Edward Bodmer – Project and Corporate Finance

Resolving BS in Project Finance

I have listed my course schedule below. I have tried to show you the courses over an extended period so you can work with your company and request approval for the courses. As long as I receive a couple of registrations I will run the class. If you would like different times, I may be able to manage this. You can click on the adjacent button to see how I have tried to run the courses.

While I teach a variety of subjects, there is a common theme to all of them and I use a similar teaching approach. I hope all the classes are very practical and they encourage you to be creative rather than to apply magic potion formulas from business school or using bureaucratic Blah Blah Blah from companies that teach you their so called “best practices.” So that you get some hands on experience, you the participants share the screen and work through the technical exercises.

If you need any help with approval from your company or if you have any questions or suggestions about the courses please send an email to me at edwardbodmer@gmail.com.

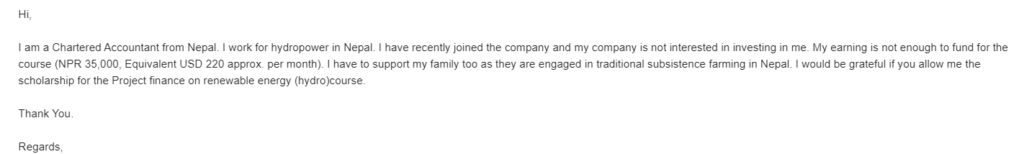

Click on This Button for Form to Receive Comprehensive Google Drive with My Excel Files Organised, My Collection of Articles, Case Studies I Use, My Course Slides, Examples of Contracts and Other Information …….. Click on This Button for Information on How to Apply for a Scholarship and Options for Receiving Discounts if you Sign-up for Multiple Different Courses. You can also Send me an Email at edwardbodmer@gmail.com with Questions

| Course/Webinar | Sessions | Time per Session (Hours) | Start_Date for the Course | Days per Week From First Day | Course Time London | Course Time Paris | Course Time Shanghi | Course Time in New York | Max Partip | Price (USD) | Book a Place | Outline |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Project Finance A-Z Modelling and Consolidation | Sat, Sun, Sat | 3 Hours | 7-8 and 14 May | Sat and Sun | 1:00 PM | 2:00 PM | 8:00 PM | 8:00 AM | 15 | $250.00 | Book a Place | View Outline |

| Hydrogen Analyis | Three Sessions | 3 Hours | 3, 6, 10 June | F,M,F | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 20 | $300.00 | Book a Place | View Outline |

| Financial Modelling of Tax Equity | Three Sessions | 3 Hours | July 2022 | Book a Place | View Outline | |||||||

| M&A Valuation and Modelling | 5 | 3.5 Hours | M,T, W, Th, F | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 15 | $300.00 | Book a Place | View Outline | |

| Project Finance Analysis and Case Studies | 5 | 4 Hours | Later in 2022 | M,T, W, Th, F | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 20 | $300.00 | Book a Place | View Outline |

| Risk Analysis with Models | 5 | 2 Hours | Later in 2022 | M,T, W, Th, F | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 20 | $300.00 | Book a Place | View Outline |

| Merchant Prices and Electricity Economics | 4 | 2 Hours | M,T, W, Th | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 10 | $300.00 | Book a Place | View Outline | |

| Hydrogen Economic Analysis | 2 | 2 Hours | Later in 2022 | 13:00 | 15:00 | 9:00 PM | 9:00 AM | |||||

| Reserve Based Loans and Monte Carlo | 4 | 4 Hours | TBD | M,Tu,W,Th | ||||||||

| PF Pain Ponts Webinar and Parallel Model | 13:00 | 15:00 | 9:00 PM | 9:00 AM | 6 | Book a Place | View Outline |

Renewable Energy and Storage Course

The outline is kind of dry and follows some of the standard kind of stuff you may get with a course. Some of the real highlights of the course include:

- Seeing how to measure the cost of storage combined with solar and wind the see what kind of parameters can make storage economic.

- Understanding levelised cost calculations and assuring that you focus on the real drivers of value and that you are never intimidated to make your own calculations.

- Becoming comfortable with debt terms and financial models without working through every little detail.

- Being able to read and interpret a resource study and understand the uncertainties that are driven by things that mean revert and things that do not mean revert.

- Evaluating hydrogen and biomass projects with more components than other renewable energy courses.

Project Finance Modelling Course

The outline has a different title than project finance modelling, but this is the subject. Some of the key things that I really hope you get out of the course include:

- Seeing that modelling is a creative process and that applying some sort to bureaucratic rules is not the way to go.

- Understanding how to apply a modelling philosophy where you will make your models completely transparent and easy for users to understand, trace and revise.

- Becoming comfortable with some of the more complex issues in project modelling related to debt structuring and taxes.

- Being able to understand the financial concepts that are the foundation for financial model including changing risk over time, the real meaning of IRR, how banker think about debt capacity and so forth.

- Using tools that can make your work much more efficient.