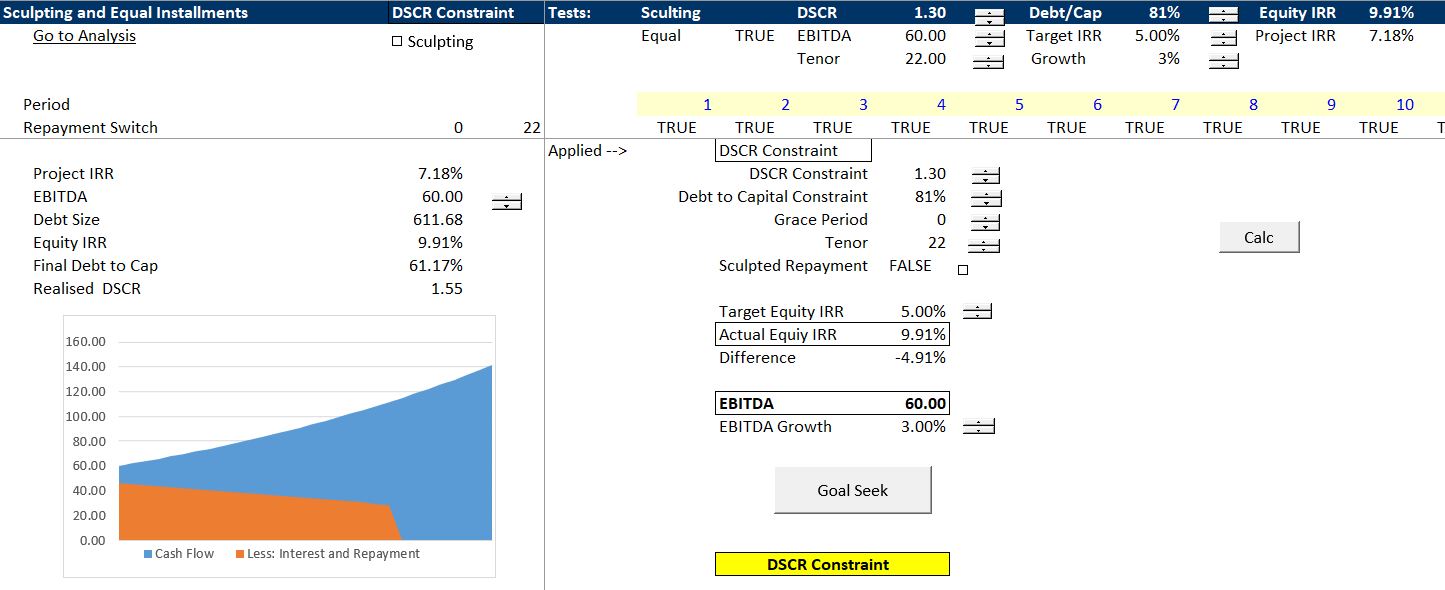

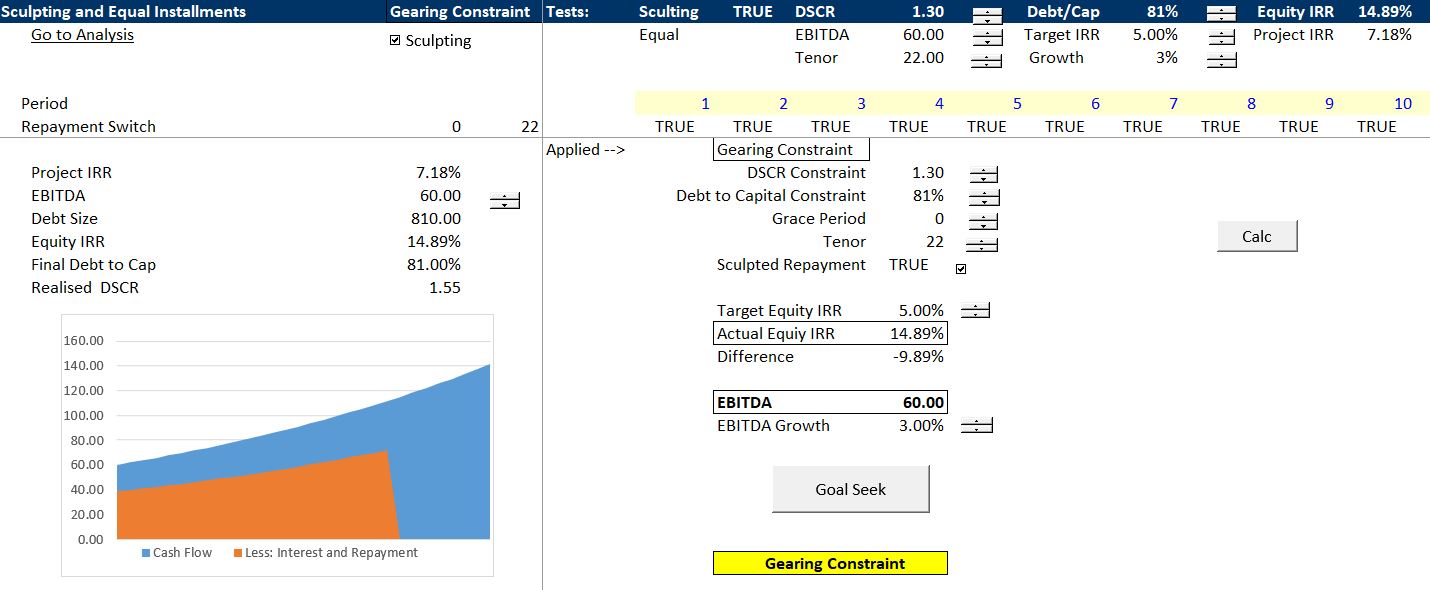

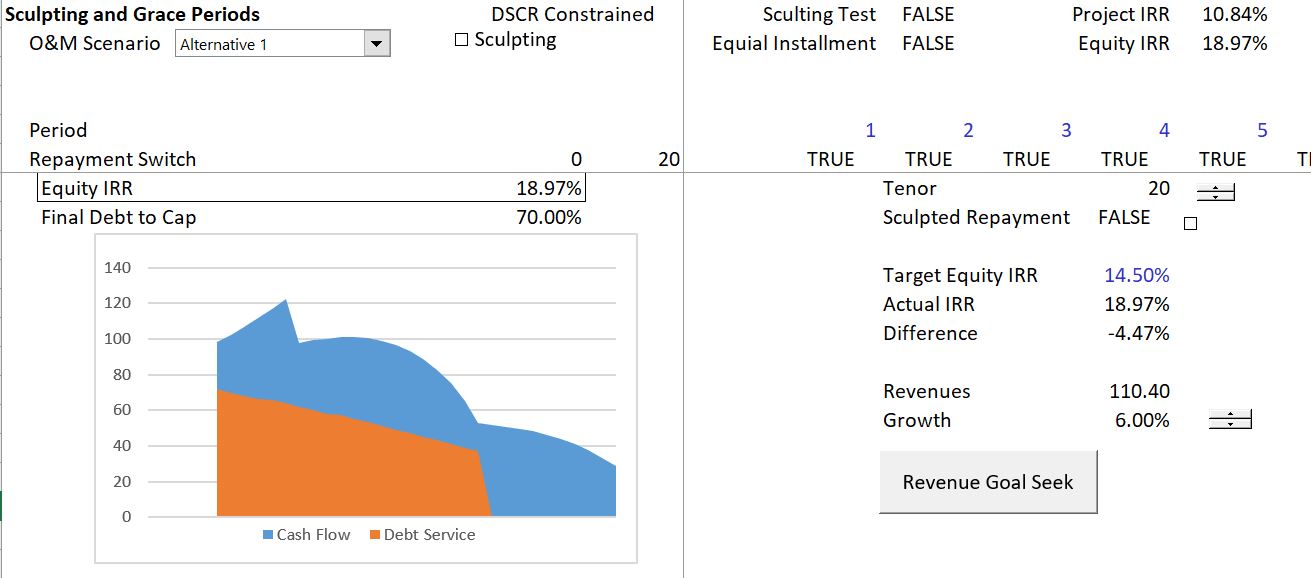

Depending on whether the debt to capital or DSCR constraint is the determinant of debt size, sculpting can make a big difference to equity returns or it may not be a very big deal. In particular, if level repayments are causing the DSCR constraint to determine the amount of debt, sculpting can move from the DSCR constraint back to the debt to capital constraint. This is illustrated in the two excerpts below that were presented in the webpage discussing sculpting in general. In the first case with level payments, the DSCR is limiting the amount of the debt. When sculpting is used for repayment, the debt to capital is the constraint and a lot more debt can be issued. The first excerpt shows the DSCR constraint with a 1.30 constraint and level repayment. The second excerpt shows the amount of debt that can be raised with 81% debt to capital constraint. In the hypothetical example, the IRR is a lot higher in the second case.

In Brazil, the BNDES provides lower interest rates and long tenures than you can find anywhere else. But BNDES requires level debt repayments rather sculpting. This causes the DSCR to be a constraint and can limit the debt to capital to a relatively low level.

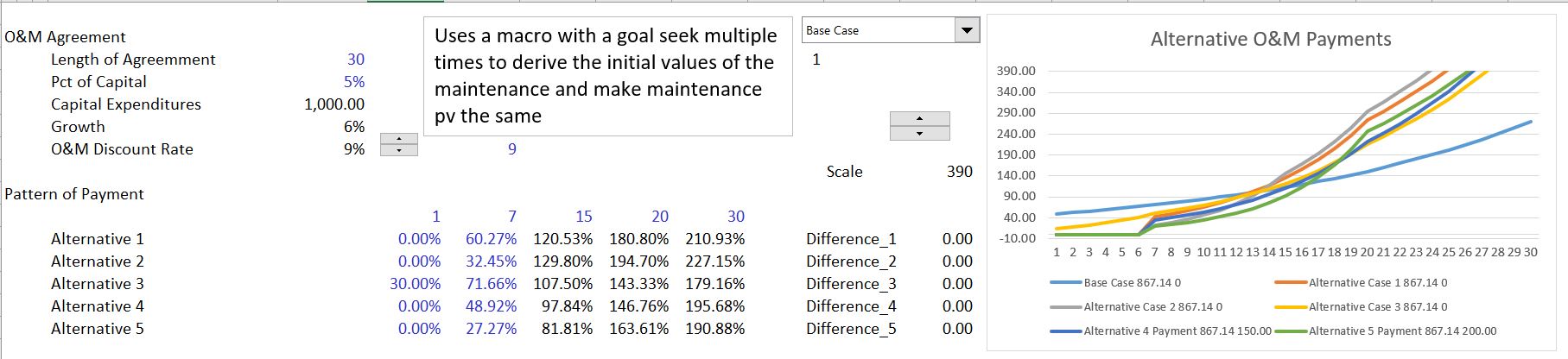

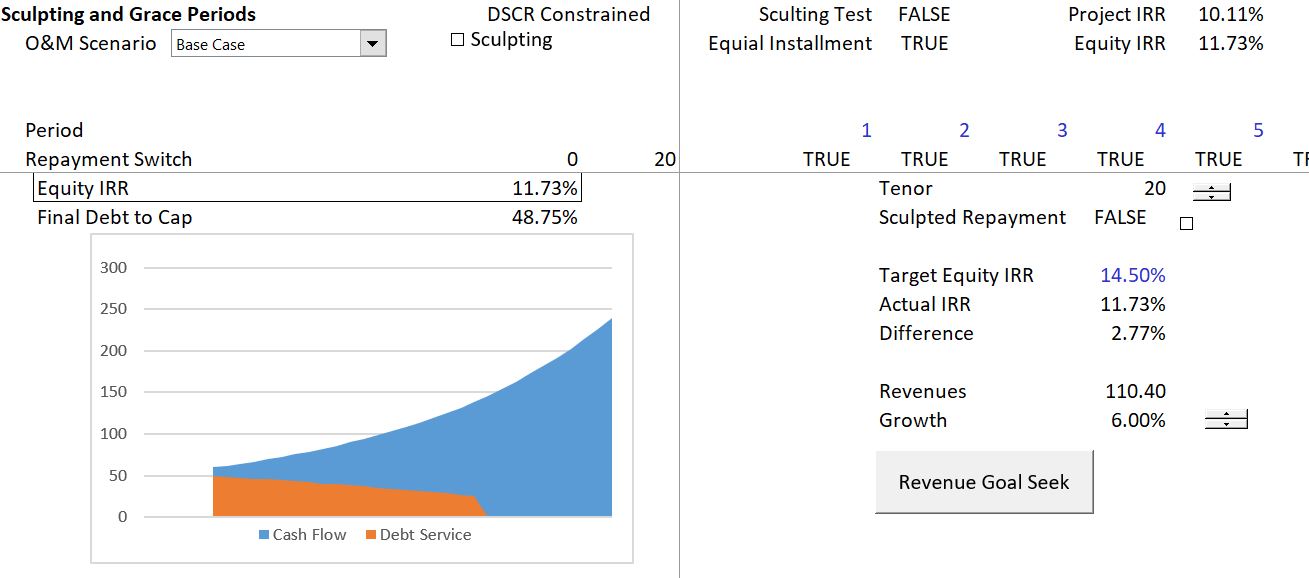

One alternative to addressing this issue is to re-structure the O&M contract so that the payments are low in the early years and increase thereafter. This is the reverse of the repayment structure of the debt and can result in cash flows that look like they are sculpted to revenues.

File with Exercise that Evaluates Different O&M Payment Structures

Exercise to Evaluate Alternative Repayment Structures for O&M Expenses to Affect DSCR and Debt Size

The file below is a project model for a representative wind farm in Brazil. It includes financing techniques that are associated with BNDES lending that do not correspond to the tariff structure. I call some of the adjustments made to O&M contracts in this reverse sculpting. This happens because the debt structure is given and the cash flows are adjusted to correspond to the financing rather than the other way around. The file includes functions that resolve circular references associated with financing and the file also demonstrates the modelling of an Equity Bridge Loan during the financing period.

Brazil BNDES Structure.xlsm

The file and the video below illustrate how this notion of reverse sculpting can affect returns and increase the debt capacity.

Taxes and Delay in Project Finance Model

Audit Tests and Audit Page

DSCR, LLCR and PLCR