This page includes files and videos for a course on tax equity modelling. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield based flip. In subsequent exercises, the constraints on tax deductions from analysis calculation of the inside and the outside basis for each partner. The files that are documented on this page include discussion of the IRA and the standard ways of financing including back leverage and project finance at the company that owns the partnership. Other issues covered include the important timing of operations that are probably monthly and then go to quarterly timing for tax analysis. The tests for partner capital are made on an annual basis and the debt may be repaid on a semi-annual basis. The key is to have detailed monthly analysis that can be summed and no go the other way where you extract monthly from aggregated data.

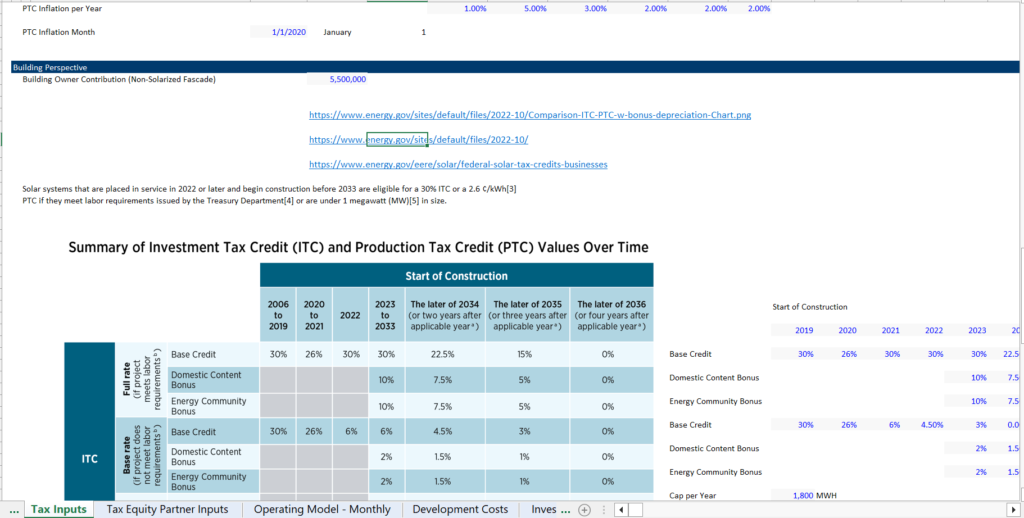

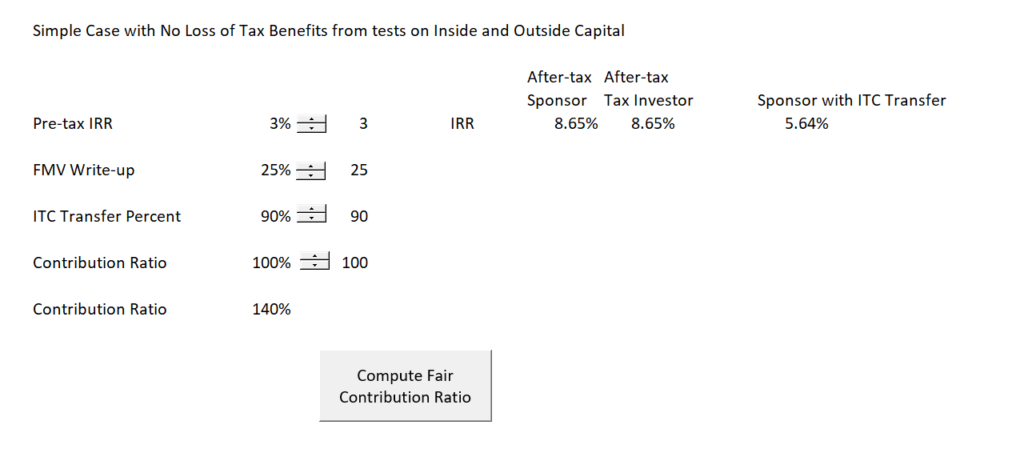

The three files below are examples with tax equity issues and the IRA. Some of the IRA issues include (1) computing different ITC rates for different types of projects; (2) evaluating the effect of the ITC transfer; evaluating the effect of ITC and PTC. If you set-up a simple model, you can see how these things work. The first file is a comprehensive example using different types of projects with data for the different ITC rates. The second file is a very simple (and I hope effective) example that shows how key parameters affect the economics of direct transfer of ITC versus setting up a partnership with a tax equity investor.

.

.

.

.

.

A screen shot summarizing the simple model is shown below.

.

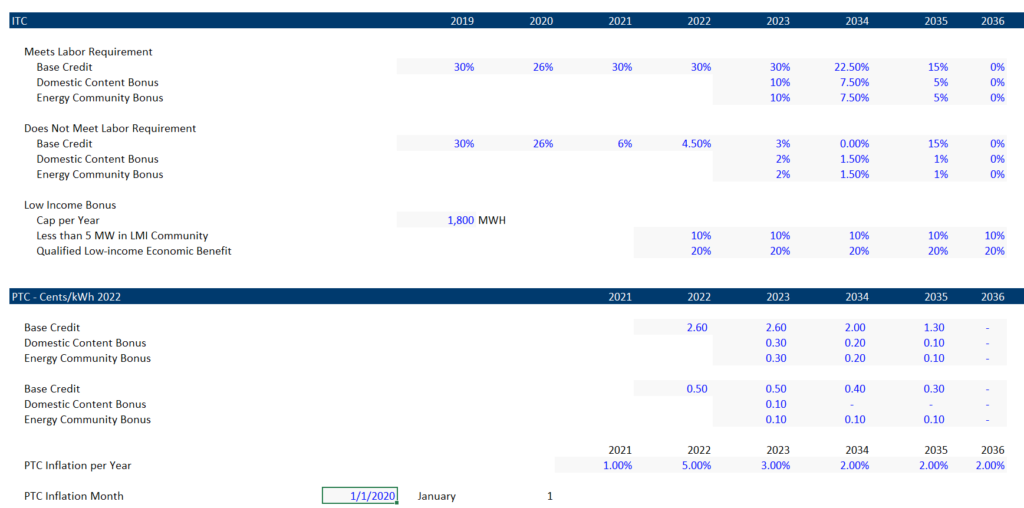

This page also discusses the IRA (not the Irish Republican Army, but the Inflation Reduction Act). Provisions of the act allow different Investment Tax Credit or Production Tax Credit depending on various factors such as fair labour practices and whether the project is in a low income area. The act also allows direct transfer of the Investment Tax Credit to an Investor. In this page I demonstrate a model that simulates various provisions of the IRA in the context of energy efficiency programs. In addition to the provisions for possibilities of very high investment tax credit, complexities of tax equity transactions still exist. I have worked on a model that includes IRA provisions and I describe the IRA model on this page. I have made the model in the context of a energy efficiency investments, but the model can be used for other investments.

.

Videos and Exercise Files from Annual Case without Capital Constraint

.

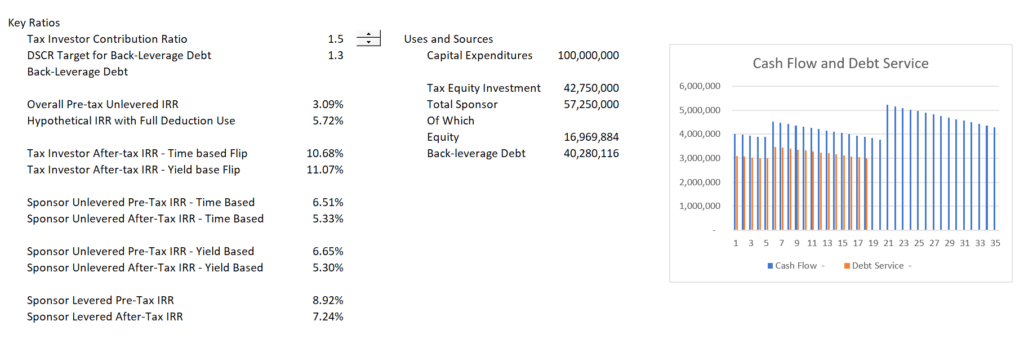

I have made the first exercise for a case that was assigned as part of an interview process. The case requires you to make some tax calculations, allocate the income and cash flow and then to compute back leverage. The case also has both a time based flip criteria and a yield based flip criteria. The two buttons below include the blank case and also the completed case that is worked through in the videos below. Simple Output from the model is shown in the screenshot below.

.

.

This first video works through how to set-up the model and compute the fundamental tax data including tax depreciation with the basis effect of ITC and the Modified Accelerated Recovery System depreciation rates. The case includes an adjustment in the capital cost for costs that qualify. The case does not include a fair value write-up.

.

.

.

.

.

The financial model with the IRA is attached the the button below.

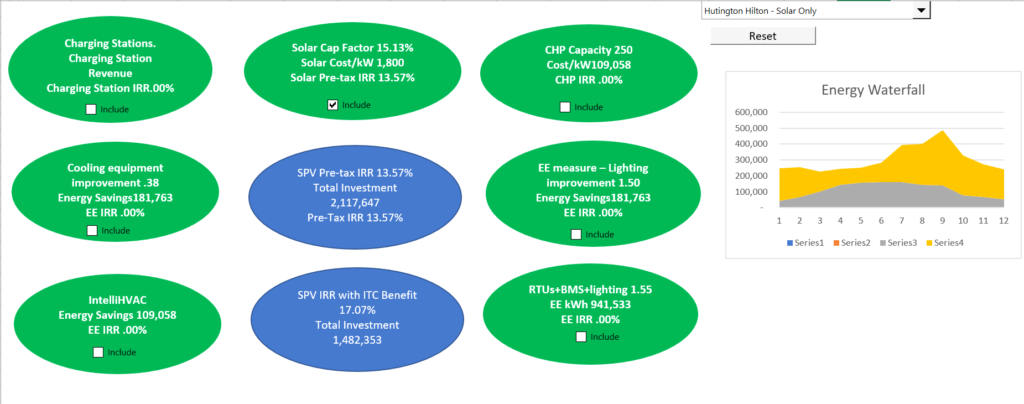

Economics of Energy Efficiency Programs

.

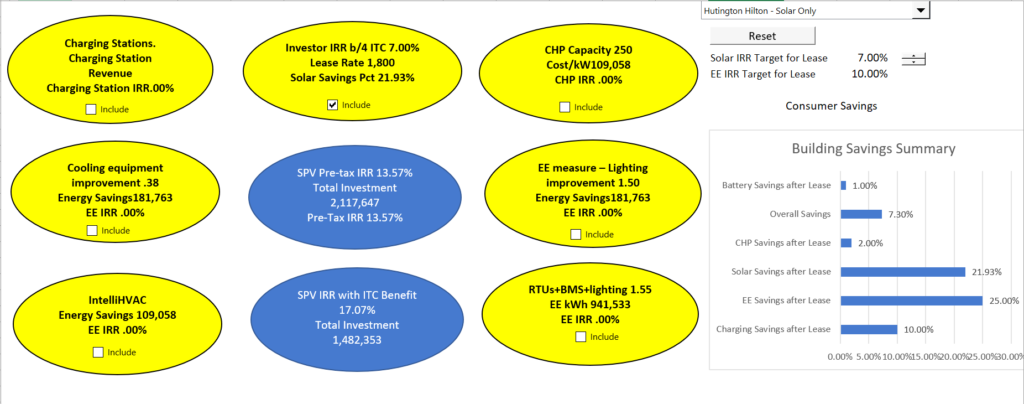

Note how you can input different programs and evaluate the economic return. You can use the check boxes to turn the programs on and off.

.

.

Allocation Issues in Energy Efficiency and Tax Equity

There are a whole lot of issues in making allocations. The first is the allocation between the investor in the energy efficiency programs and the owner of the facility. This is done with some PMT functions.

.

.

.

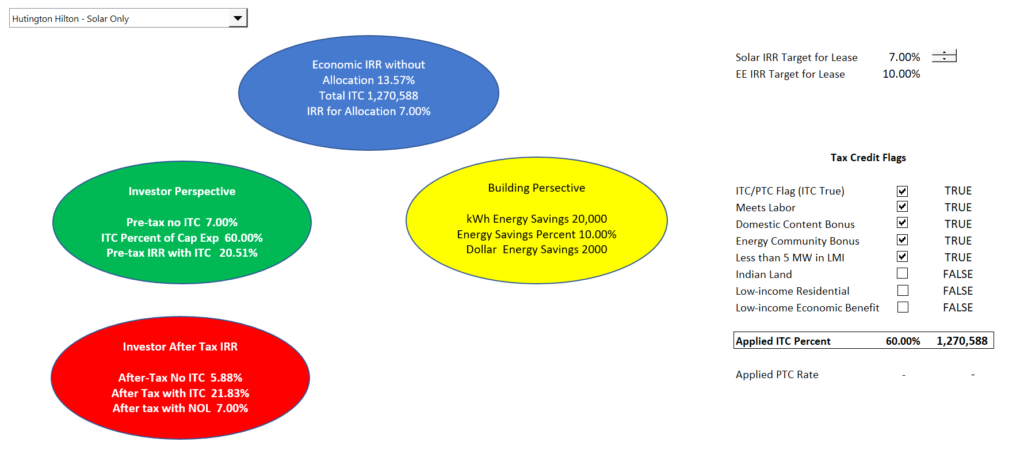

Allocation to Investor and Building Owner

The screenshot below illustrates calculation of the IRR with and without the ITC. The general idea is that after computing the economic effectiveness of different options, you can split the economics between the developer and the building owner. As shown in the diagram, you can use different target IRRs to compute the lease rate and allocate the savings. This is dependent on the ITC as shown in the diagram.

.

.

.

Tax Inputs from the IRA

.

.

.