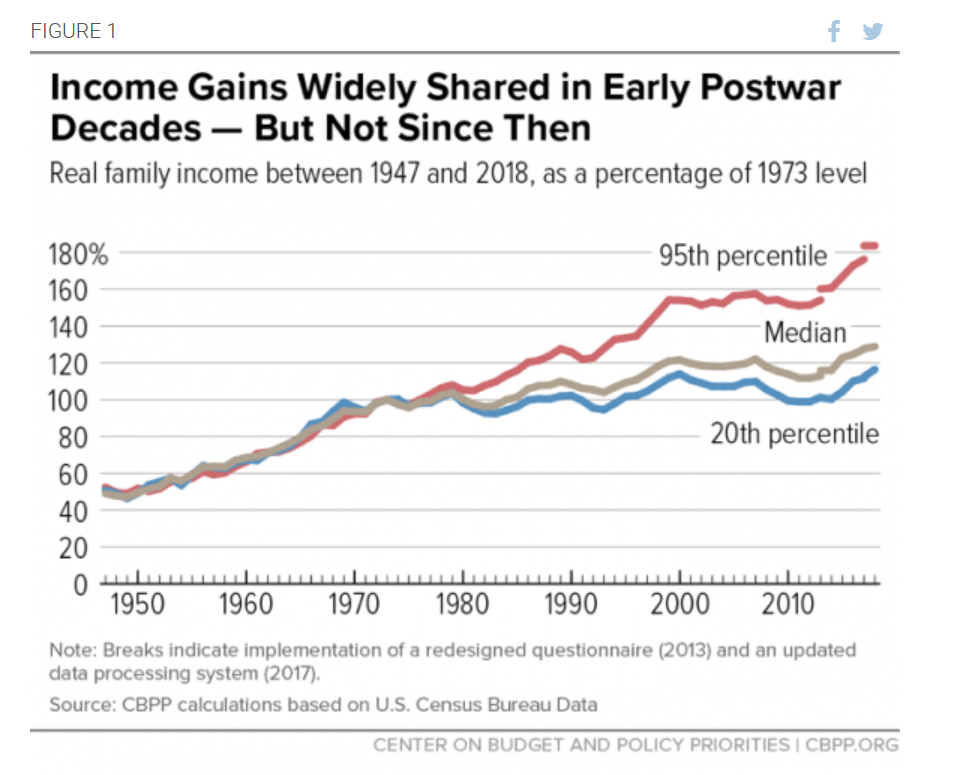

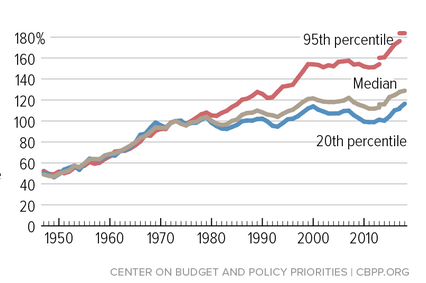

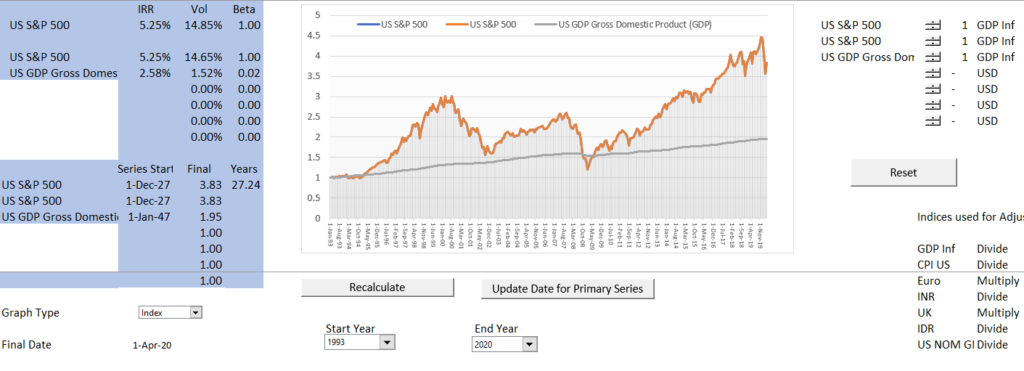

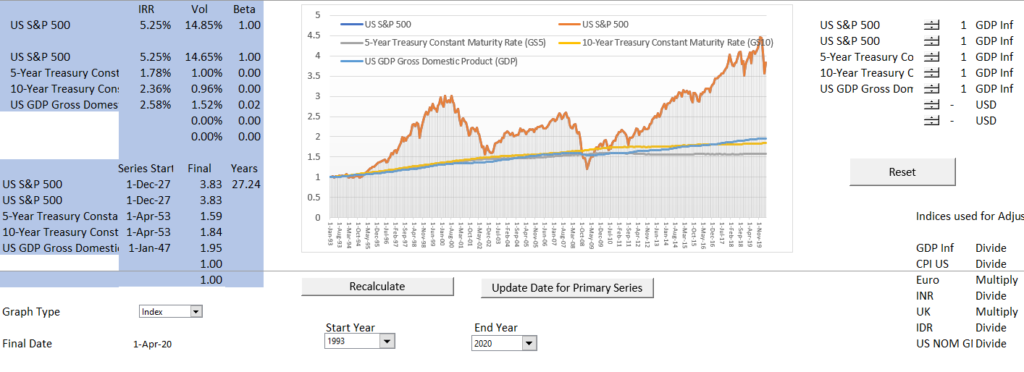

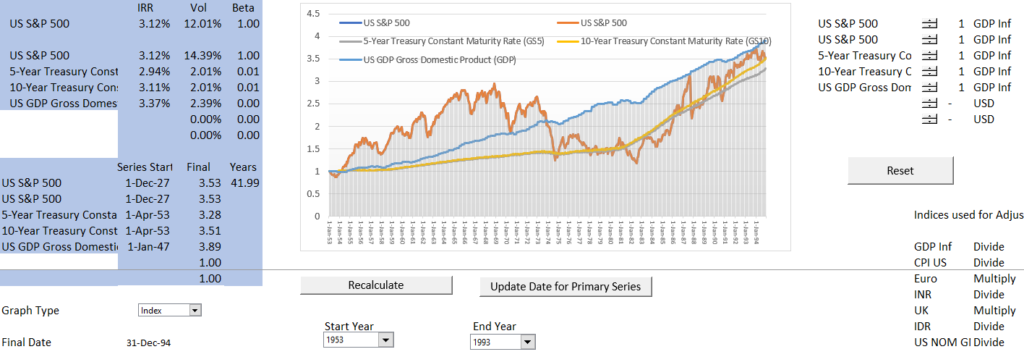

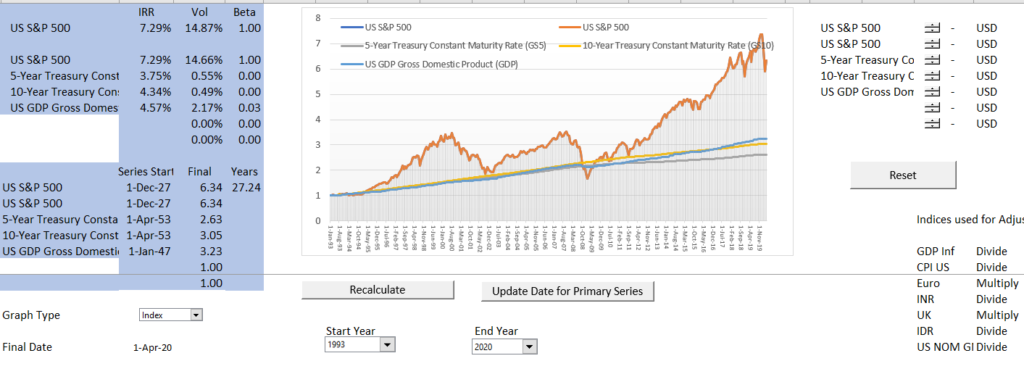

Notice from Figure 1.2 that IRR for stocks since was 4.14%, (not 8% that compares to the real GNP growth of 3.16%. Note that return on stocks did not exceed the

I have used 1993 as the split year. The first graph shows the GNP and the stock price from 1947 to 1993. The second graph shows the same graph after 1993.

Start in 1953 when the interest rate was published.

test

Introduction – Problems with Finance Theory and Practice

I have had stops and starts at writing this book for many years. When I began, I believed the Gods of finance like Merton Miller, Harry Markowitz, William Sharpe, Fisher Black, Myron Scholes and Eugene Fama (with the exception of Sharpe, all had a close association at some point in their lives with the University of Chicago). In the late 1970’s and 1980’s I was impressed by the elegance of Sharpe’s CAPM and I was anxious to understand how real bankers used the discounted cash flow model (I am showing my age). I wanted to become familiar with how investment bankers created a selection of comparable companies to determine the appropriate valuation multiple and how project finance professionals used sophisticated techniques to derive target values for the debt service coverage ratio and the equity internal rate of return. But after reading many articles and books; providing expert testimony on cost of capital in courtrooms; working as a banker; building innumerable financial models; living through financial crises; observing bull markets and low credit spreads; and, most of all meeting practitioners all around the world while teaching my courses, I have come to conclude that very much (not all) of finance theory either useless or incorrect.

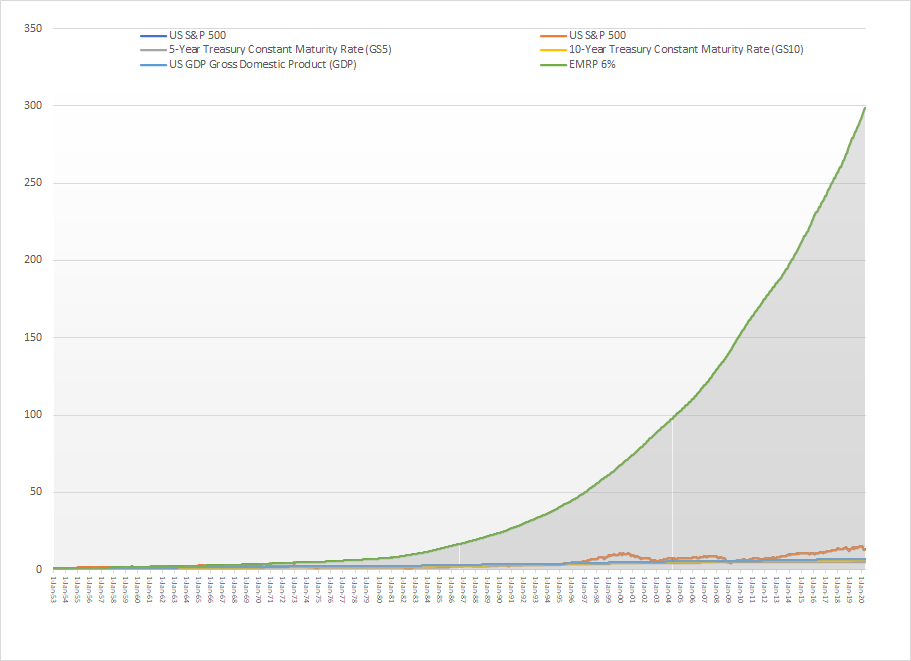

I am now brave enough to assert that the very foundations of finance are flawed (because I am old, I don’t work for a big bank anymore and have nothing to lose). I am also not shy about suggesting that financial ideas developed in business schools have led to social problems and aggravated difficulties faced by companies attempting to develop. For example, the idea that an equity market risk premium is anywhere near 6% is at its root an excuses for the rich getting richer (why shouldn’t poor schmuks working for the corporation and taking risks of being laid off get a big risk premium relative to economic growth). Some of the things that finance theory gets wrong include the assumption that equity is almost universally riskier than debt; that the cost of debt should be multiplied by one minus that tax rate in computing WACC; that terminal value calculations with continually growth rates and no careful stable assumptions typically used produce reasonable valuation; that country risk premiums should be applied to the cost of debt and equity capital for developing countries; that the McKinsey value driver formula [Value = Income x (1-Return/Growth)/(Cost of Capital – Growth) ] is useful or accurate; that companies earning high returns are good for society; that return on investment in practice can measure financial performance; that risk of a corporation or a project is stable over time; that it is possible to find a set of comparable companies for computing multiples in valuation; that you can apply standard cash flow analyses to investments with stages and gates that depend on probability; that adjustments for success probability cannot be incorporated in standard valuation; that asset beta can be computed by assuming a debt beta of zero; .

An example of the main things that I question, that the equity market risk premium is anywhere near 6%, is illustrated on Figure 1.1. In teaching my classes I sometimes ask students how fast your money would have grown if you invested in the overall equity market (I will show you that it is best to define the IRR as a growth rate). My students seem to have been taught somewhere along the line that 8% is about what you could have earned if you invested in the stock market. Perhaps this comes from the S&P 500 time series in yahoo.finance website which for me has been revolutionary. With this website you can scrape data and then compute returns for most stocks in the world. Better yet, you can combine it with data from the Federal Reserve Economic Database (FRED) and then evaluate real and nominal returns, compare stocks to economic series, adjust for exchange rates, and evaluate stock performance relative to commodity price movements. Perhaps the 8% comes from an equity market risk premium of about 6% with a risk free rate of about 6%. When you look at this more carefully,

Some parts of this book where I work through problems with finance theory are by necessity pretty detailed and somewhat archane. For example, I generally defend the use of IRR in evaluating financial performance compared to alternatives (like the MIRR and NPV) and demonstrate how you can reconcile the IRR and the ROI. I also try to reconcile the theory of finance with macro-economics to discuss the philosophy of cost of capital; country risk premium; credit spreads terminal growth and other issues. You may think that macro economics and GNP accounting is largely a waste of time and you may be correct. But to work through many financial issues, I have created relatively simple economic and financial model. I hope you will find these models that contain proofs of why a particular aspect of financial theory is incorrect easier to confirm than absurd and unnecessary equations with integrals that prove nothing other than the authors ability to make up equations. For example, the McKinsey Valuation book (including re-reading what I refer to as the famous McKinsey Valuation Book that some people refer to as the Valuation Bible [footnote] contains more than 800 pages that praise the virtues of earning monopoly profits demonstrated by the ability of earning a return above the cost of capital and asserts that very high returns are good for everybody including workers. The models I create try to demonstrate whether ideas such as this are correct. If you invest in every company in the world, and if profits from companies have the same long-run percentage of the GDP, your portfolio should grow in real terms at the same rate as the real GDP. More importantly, it should have about the same long-term risk that is associated with economic growth. Further there should be less risk of changing risk of inflation with your big portfolio than the risk of inflation in long-term bonds. This is the contribution of Harry Markowitz.

To make the ideas easier to understand and to make the I have decided to explain my conclusions with respect to finance practices and financial theory through discussion of case studies. I have unfortunately learned most things in my life through making mistakes (I am hoping with old age these learning experiences with decline or stabilize, but that does not seem to be happening). To demonstrate my ideas, I use case studies that can be considered failures. But these cases when they were written by finance professors at Harvard and other universities were not originally considered to be failures. For example, the case used in Chapter 1 was the Dabhol plant in India that was project financed by Enron, General Electric and Bechtel. Harvard students were initial taught how this international project with its structured contracts could solve problems of bringing much needed electricity and private enterprise to India. Even though the project initially earned the project of the year award (like an academy award), it was a spectacular failure. By working through project finance ideas how to really measure financial performance; how credit risk can be measured with credit spreads and the DSCR; contracts should be structured and other issues associated with finance theory, I suggest you can understand why this project failed.

In selecting case studies and discussing finance theory I use both project finance and corporate finance examples. Corporate finance is a typical course in masters programs and it is generally considered a separate subject from project finance. But I find that real understanding of corporate finance is not possible without understanding the economics of individual investments that make up the corporation. Indeed, a corporation can be considered a portfolio of projects that are consolidated. For example, if a corporation is investing in projects that are being developed, you cannot use the same performance criteria and financial ratios (the ROIC) as you can for a slow growing corporation with mature assets. You cannot really understand corporate finance without understanding the economics of separate investments that make up the corporation. To understand project finance it is also essential to understand corporate finance.

In Chapter 3 I discuss a case study presented in the McKinsey Book

Accepting some level of uncertainty is a natural part of just about any valuation process. Bankruptcies as well as dramatic changes in value do not necessarily imply bad decisions given available information at the time investment decisions were made. Some investments that went bad to be sure could have turned out to be very successful. The general idea of this book is not to suggest dramatic changes in valuation that deviated from initial expectations can be avoided, but it is rather to identify where faulty analysis and application of use of defective financial theories have resulted in massive losses or gains for debt and equity investors. Valuation errors that have resulted in inappropriate investments that are addressed in the book have not only had devastating implications for investors, they often have had devastating effects for the overall economic vitality of a region.

This book deals with a myriad of errors that occur in the debt and equity valuation of corporate finance and project finance investments. The ability to value assets and to assess risk of investments is vital for business managers who make decisions about borrowing or lending money, who invest in new projects, who acquire or sell companies, who sign contracts or who dispose assets. Without doubt, valuation and risk assessment are surely the two most important skills for any finance professional to master. The good news is that when gauging the value of anything — from factories, to debt or equity investments, to marriage contracts — the ultimate analytical problem can be boiled down to only two things. The first is forecasting your future net benefits, (measured in finance by prospective cash flows), and the second is assessing the risk associated with your projections. The bad news is that even though these two things are all that is at the root of any valuation problem and indeed are at the bottom of any subject in the study of finance, application of finance theory to real world investment decisions has been frustrating at best and just plain irrelevant at worst. To present valuation techniques that can improve real world investment analysis, subsequent chapters will delve into a variety of practical ideas and analytical models that project cash flows and assess risk.

Part 1 – Case Studies.pdf

My first book (not yet published) deals with valuation blunders both from a practical perspective and a theoretical perspective. The book addresses theoretical errors made in measuring country and/or political risk for equity and debt; in computing cost of capital from the CAPM and other methods; in using multiples for valuation; in evaluating return requirements for different capital structure; in applying the IRR to long-lived projects and interpreting high IRR’s; in attempting to implement real options; in creating time series equations with different volatility and mean reversion parameters and, most importantly, in developing sensible assumptions for financial models. The conceptual problems are discussed in the context of case studies where managers, analysts, bankers and other professionals make recurring errors.

Drafts of various sections from this book are included below.

Part 1 – Introduction and Case Studies of Valuation Nightmares

Part 1 reviews various case studies of valuation errors and identifies common threads that recur in valuation analysis related to assuming high levels of earned returns can continue without creating some kind of addiction to products; not understanding the exposure to high levels of fixed costs; making agressive assumptions without using simple benchmark analysis to verify them, relying on experts such as rating agencies, consultants and well renowned executives, believing that investments can earn economic returns because of alternaitve methods of modelling such as real options, not fully investigating the long-term prospects for fundamental assumptions through analysis of marginal cost and believing that earnings multiples or book value multiples can be sustained. The case studies are not intended to encompass all valuation errors. Many bankrupcies and value changes come from obselete products and inept and/or corrupt manangement. The case studies focus on investments and re-structuring including Iridium, Dahbol, Eurotunnel, Constellation Energy, Kitty Hawk Airlines, Quicksilver Resources (shale gas) and the California Electricity Crisis.

Case Studies

This chapter introduces three general frameworks to valuation and then describes a few case histories in which classic valuation mistakes were made by bankers, investors and other financial analysts. The case studies recount situations in which finance professionals either have used valuation techniques that did not adequately consider risks, or they misapplied valuation concepts and analytical models. Although some rather complicated models are presented and a bit of finance theory are discussed, the stories of valuation mistakes emphasize that better human judgment and intelligence with respect to very basic economic principles rather than increased sophistication in analytical techniques is the primary factor that could have avoided most of the valuation errors. The different valuation debacles an obvious but often neglected point that all of the sophisticated financial models, elaborate mathematical representations of risk, application of intricate finance theory and other analytical tools are irrelevant without being supplemented by a healthy dose of wisdom and business sense. Many learned the hard way that risks associated with lending money to a waitress in who puts no money down on a $500,000 house cannot be gauged by running thousands of simulations by a creditanalyst at Standard and Poor’s on the 50th floor of an office building in Manhattan.

The importance of benchmarking is emphasized and the necessity of developing bechmarks is emphasised (failure to benchmark). Examples include computing the capacity factor of a solar project, evaluating the return on investment in the context of historyand testing IRR.

Part 1 – Case Studies.pdf

Chapter 1.pdf

Chapter 1 Excel Models

Part 2 – Why the IRR does not Measure Value and Expropriation of Money from Developing Countries through Risk Assessment and Mistakes made in Applying Ideas from Science that do Not Belong in Financial Analysis

Part 2 of the book begins the analytical theoretical problems with the way project finance and corporate finance investments are evaluated. Expectations and measurement of IRR is the first issue addressed. Chapter 2 begins with discussion of the all pervasive IRR and why it has so many problems including: (1) not appropriately valuing long-term investments; (2) over penalising investments with so-called country risk; (3) not accounting for changes in risk over time; and (4) not directly measuring risk premiums. The chapter includes discussion of the philosophy of banking and the volatility of the value of investments versus volatility and potential changes in the value of cash flows. Trusting business plans and sales presentations versus real history. What it takes to get a stamp of approval from a bank or a market and why stamps of approval are so important.

Chapter 2 Page

Chapter 3 – Risk Assessment and Mistakes made in Applying Ideas from Science that do Not Belong in Financial Analysis

Chapter 3 addresses the philosophy of risk and general appraches to making forecasts for valuation analysis. The notion of being some kind of historian/statistician/fortune teller is the starting point of the analysis. The difference between fancy looking business plans and sales presentations versus real history provides is described in the context of renewable energy analysis. Chapter three addresses risk analysis in valuation by first presenting a variety of practical ways to directly measure risk using traditional sensitivity analysis, scenario analysis, break-even analysis and tornado diagrams. After describing judgmental approaches to risk analysis requiring judgment with respect to prospective economic variables, the remainder of the chapter focuses on use of time series models as the basis for mathematical quantification of risk – equations developed from statistical parameters such as volatility, mean reversion, price boundaries, industry productivity trends, correlation between variables and jump processes. Development of time series equations as part of the valuation process can appear very attractive because the equations can be used to compute statistics such as value at risk, probability distribution of equity returns and minimum required credit spreads. The discussion notes that while time series models can become addictive in seeming to provide answers to many financial problems such as deriving the probability of achieving returns for assets with different risk characteristics, the mathematical techniques can also be useless if statistics are used without explicitly considering the economic fundamentals that underlie the mathematical equations. Because of problems with application of historic data in construction of time series model parameters, the chapter explains how to construct time series equations using economic theory together with business judgment that allows for dramatic deviations between historic statistical data and prospective distributions.

Chapter 3.pdf

Chapter 4 – Attempts to Quantify Risk using Cost of Captial and Distortions in the Capital Asset Pricing Model

Chapter four moves to the question of converting risk into value. The discussion covers various different investment valuation techniques that compute the value of an investment given the riskiness of cash flows. Different approaches that apply the theory of finance, that use financial market data, and that extend option pricing theory to measure risk are presented. The chapter begins by reviewing traditional discounted free cash flow and cost of capital analysis. This demonstrates that the typical discounted cash flow techniques taught in business schools fail when it comes to most practical investment decisions. Next, an alternative way to translate cash flow risk into value is described which uses debt capacity to evaluate equity returns. The information source for the debt capacity analysis is financial criteria from bankers and credit rating agencies in asset and equity valuation. Because bankers and credit rating analysts are people who supposedly measure risk and to quantify the overall risk of an investment, valuation techniques derived from debt capacity should be superior to theoretical analyses using the capital asset pricing model which is founded on un-measurable parameters and is subject to bias. That is as long as bankers are doing their job. In fact, bankers and credit rating agencies have not had a stellar record in assessing risk. Because of this, a third method of translating cash flow into value is introduced that uses synthetic debt capacity measurement and time series analysis. This method simulates the theoretical debt capacity of a project through evaluating the probability of default and loss given default derived from time series parameters and Monte Carlo simulation. Once the theoretical debt capacity is established, the value of an investment can be derived through establishing a minimum rate of return as with the method that uses benchmark ratios from bankers and credit rating agencies.

Chapter 4.pdf

Chapter 4 Excel Models

Chapter 5 – Inappropriate Attempts to Overstate Value using Real Options in Valuation

Chapter five considers the question of whether option pricing models can realistically be applied to real world capital investment and budgeting decisions. This is not the perfunctory option modelling chapter that seems to be part of any finance text these days. In working through the question of whether option models are really useful, emphasis is placed on practical issues involving the lack of the ability to hedge, mean reversion in cash flow, undefined exercise prices and required management action. These factors create a large gap between plugging in option pricing formulas and applying option theory in a practical manner to measure the value of real investments. The practical issues are illustrated using real options to delay development of an investment, cancel construction of a plant, cease operation, mothball and retire a plant by using different volatility, mean reversion, price boundary and correlation parameters. Monte Carlo analysis that accounts for the mean reversion and the specific operation of plants are compared to option models such as the Black-Scholes equation. At the end of the chapter, option concepts are applied to measurement of the value associated with a company being the “provider of last resort” where long-term capacity contracts exist along side customer options to switch suppliers when market prices fall.

Chapter 5.pdf

Chapter 6 – Multiples, Terminal Value and DCF Complexities

Chapter six describes practical [[#|application]] of valuation analysis using multiples such as the price to earnings (P/E) ratio and the enterprise value to the EBITDA (EV/EBITDA) ratio as well as detailed issues associated with the discounted cash flow model. This chapter is not like a typical textbook treatment of discounted cash flow analysis that describes how to compute free cash flow and then add the terminal value and discount the cash flow at the WACC. Instead, the chapter explains theoretical and simple mathematical flaws in the way simple weighting of debt and equity is computed in the WACC; it describes flaws in how betas are un-levered and then re-levered and it explains why the cost of equity does not necessarily increase for highly leveraged companies due to call option characteristics of equity capital. The chapter explains how to establish drivers that explain why a P/E ratio, an EV/EBITDA ratio or a market to book ratio should be at a given level. Finally the chapter bridges the very wide gap between theory and practice in applying the discounted cash flow model. Real world problems addressed include determining stable relationships between depreciation and capital expenditures, treatment of deferred taxes and long-run estimates of changes in deferred taxes, consistency between working capital changes and growth rates, use of multiples in computing terminal values and other issues.

Chapter 6.pdf

Chapter 7 – Development of Long-term and Short-term Price Forecasts in Valuation Analysis

Whether it be through government support, contracts developed by lawyers who charge thousands of dollars per hour, through advertising that creates addictions to products, the assumption that prices can remain above the cost of production for an industry is a dangerous way to make long-term projections. Part 7 explains how to evaluate supply curves and the cost of production in an objective manner. The discussion begins with explanation of how companies desire to explain how they have unique advantages that enable them to maintain prices above the cost of production and earn returns higher than their cost of captial. Examples where earned returns are very high including the cable industry are described.

Chapter 7.pdf