This page includes background for project finance analysis and theory courses. The project finance theory includes the essence of project finance, selected case studies, debt financing structure and the theory of debt contracts. I begin courses by discussing what is finance — something I was never taught in business school classes. I suggest that finance is about making an investment. An investment could be a buying a stock; it could be buying a whole company as part of an acquisition program; it could be making capital expenditure for a factory; it could also be the time taken to go to the heath club; it could be the cost and time taken to go to the dentist to have your teath cleaned; it could be the opportunity cost and out of pocke cost of getting an education; it could be the gambling. For each of these investments, you have to wait to get the benefits. If you have to wait, the benefit of an investment is uncertain. You do not know whether the stock will increase and pay you dividends; you do not know if your excerise make you healthier and/or more beautiful; you do not know with certainty whether the capital expenditure will produce more money that you paid for it and you need to do some kind of cost benefit analysis to evaluate whether the investment is a good one.

The idea of finance is to perform such a cost and benefit analysis. This cost and benefit comparison can also be termed the rate of return. The problem in finance and with so many decisions in your life is that when considering the future benefits that by definition have some associated uncertainty, you need to make some kind of assessment of the risk associated with realising the benefits. This is what finance is about. It is about why London has such a good public transporation system while you could not image life without a car in Silicon Valley. It is about wondering how people constructed incredible catheridials while we now build data centers. Somebody had to make a whole lot of assessment of the cost and benefits of investments.

A theme of the project finance course is that project finance is much more than just another kind of debt. I suggest the debt financing of the project defines the value of the project and the cost of capital for an investment which is a cost and benefit technique for really important long-term investments. Project finance deals with difficult issues of cost of capital and risk measurement in a unique way. As with other pages, this webpage includes a number of files attached to different buttons which include PowerPoint slides and a number of excel files that are used to demonstrate various theoretical issues. The initial section covers the difference between project finance and corporate finance, arguing that project finance should be the foundation of much of the study of finance. The course then moves to four mini-case studies that are designed to demonstrate the structure, contracts, economic analysis and other issues associated with project finance. I have tried to select historic case studies that were spectacular successes or failures. In the subsequent section I move to contract analysis, including the loan agreement. Finally, I discuss the upsides in project that arise from reduction in risk.

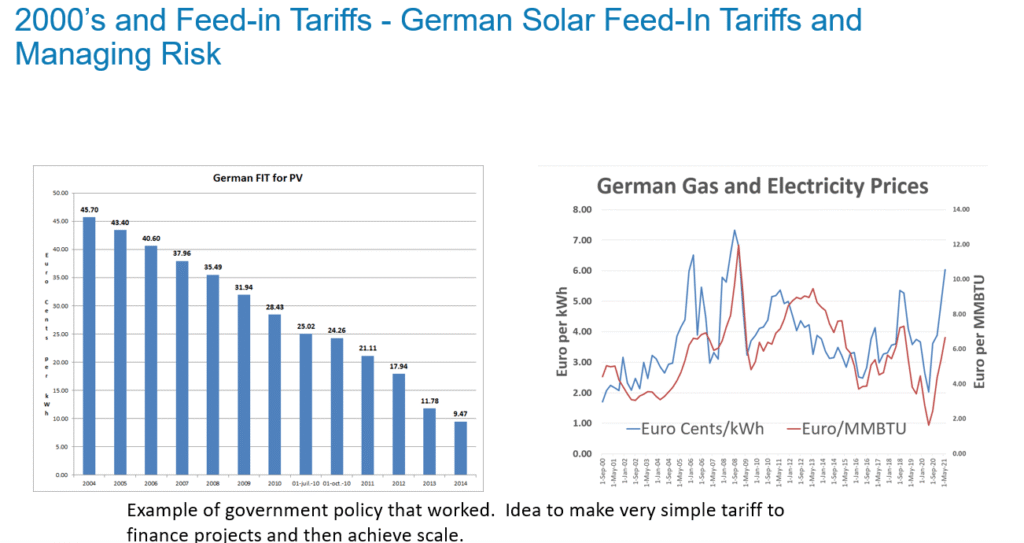

Project finance can involve important public policy issues where capital intensive assets my need goverment support to promote an industry. When public policy issues are combined with project finance, investments can be encouraged along with providing incentives for owners to act in an innovative manner. An example that is a little forgotton now is the manner in which subsidies were set to encourage the development of renewable energy. Contracts were structured to provide incentives to achieve good capacity factors (yield) and at the same time the contracts (feed in tariffs) allowed investors to raise financing. The financing was a crucial verification on the feasability of the projects.

As part of my new book on re-thinking finance I have a section devoted to project finance. A few of the introductory chapters to explaining project finance and the foundations of IRR and DSCR are discussed in the excerpt attached to the button below. Below the button I have included an example of how project finance theory combined with governement policy can change the world. The German government decided to push development of solar power through allow fixed and low risk prices for solar power to be offered to investors. If solar power developers produced energy, they were paid — of course they had to produce the power. The rates are shown on the left graph. By offering a stable cash flow but also giving incentives to prodce power, the program promoted development of solar power (it was not all a success because the construction of solar power moved to Asia).

.

.

.

Project Finance Foundations

The idea of this course is to think differently about the essence of project finance and work through some case studies with different contract structures. When teaching the course I put some of the files we use on this website. The button below includes the power point slides that I use. The power point slides discuss various theoretical issues related to project finance and also some famous case studies that I use to address some of the nuanced issues and that also illustrate problems when the financing of projects and the ideas of effectively using contracts to allocate risk are not applied. The power point slides below are designed for participants who do not have much experience in project finance. An alternative set of slides is designed for more advanced project finance issues.

.

Power Point Slides for Project Finance Foundation Course with Theory and Case Studies

.

Quiz Questions

- Which is not an investment

- Which is most capital intensive

- What is important for capital intensive assets

- Which is not a definition of IRR

- Which is the best definition of IRR

- What does non-recourse mean

- Is Non-Recourse good or bad

- Who defines risk in project finance

- What are the two main objectives of project

- How do the two main objectives relate to government (regulated) finance and how do they relate to corporate finance

- Why is the DSCR used in project finance

- Which best represents the difference between project finace debt and corporate finance debt

Financial Model Excel Files for Foundation Course

.

In the project finance foundations course I have included some financial modelling files to demonstrate the issues. These files also include discussion of the case study and the primary issues identified by case study writers. The files are designed so that partipants can focus on critical issues of measuring return with IRR and risk with DSCR. There where will be a few excel formulas but the models will be primarily related to thinking about analysis — debt structuring, credit risk analysis and understanding the perspective of equity investors.

The first file below is and excel file with some excel exercises designed to allow you to understand the meaning of IRR (as the growth rate of cash flow) and the DSCR as a measure to evaluate the buffer in cash flow that covers the year to year risk of projects. The that is a relatively simple model. We will use this file to illustrate various ideas related to measuring risk and return and issues such as the project IRR versus the equity IRR.

.

.

In addition to the excel file used to work through mechanical issues assoicated with project finance, I have included four financial models developed for the cases that are used to quantify some of the policy, and risk issues associated with the cases. The case study files with financial models include a model of the Ras Laffan project in Qatar, the Petrozuata project in Venezuela, the Dabhol project in India and Eurotunnel project. I call the cases oldies but goodies because of the way each case hilights particular issues with project finance concepts, risk analysis, government policy and contract structuring. The first case below is for Ras Laffan and Petrozuata which introduce reasons for project finance versus other financing such as govermnent financing. My notes on these cases are discussed in the power point slides.

.

Financial Model File for Qatar Ras Laffan LNG Model from S&P Projections without Equity Cash Flow

.

.

The next case moves through issues associated with contracts and how to evaluate the economics of contracts as well as the structuring of contracts between parties in the context of electricity generation. This is the case named Dahbol which was a famous case involving a plant near Mumbai India and Sponsors from the U.S. The case questions methods for bidding and the reasonableness of the ultimate results of contracts.

.

.

The the final case discussed in the Foundations course is for the famous Eurotunnel project. The case prompts questions of what kind of risks should be supported by the government in favour of encouraging public policy (like taking the train) and what kind of risks should be taken by private sponsors. As with the other cases, you are encouraged to ask what could have been done differently with hindsight to avoid the problems that occured. These issues involved question of contract structures (the construction contract), the ownership structure and allocation of traffic risk.

.

.

Term Sheets, Contracts and Credit Write-ups used in Discussion of Project Finance Foundations

.

The file attached to the button below is a file that illustrates different financial issues that are used in the remainder of the course. The file attached to the first button is an example term sheet. If you work through the document and understand the language it would be a good thing to do.

.

PDF File with Term Sheet for Loan Agreement that Illustrates Various Financial Structuring Items

.

The file attached to the button below is an example of how lenders assess risks of a project. The file attached to the button below is meant to demonatrate how lenders can have more background on a project than developers because of the history of how they assess projects. They have databases, experience with other projects, they hire experts, they have consistent ways to evaluate risk and so forth ..

.

Example of Analysis of Solar Project with Independent Engineer and Sensitivity Analysis

.

Once the ideas of risk allocation to encourage efficiency and social objectives are established, contracts apply the ideas. To discuss how the objectives translate to contract language, actual contracts are reviewed. The discussion of contrat structure uses examples of contracts that are public or disguised. The button attached to the Purchased Power Agreement (“PPA”) contract has some standard langauage that works through different terms designed to allocate risk. The second contract is an example of and Engineering, Procurment and Construction (“EPC”)contracts.

.

Example of EPC Contract for Discussion why Provisions Such as Liquidated Damanges and Focre Majure

.

Example of PPA Contract for Pricing Provisions Capacity Payment, Energy Payment and Inflation

.

Example of PPA Contract Terms including Performance Ratio and Pricing Mechanisms and Other Aspects

.

A third contract that is typical in project finance is the Operating and Maintenance Agreement. This agreement can be made with a different special purpose vehicle of the sponsor. You can evaluate whether how the O&M agreement corresponds to the PPA agreement.

.

Example of O&M Contract Terms including Performance Ratio and Pricing Mechanisms and Other Aspects

.

.

Excel Files with Corproate Financial Analysis Used to Illustrate Project Finance Concepts

The power point slides attached to the button below include three historic case studies that I like to discuss that address some key ideas about incentives, contracts, acceptable risks, financing structures and other issues that I address. The case studies include the Ras Laffan project in Qatar where the project finance structure arguably allowed the country to get the world cup and do other things that could not have occured in a traditional goverment ownership structure. The second case, the Dabhol plant in India allows us to discuss contracts, incentives and affordability issues. This case was a famous failure. The third case, Eurotunnel, prompts us to discuss efficient contract structures, output versus availablity risk and other issues.

.

.

The file below includes power point slides for my analysis of Orsted which is an effective contrast between corporate finance and project finance and suggests that the analysis done by an outside party to the company making the equity investment — the lenders — provides a crucial test of whether a large invesment makes sense.

.

.

The file below is an excel file with analysis of corporate finance. The files compare renewable energy companies to other more traditional corporations.

.

.

.

Advanced Project Finance

The idea of this course is to address more advanced issues of risk analysis, government policy, financial structuring and contract analysis surrounding project finance. The course designed with financial modelling, detailed contract analysis, evaluation of nuances in project finance statistics and risk analysis. The button below includes the power point slides that work through issues in the case. The power point slides discuss various nuanced issues related to evaluation of risk and return alternatives to IRR, DSCR, re-financing, liquidated damages, financial structuring and credit support. It may be helpful for participants in the course to review slides for the foundations course as well.

.

.

Quiz Questions

- What is the ultimate measure of risk for a project finance loan

- What is the best measure of the ultimate risk of a loan

- Does the IRR give more weight to near term cash flows

- With and IRR of 12% what is the difference between doubling the cash flow after year 40

.

.

Financial Model Excel Files for Advanced Project Finance Course

.

In the advanced project finance course I refer to some financial modelling files to demonstrate the nuanced risk and return, contract and public policy issues. The files are designed so that partipants can focus on nuanced issues of measuring return with alternatives to IRR and risk with LLCR, PLCR and probability of default. There where will be a some practice excel formulas but the models will be primarily related to thinking about analysis — debt structuring, credit risk analysis and understanding the perspective of equity investors.

The first three files below are excel files with some excel exercises designed to allow you to understand the nucances of IRR (as the growth rate of cash flow) and debt structuring to illustrate the skeleton of any project finance analysis, nuances of DSCR, LLCR and PLCR and application of cash sweeps in a cash flow waterfall. In the first model you create a basic financial analysis to compute project IRR and equity IRR. This file is used to illustrate various ideas related to measuring risk and return and issues such as the project IRR versus the equity IRR. It is also used to demonstrate debt sizing and debt structuring issues. In the second file more advanced issues are discussed including illustrating the mean reversion and volatlity and their relationship with DSCR, LLCR and PLCR.

.

.

.

.

In addition to the excel file used to work through mechanical issues assoicated with project finance, I have included financial models that are used to quantify nuances of the policy, and risk issues associated selected cases. The first case study is the same as the case for the foundations course, but the case is used to evaluate different issues including problems with measuring risk and return. The first modelling case study file with financial models uses a model of the Petrozuata project in Venezuela. My notes on these cases are discussed in the power point slides.

.

.

The second case for the advanced course addresses issues with development costs, corporate financing versus project financing of off-shore wind projects, details of financial structring and, not least political risk issues. I have included a fairly detailes financial model of an off-shore wind project to demonstrate the effects of debt structuring when different constraints are in place. This is the case of Orsted in Denmark which faced dramatic risks when investing in off-shore wind projects in the U.S. The case questions how to achieve verification of risks from lenders and other renewable energy issues.

.

.

The the final case discussed in the Foundations course is for the famous Eurotunnel project. The case prompts questions of what kind of risks should be supported by the government in favour of encouraging public policy (like taking the train) and what kind of risks should be taken by private sponsors. As with the other cases, you are encouraged to ask what could have been done differently with hindsight to avoid the problems that occured. These issues involved question of contract structures (the construction contract), the ownership structure and allocation of traffic risk.

.

.

Back-up Files for Discussion of Case Studies for Advanced Course

.

The files below include some back-up for the case studies. These files include data for the production of wind for Orsted projects; a Standard and Poor’s write-up of the Ras Laffan project; Excel files for the Dahbol project and the initial offering memorandum for the Eurotunnel project. This file is used to introduce the Ras Laffan case with analysis of commodity prices. You are supposed to look for volatility and mean reversion in the prices and make a judgement as to what is acceptable.

.

.

.

This file contains the pre-sale report for Ras Laffan which was used as a credit write-up and discussed the risks of the project. The idea of this report is just to skim through the discussion of risks and look at the presentation of the financial model.

.

.

This file is the financial model for Ras Laffan with alternative oil prices. You are to use this file to evaluate the cost structure of the project and to compute the break-even oil prices by yourself. When you compute the break-even price, you need to subtract the transport cost to derive the cost realized by the project. In formula terms: Worldwide Gas – Transport Cost = Gas to Project. This can be computed with a simple oil to gas ratio of about 6 bbl per MMBTU. This means if the oil price is 60 then the gas price is 10. If the trasport cost is 3 then the net gas to Ras Laffan is 7.

.

.

The button below is for the Dahbol case. You are to compute a couple of IRRs and use the data to evaluate the key risk of the project which could not be easily mitiagated. This excel file comes straight from the HBS case study where provision of the contracts were published.

.

Excel File with Data from the HBS Dabhol Electricity Plant Case with PPA and Capital Costs

.

The file below has the exercise for Eurotunnel. You can evaluate the construction risk and the traffic risk, both of which were not properly mitigated and both of which were difficult to accept in project finance.

.

.

The file below has the initial offering memo for Eurotunnel which describes the construction contracts and the traffic projections. The file is ancient from the 1980’s but you can see some of the ideas that we would now think are crazy. The ideas include taking traffic risk, having the EPC contractor own a majority of the project during the signing of the contracts, having an IPO structure …

.

Offering Memo for Initial Public Stock Offering of Eurotunnel Project before Financial Close

.

The file below is back-up data in an excel file for Orsted. This file was only availble after the large write-off for the Ocean Wind project. Before the write-off it was not possible to see detailed data on a project by project basis. There is still limited data on the performance of individual projects.

.

.

Term Sheets, Contracts and Credit Write-ups used in Discussion of Advanced Project Finance Course

.

The file attached to the button below is a file that illustrates different financial issues that are used in the remainder of the course. The file attached to the first button is an example term sheet. If you work through the document and understand the language it would be a good thing to do.

.

PDF File with Term Sheet for Loan Agreement that Illustrates Various Financial Structuring Items

.

The file attached to the button below is an example of how lenders assess risks of a project. The file attached to the button below is meant to demonatrate how lenders can have more background on a project than developers because of the history of how they assess projects. They have databases, experience with other projects, they hire experts, they have consistent ways to evaluate risk and so forth ..

.

Example of Analysis of Solar Project with Independent Engineer and Sensitivity Analysis

.

Once the ideas of risk allocation to encourage efficiency and social objectives are established, contracts apply the ideas. To discuss how the objectives translate to contract language, actual contracts are reviewed. The discussion of contrat structure uses examples of contracts that are public or disguised. The button attached to the PPA contract below has both and output based contract and a capacity based contract in the context of a battery plus solar project. The contracts raise risk allocation issues.

.

.

.

The file attached to the button below may not seem to have too much to do with project finance. It is my general file on downloading stock prices and includes the IRR’s, volatility and betas for many stocks. I use the file to discuss general issues about IRR and growth and also how dividends come into play in the calculaiton of IRR using adjusted stock prices.

.

Excel File that Uploads Stock Price Data from Finance.Yahoo Economic Data from FRED using Python

.

.

Monte Carlo Simulation, Risk, Mean Reversion and DSCR

The first exercise demonstrates risk issues with volatility and mean reversion. The idea is to show how project finance is about managing risk over long-term periods. You can use the probability of default with the DSCR and the probability of loss with the PLCR. You can see the probability of default and probability of loss with different DSCR Ratios. The idea of this file is to enter different levels of volatility and mean reversion and then determine what DSCR will result in a reasonable probability of default and probability of loss. You can look at the macros in the file that are used to create a Monte Carlo simulation.

.

.

The file below is an excel file that reconciles project finance with corporate finance.

.

Excel File with Projects Consolidating to Portfolio Demonstrating Returns and Financial Ratios

.

Alternative Project Finance Definition … finding money from a bank (not associated with your company) and/or an investor for a capital investment where you can prove (through nonrecourse loans and equity cash flow evaluation) that the project is economic on a stand-alone basis and has acceptable risks where debt and equity is structured corresponding to the risks, the timing and the pattern of cash flows from the project. Long-term financing is achieved through demonstrating mean reversion in cash flow and/or use of long-term contracts can meet debt service and provide a reasonable growth rate in cash flow to investors.

.

.

Project Finance and IRR

The file attached to the button below addresses the definition calculation and nuances of the IRR. The file demonstrates that the IRR is a growth rate when measuring stocks or when measuring the IRR earned from an LBO where there is one date for the investment and one date for the exit value (i.e. there are no intermediate dividends). The file demonstrates that the biggest problem with the IRR is in the context of project finance where there are a lot of dividends and the implicit assumption is that the dividends are re-invested at the same rate as the IRR itself. (I have an alternative to this where the risk premium is computed, but it is not used much). I also reconcile the IRR and the ROI in the sheet using economic depreciation and demonstrate that you can use this method to compute performance measures.

.

.

.

The final file for the first session compares companies investments in renewable energy project finance to other companies such as oil companies. The file use the financial database that is described in detail on the database menu. When you compare the ROE to the price to book ratio or the EV/EBITDA ratio, you can see how the value of project financed investments are high compared to the cash flow produced by things that have more volatile cash flows.

.

.

.

Project Finance and Cost of Electricity

.

I have worked matching a project finance model and equations that use the PMT and PV functions to compute the levelised cost of electricity. The file attached to the button below includes a data set with the Lazard operating assumptions and many different financial inputs. The file demonstrates the importance of project finance in evaluating the cost structure of capital intensive investments.

.

.

.

.

Solar Resource Analysis for Solar Case Study

.

The two files below are for introduction to the solar case study. The first file is for the Middle East and the second file is for northern Europe. You can see the dramatic difference in solar patterns. These files will be used to discuss the performance ratio that can be part of EPC and O&M contracts. The video below works through the example and how to find the data. The analysis uses temperature coefficients and estimated temperature that hits the panel.

.

Partner Files to So You Do Not Waste Time on Formatting and Using the Paint Brush

I have included two files that are used to make the excel exercises work more smoothly. The first is a file called Read PDF which allows you to grab data from PDF files and then convert the data to excel files. To run this file you copy stuff from the pdf file and then operate the macro with SHIFT, CNTL, A. When you copy data from a PDF to excel, make sure that you copy and paste special as UNICODE text. There are different formats that you can use to resolve the PDF. If you are reading from the Lazard LCOE stuff you can use the first green box. If you are reading from the PVGIS you can use the second green box.

The second file is a file that has a whole lot of macros to prevent you from wasting time on formatting and copying formulas to the right. This file is called GENERIC MACROS. I have revised the generic macro file in the link below so that you are not prevented to open it because of something called the auto open — a macro that operates when you open the file and excel considers dangerous. When working through the exercises, it would help a lot if you have this file open and enable the macros. The big things that this GENERIC MACRO allows are to press SHIFT, CNTL, R to copy to the right and also CNTL, ALT, C to open the window that has a whole lot of formatting options. There are a lot more utility macros in the GENERIC MACROS file. You can go to https://edbodmer.com/excel-utilities-and-backpack/generic-macros-file/ and see some of the other stuff including a few user defined functions.

.

.

.

Excel File with Exercise for Analysis of Capital Intensive Water Pipelines Including Levelised Cost

.

.

PDF File with Outline for Project Finance Master Class with Analysis of Different Types of Projects

.

.

.

The file attached to the button below includes power point slides on general project finance issues that discuss the essence of project finance (it is not just a kind of debt) and more technical issues about project finance.

.

.

Exercise for Project Finance Theory and Renewable Course with Re-financing and Debt Sizing Analysis

.

.

Working File for Levelised Cost of Electricity Analysis with Solar Data and LCOE Calculations

.

Parked Files

.

The first file below is and excel file that is a relatively simple model. We will use this file to illustrate various ideas related to measuring risk and return and issues such as the project IRR versus the equity IRR. The file contains macros and you will probably have to de-block the macros when you open the file.

.

.

I am so honoured to be able to come to LBS and discuss project finance along with practical modelling. The page includes slides I use for our session as well as exercises that demonstrate theoretical points and databases. As with other pages for the subjects I also include some of the utility files — the generic macro file and the read pdf file.

.

.

.

.

.

Exercise for Project Finance Theory and Renewable Course with Re-financing and Debt Sizing Analysis

.

.

.

.

The file attached to the button below includes a term sheet that we use in the course to understand and not be intimidated by various elements.

.

.

Excel File with Comparison of Alternative Models for Computing Solar Resouce with Saudi Example

.

.

.